Do you have enough for retirement?

Many of us dream of the day that we can retire and have the time to ourselves that we have dreamed of for so many years. But, to have a genuinely contented and relaxing retirement, you need to ensure that you have the means to afford it. So, now’s the best time to consider the three critical stages of retirement planning.

Accumulation

This is the stage you save for your retirement – essentially, the majority of your working life. So, naturally, if you start saving for your retirement early, you will have the ability to save a larger pension for the future, though this is not always achievable for young people or those on a low income.

Pre-retirement

At this point, you are making the final plans for your retirement. Although you are potentially making less money at this late stage of your career, it’s still a necessary time to continue saving and making sure that your investments are fit for purpose.

Retirement

Once you are no longer working, your retirement income will usually come from three key sources:

-

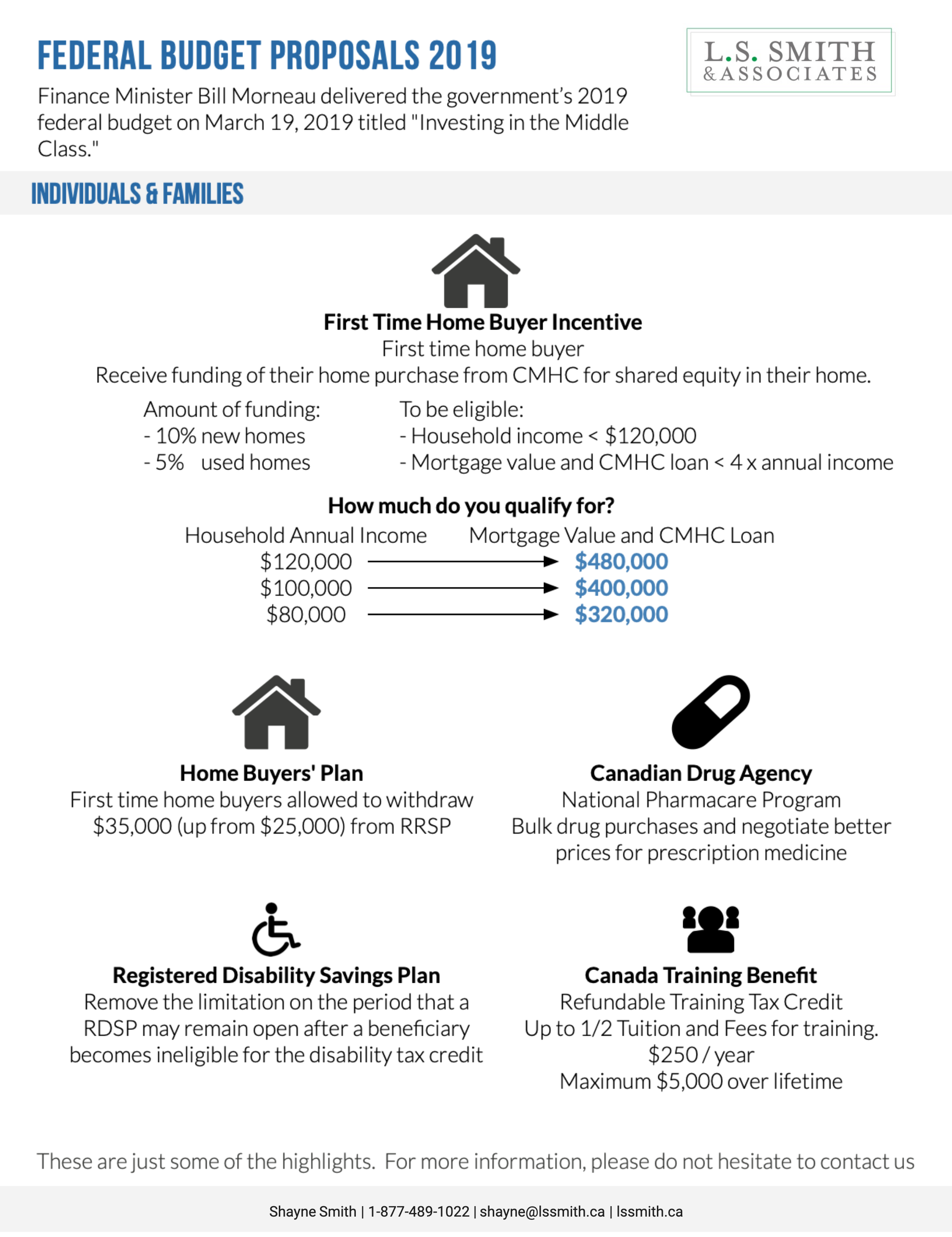

Government benefits: Canada Pension Plan or Old Age Security

-

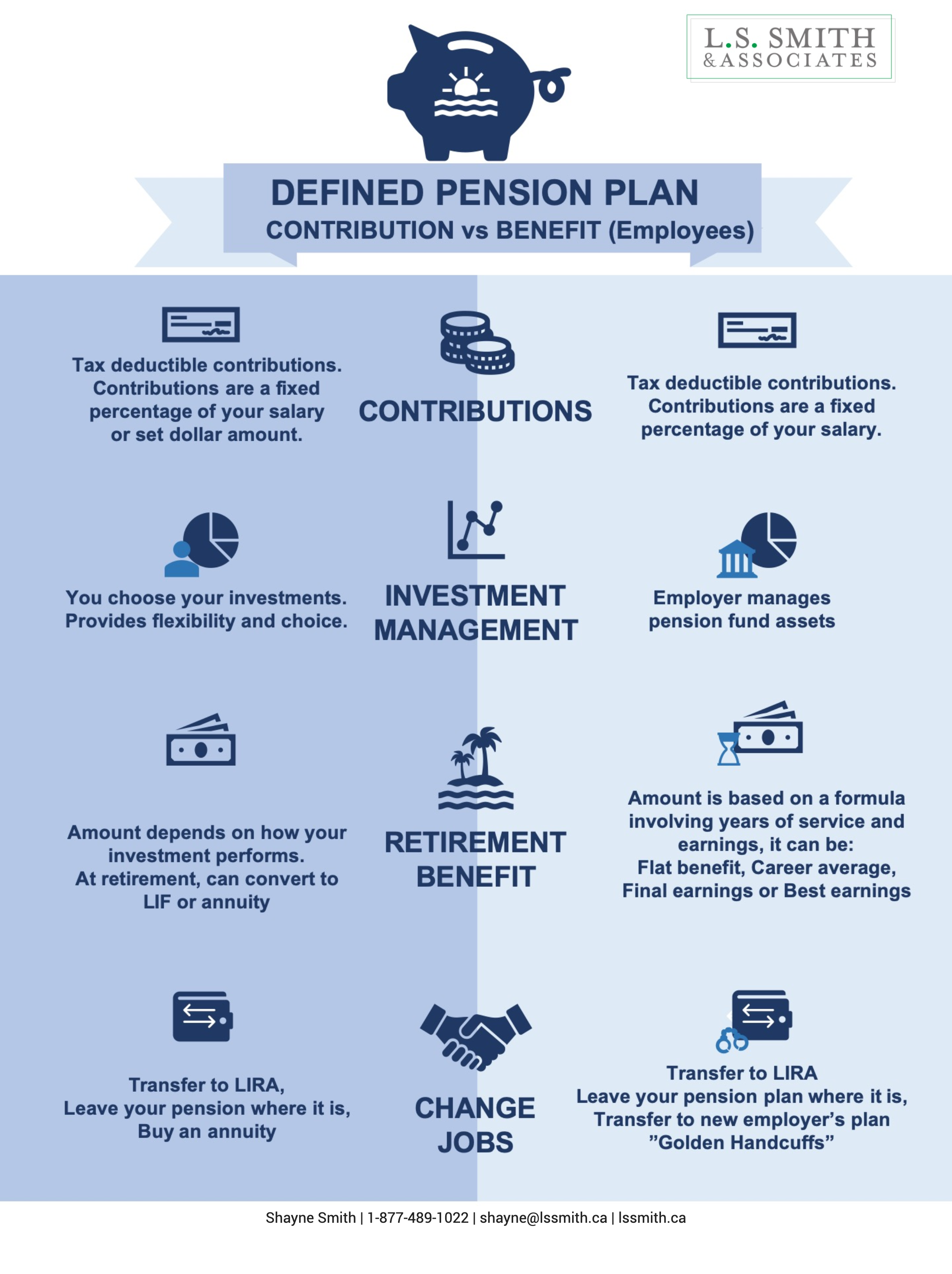

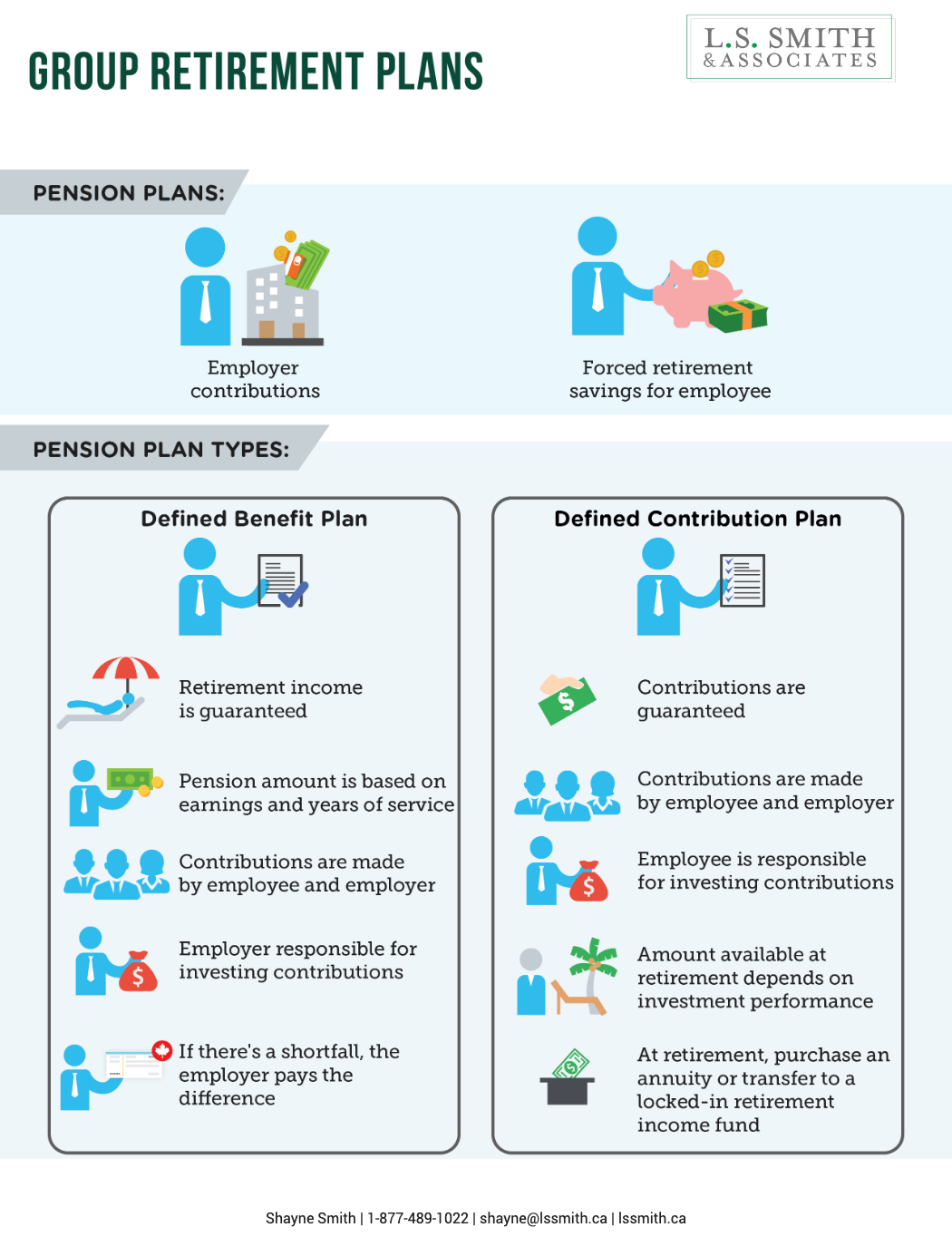

Employer pension or retirement plan

-

Personal savings: Registered Retirement Savings Plan, Tax-Free Savings Account, Non-Registered Savings

Your concern will be to ensure that your money lasts the length of your lifetime.

Drawing up a retirement plan

A retirement plan is a crucial process to undertake during your working life, as it will help you outline and achieve your financial goals for the future. However, making such a plan doesn’t have to be daunting – here are our key steps to success:

-

Work out how much income you’ll need in your retirement. This is a key starting point to ensure that you save enough to meet this need.

-

Start early. If you can, invest any spare money into your retirement fund and keep going. Small amounts grow over time and can help you create a savings fund to meet your needs in retirement.

-

Diversify as much as you can. The best way to reduce your risk and exposure to poor market performance is to spread your investments. We can help you create a strategy that focuses on your attitude to risk.

-

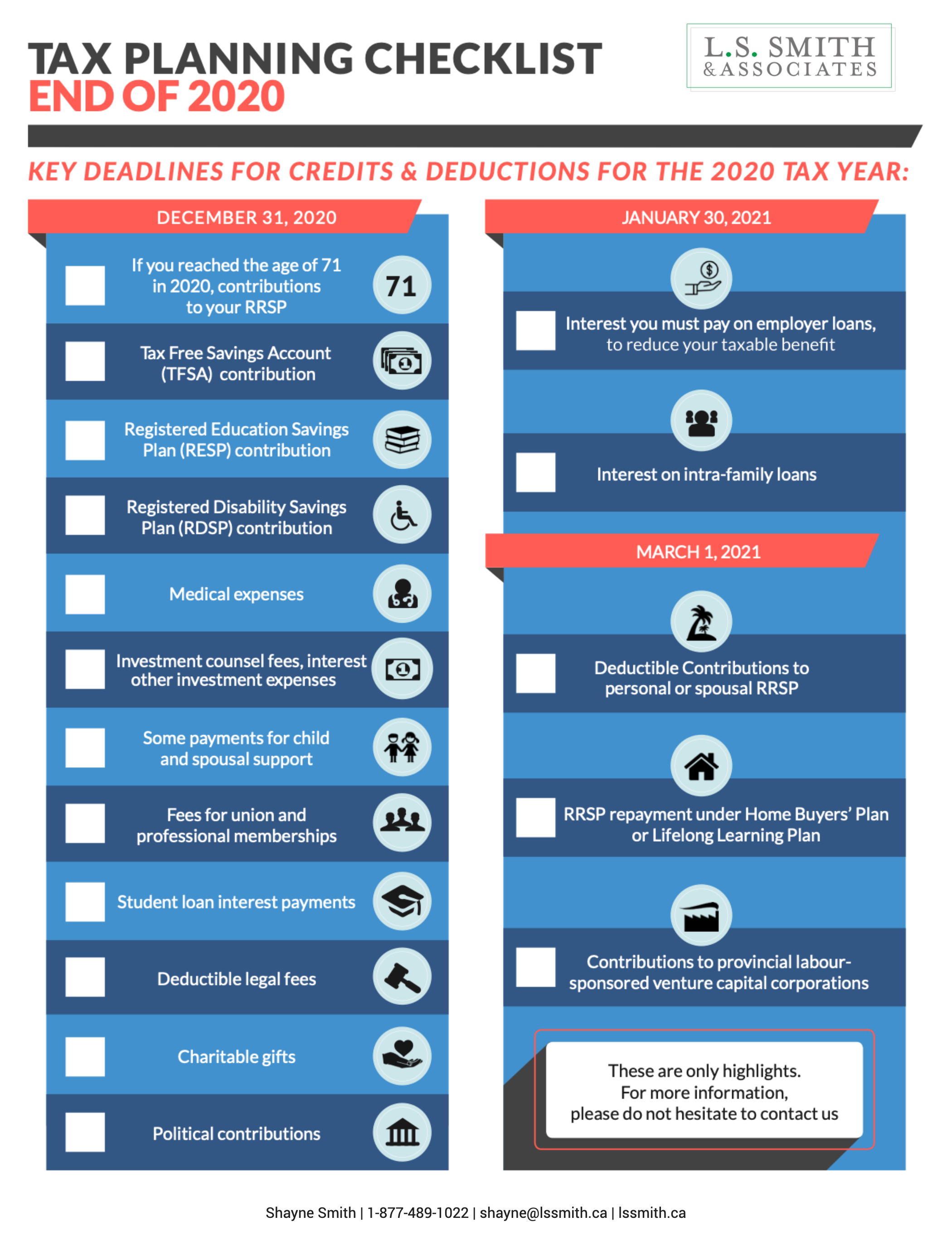

Contributing to a TFSA or RRSP is a great place to start. Contribute the maximum amounts you can, and don’t forget to contribute on a consistent basis.

Talk to us today about your retirement goals.