Manitoba Budget 2018

Manitoba Finance Minister Cameron Friesen delivered the province’s 2018 budget update on March 12, 2018. The budget anticipates a surplus of $521 million for 2018 to 2019.

Corporate and personal tax rates remain unchanged.

The biggest changes are:

● The increase in the amount of income eligible for the small business deduction.

● The increase in Basic Personal Amount

● Carbon tax

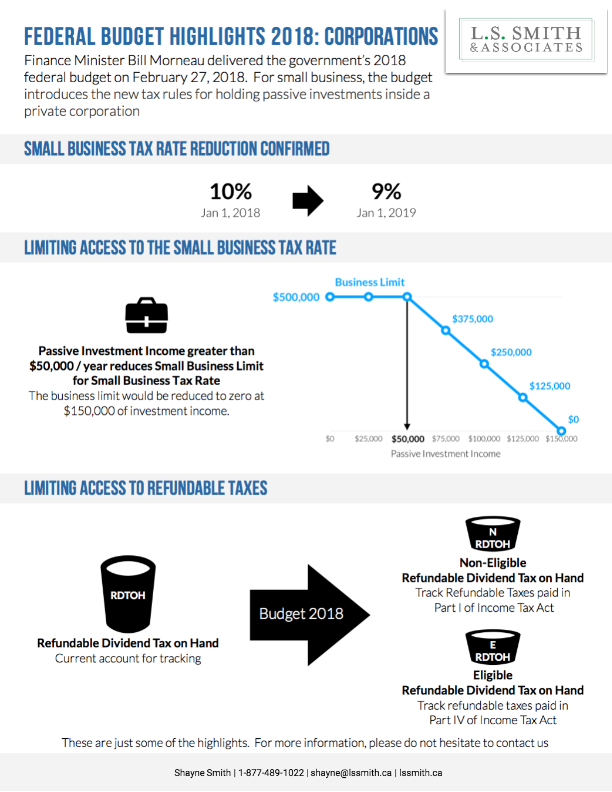

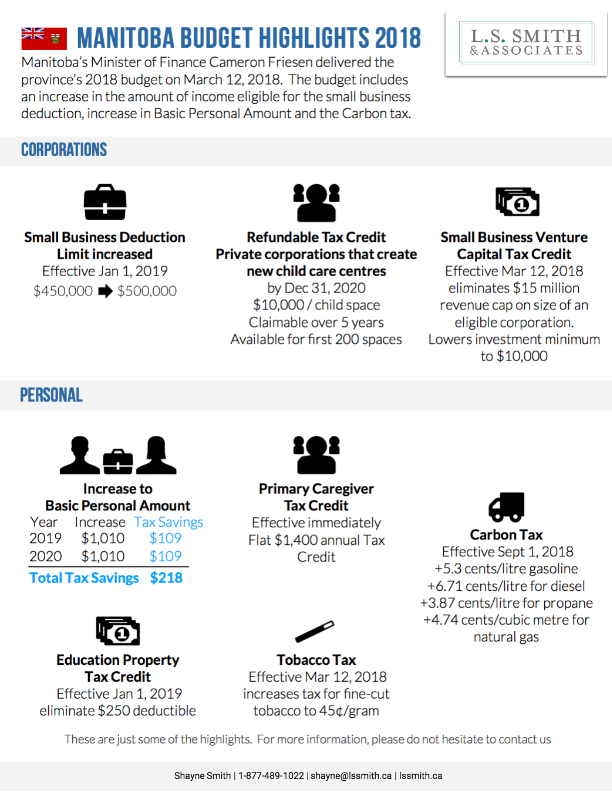

Corporation changes

- Small Business Deduction Limit Increased – Although there were no announcements about changes to the province’s corporate tax rate, it does increase the small business income limit eligible from $450,000 to $500,0000 effective January 1, 2019.

- Child Care Centre Development Tax Credit – A new refundable corporation income tax credit to encourage the creation of licensed child care centres in workplaces. The credit will be a total benefit of $10,000 per new infant/preschool space created, claimable over 5 years. (This is for corporations that are not primarily engaged in child care services.)

- Small Business Venture Capital Tax Credit – The 45% investment tax credit is intended to promote the acquisition of equity capital in emerging enterprises that require larger amount of capital. Effective, March 12, 2018 the minimum investment is lowered to $10,000 (from $20,000) and the elimination off the $15 million revenue cap on the size of an eligible corporation.

Personal tax changes

- Basic Personal Amount – The Basic Personal Amount will be increased by $1,010 each year for 2019 and 2020 (approximately 10% per year) resulting in additional savings of $109 for 2019 and $218 for 2020 or “$2,020 by 2020”.

- Primary Caregiver Tax Credit – Effective immediately, the budget implements a flat $1,400 Primary Caregiver Tax Credit available to all eligible caregivers.

- Education Property Tax Credit – Effective January 1, 2019, the calculation of the education property tax credit will be based on actual school taxes and the $250 deductible will be eliminated.

- Tobacco Tax – Effective March 12, 2018, there will be an increase to the tobacco tax rate for fine-cut tobacco to 45¢ per gram (from 28.5¢ per gram)

- Carbon Tax – Effective September 1, 2018, there will be an imposed tax of $25 per tonne of greenhouse gas emissions. This new provincial carbon regime will apply to gas, liquid, solid fuels intended for combustion.

Carbon Tax Rates by Select Fuel Type (2018-2022)

To learn how these changes will affect you, please don’t hesitate to contact us.