TFSA versus RRSP – What you need to know to make the most of them in 2022

TFSA versus RRSP – What you need to know to make the most of them in 2022

TFSAs and RRSPs can be significant savings vehicles. To help you understand their differences, we have put together this article to compare:

-

TFSA versus RRSP – Differences in deposits

-

TFSA versus RRSP – Differences in withdrawals

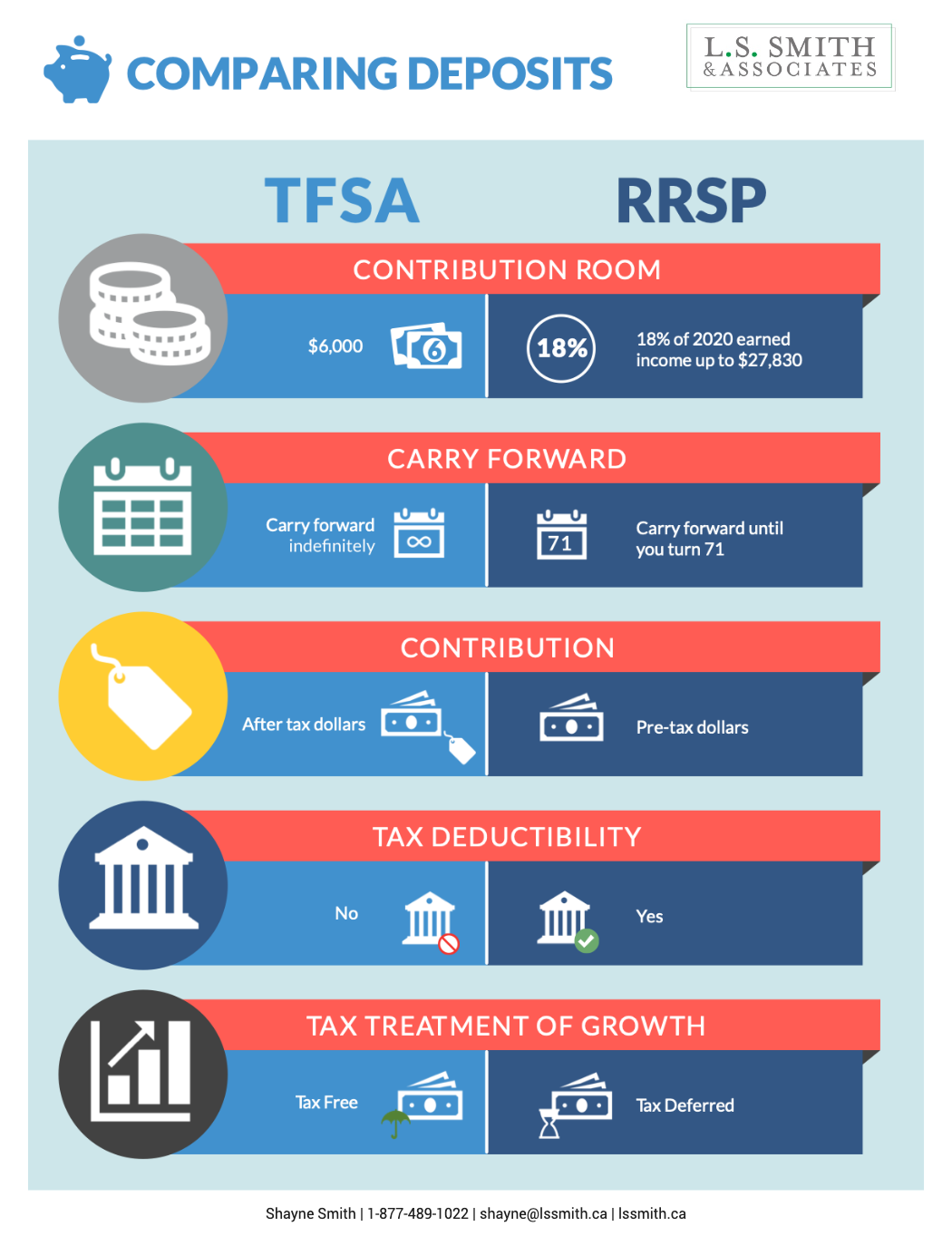

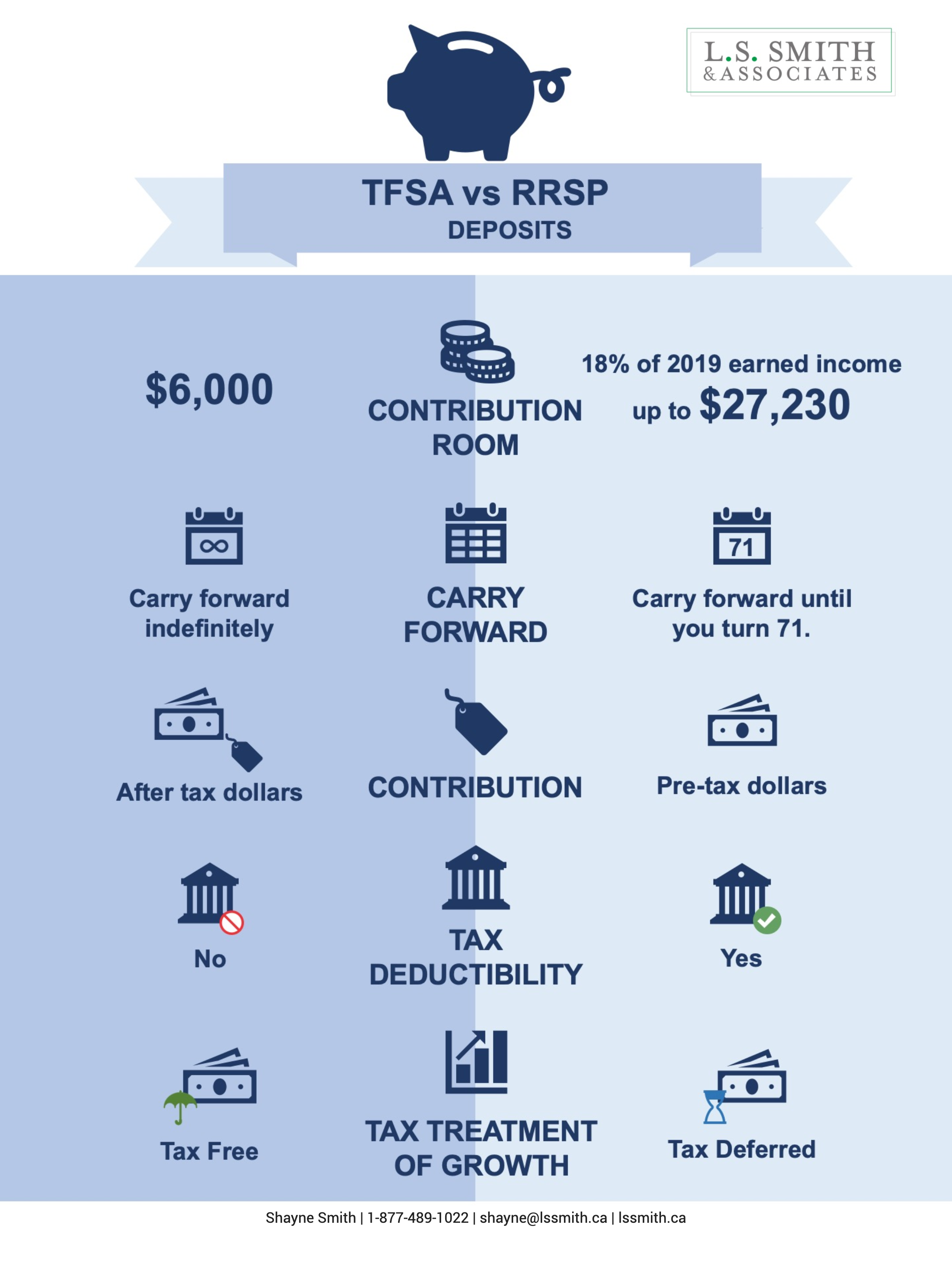

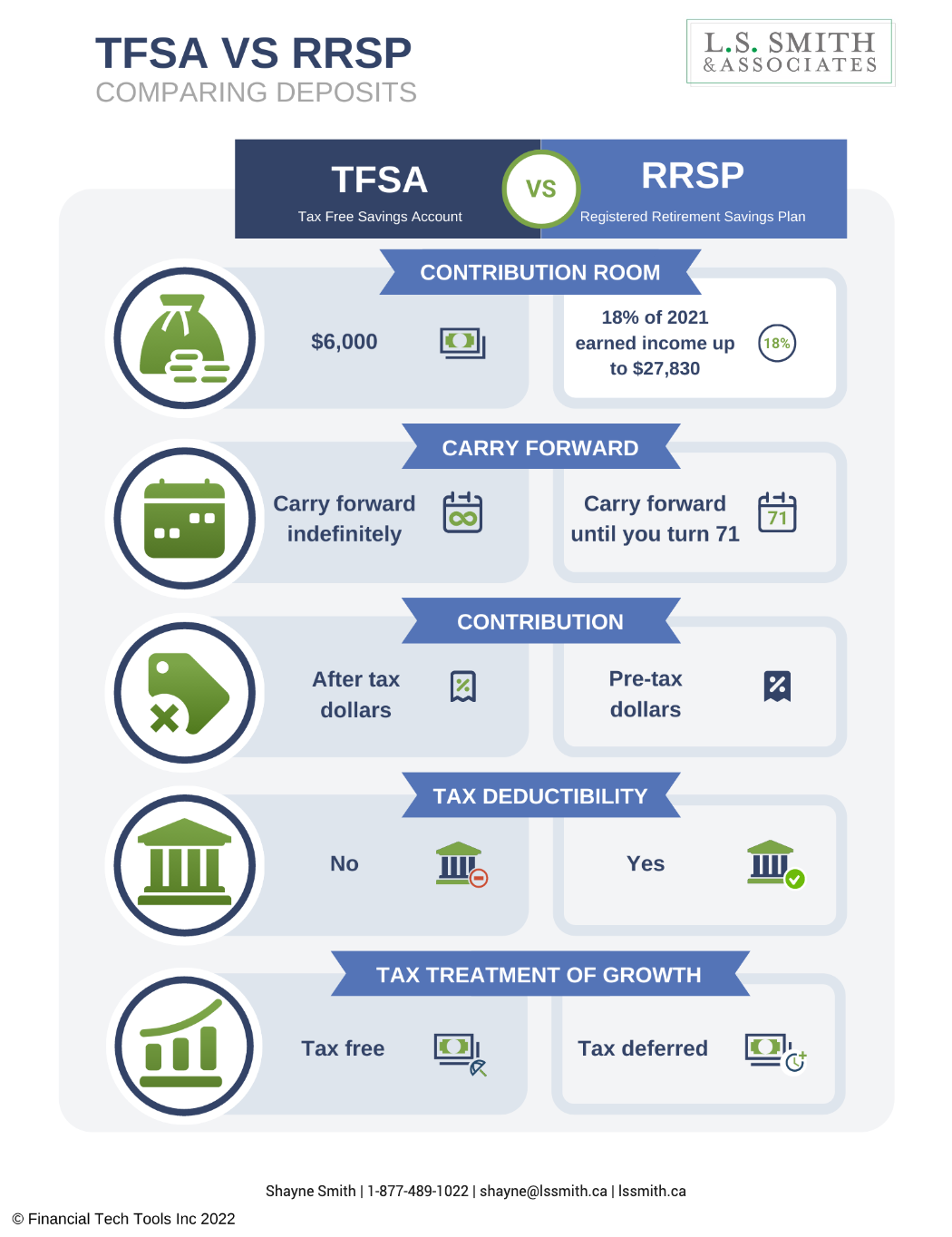

TFSA versus RRSP – Difference in deposits

There are four main areas to focus on when comparing differences in deposits for 2022:

-

Contribution Room

-

Carry Forward

-

Contributions and Tax Deductibility

-

Tax Treatment of Growth

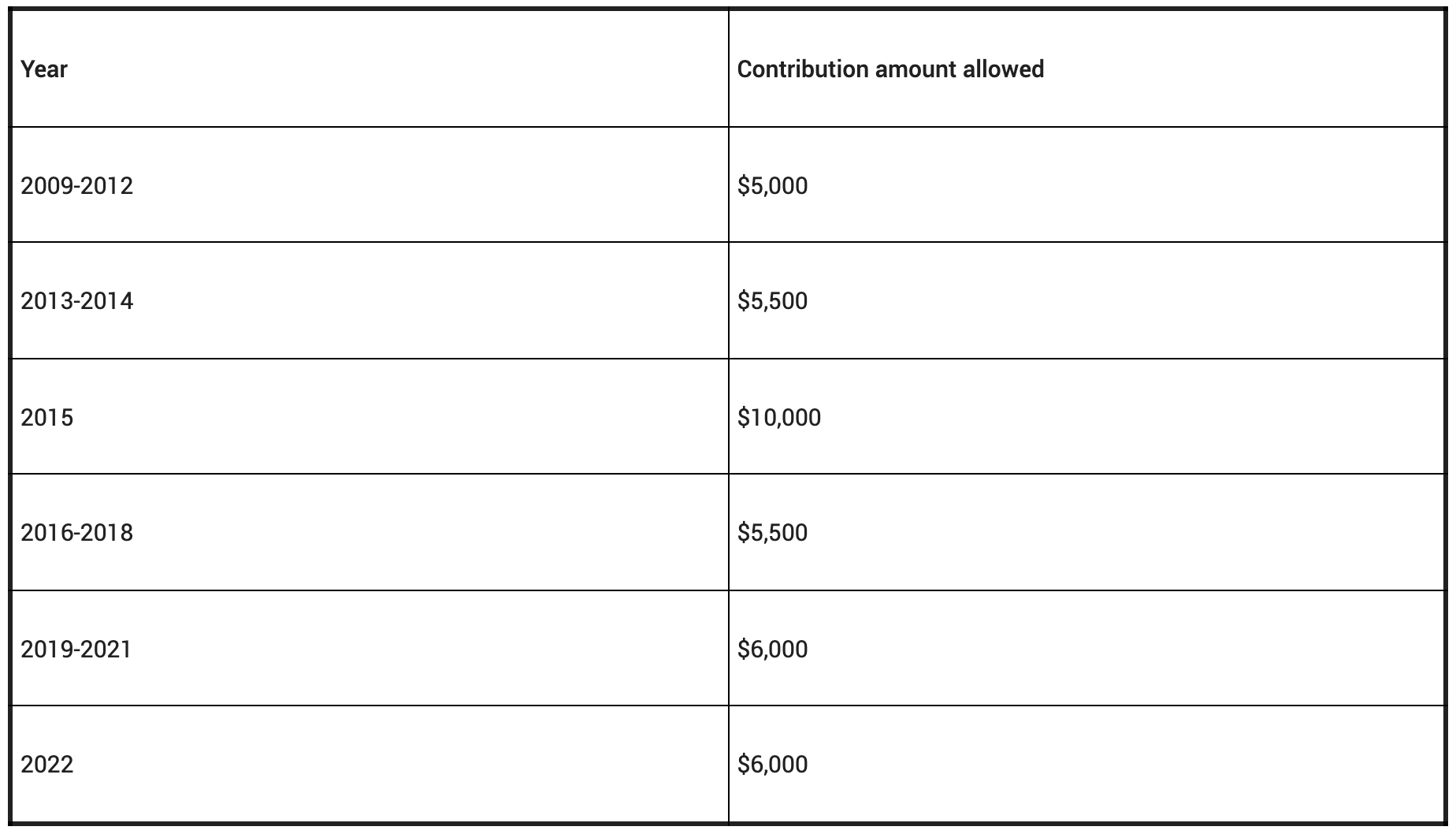

How much contribution room do I have?

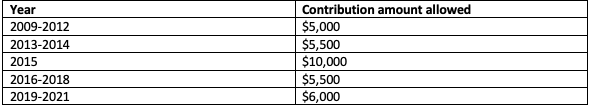

If you have never opened a TFSA before, you can contribute up to $81,500 today. This table outlines the contribution amount you are allowed each year since TFSAs were created, including this year:

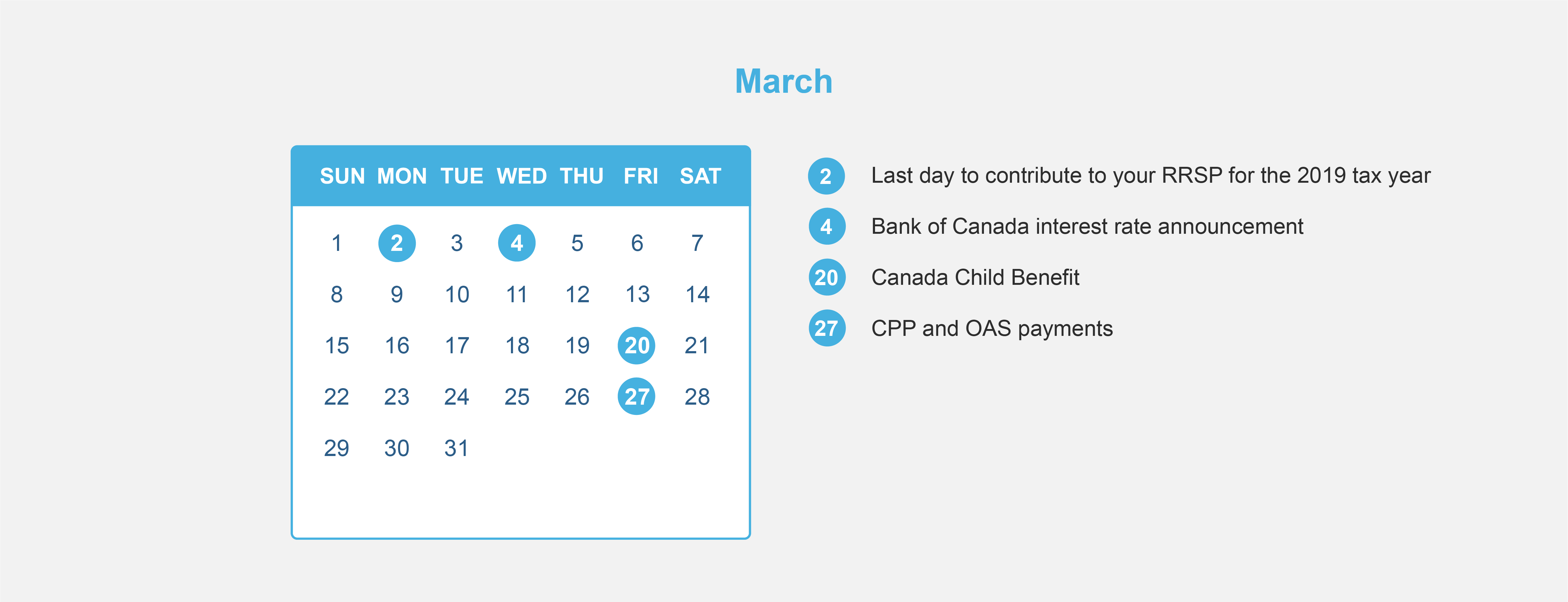

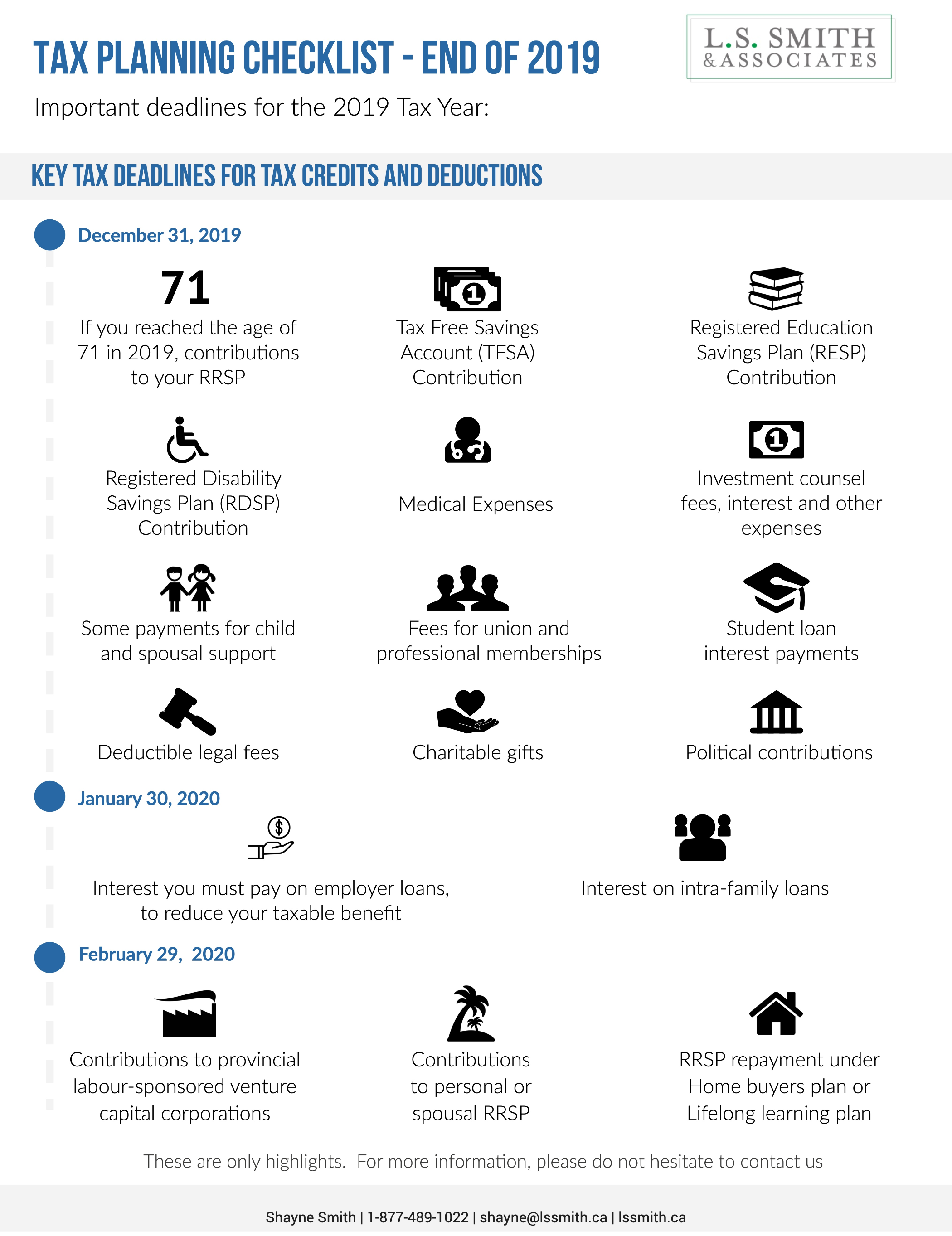

For RRSPs, the contribution limit is always 18% of your previous year’s pre-tax earnings to a maximum of $29,210. For example, if you earned $60,000 in 2021 then your contribution limit for 2022 would be $10,800 (18% x $60,000). If you earned $200,000, your contribution limit would be capped at the maximum of $29,210.

How much contribution room can I carry forward?

If you choose not to contribute to your TFSA at all one year or do not contribute the maximum amount in a year, you can indefinitely carry forward your unused contribution room. The only restrictions on this are that you must be a Canadian resident, older than 18, and have a valid social insurance number. In addition, if you make a withdrawal, the amount you withdrew is added to your annual contribution room for the following calendar year.

For an RRSP, you can carry forward your unused contribution room until the age of 71. When you turn 71, you must convert your RRSP into an RRIF. If you make a withdrawal from your RRSP, you do not open up any additional contribution room.

Contributions and Tax Deductibility

Your TFSA contributions are not tax-deductible and are made with after-tax dollars. Your RRSP contributions are tax-deductible and are made with pre-tax dollars.

Tax Treatment of Growth

One of the reasons it is essential to make both RRSP and TFSA contributions is that investment value growth is treated differently.

A TFSA is more suitable for short-term objectives like saving for a house down payment or a vacation because the investment value growth is tax-free. In addition, when you make a withdrawal from your TFSA, you will not have to pay income tax on the amount withdrawn.

The growth in an RRSP is tax-deferred, meaning you will not pay any taxes on your RRSP gains until you withdraw money from your future RRIF account; the account you convert your RRSP into at age 71. As a result, RRSPs are better suited for long-term objectives, like retirement. In addition, since you will have a lower income in retirement than when you are working, you will be in a lower tax bracket and not pay much tax on your RRIF income.

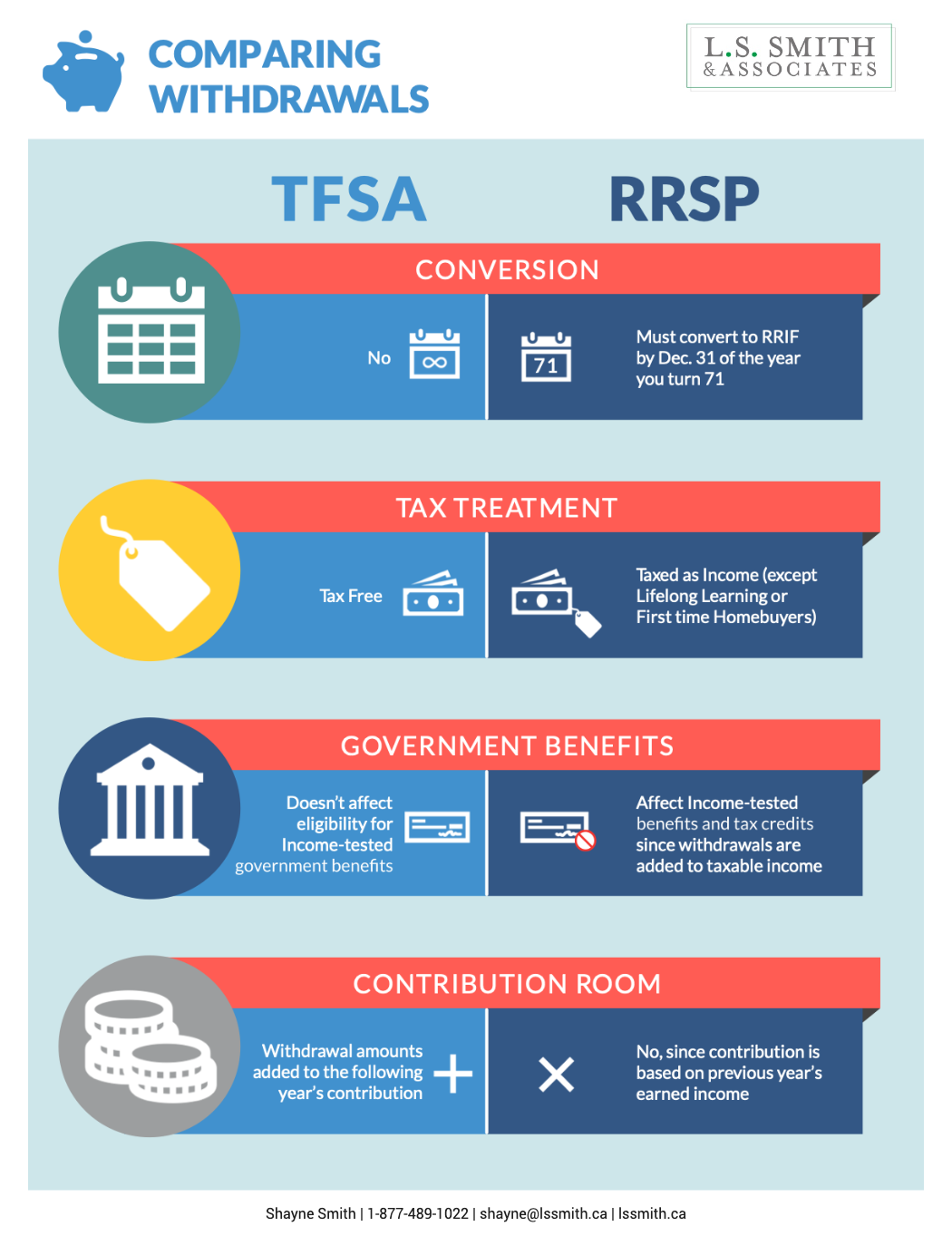

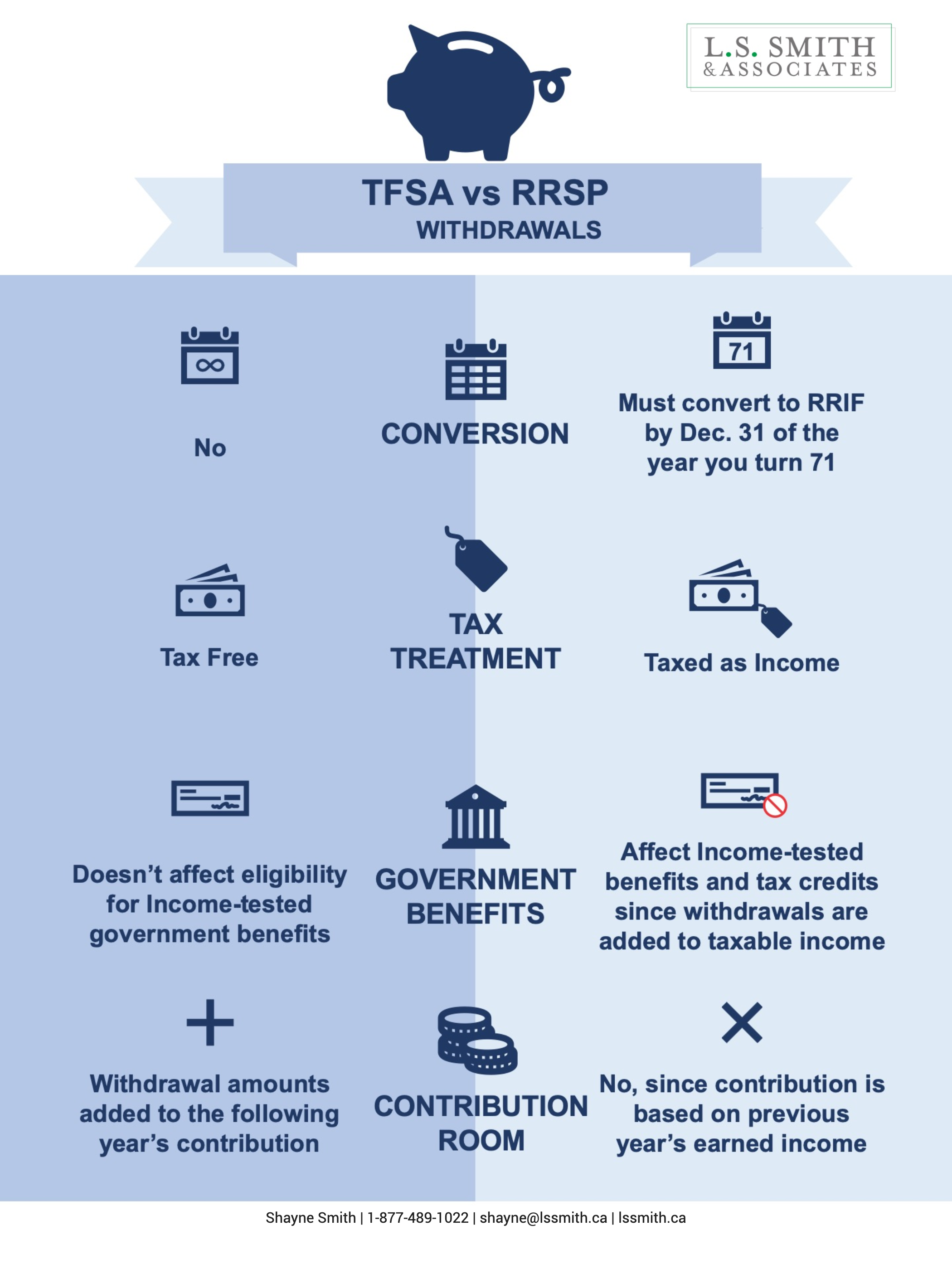

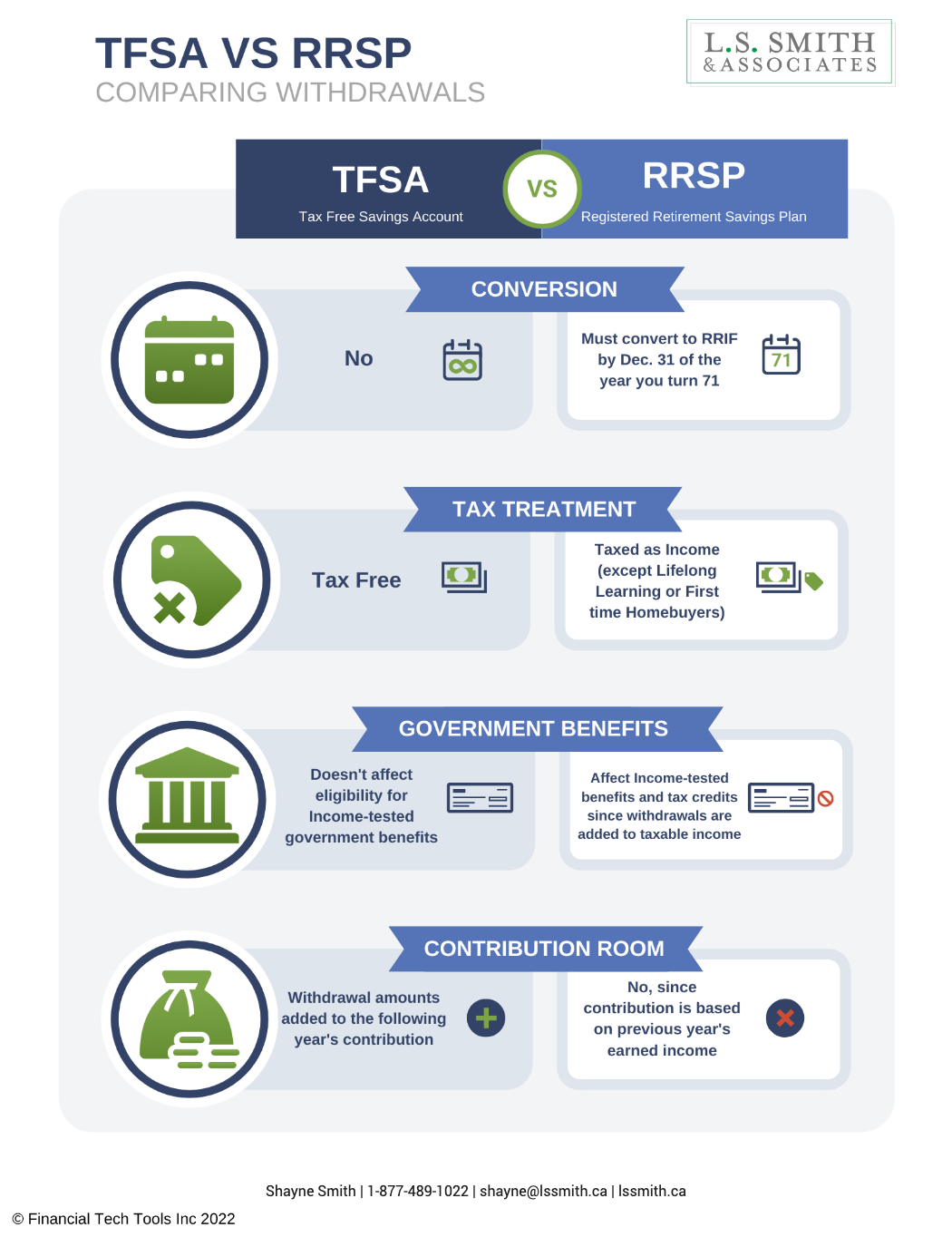

TFSA versus RRSP – Differences in withdrawals

There are four main areas to focus on when comparing differences in withdrawal for 2022:

-

Conversion Requirements

-

Tax Treatment

-

Government Benefits

-

Contribution Room

Conversion Requirements

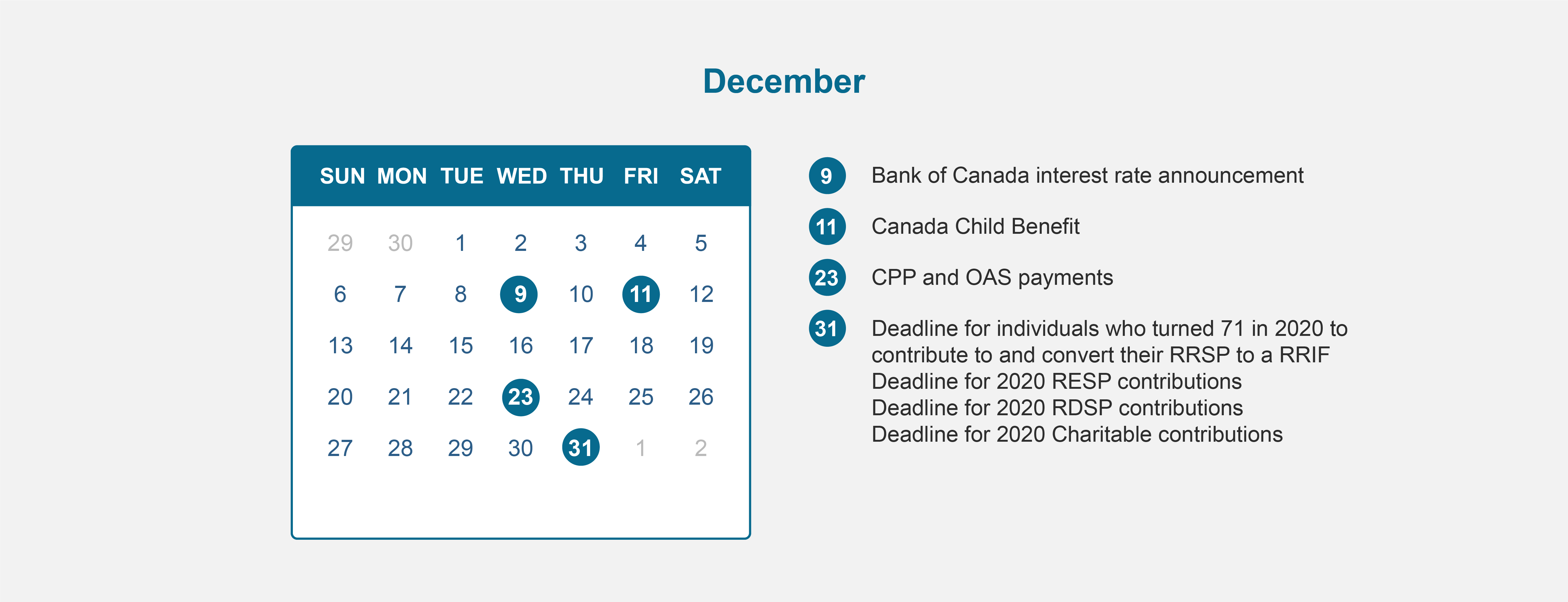

For a TFSA, there are never any conversion requirements as there is no maximum age for a TFSA. However, if you have an RRSP, you must convert it to a Registered Retirement Income Fund (RRIF) if you turn 71 by December 31st of 2022.

Tax Treatment Of Withdrawals

One of the most attractive things about a TFSA is that all your withdrawals are tax-free! This ability to withdraw funds tax-free is why TFSAs are advantageous for short-term goals; you don’t have to worry about taxes when you take money out to pay for a house or a dream vacation.

With an RRSP, if you make a withdrawal before converting it to a RRIF, it will be taxed as income except in two cases:

-

The Home Buyers Plan lets you withdraw up to $35,000 tax-free, but you must pay it back within fifteen years.

-

The Lifelong Learning Plan lets you withdraw up to $20,000 ($10,000 maximum per year) tax-free, but you must pay it back within ten years.

How will my government benefits be impacted?

If you are withdrawing from your TFSA or RRSP, it is essential to know how your withdrawals can impact any benefits you receive from the government.

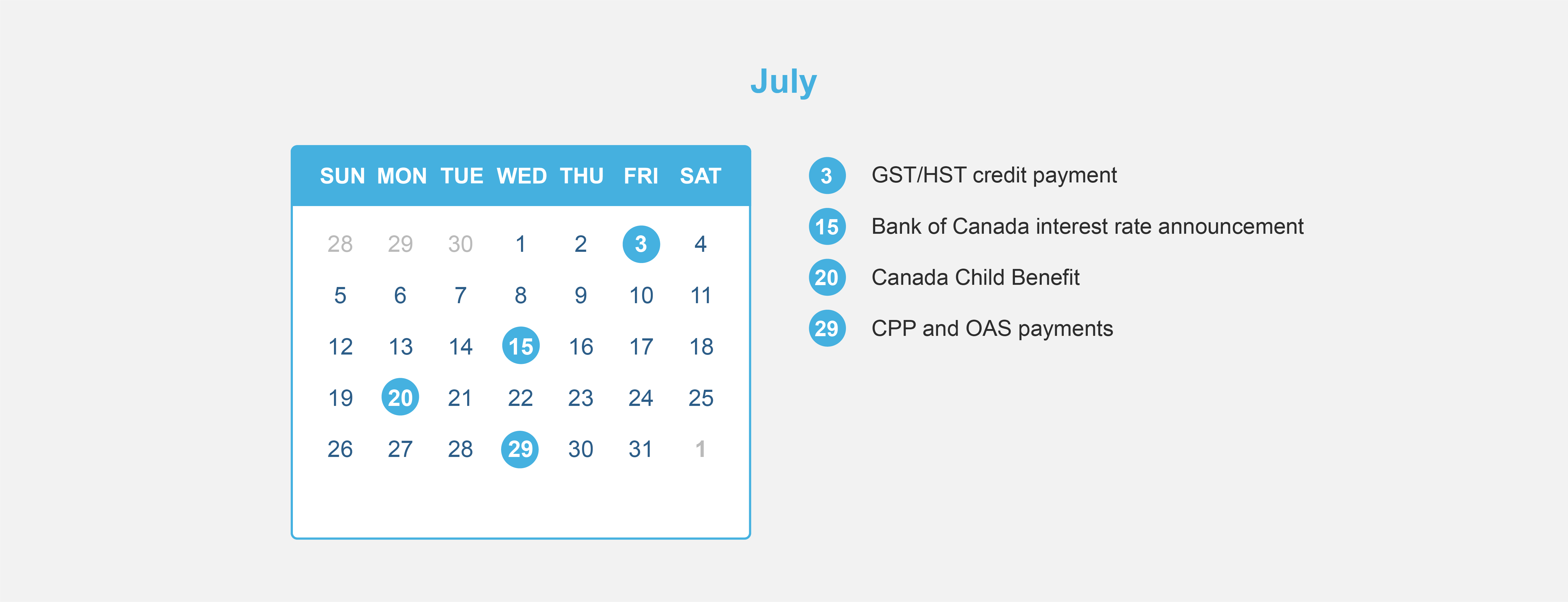

Since TFSA withdrawals are not considered taxable income, they will not impact your eligibility for income-tested government benefits.

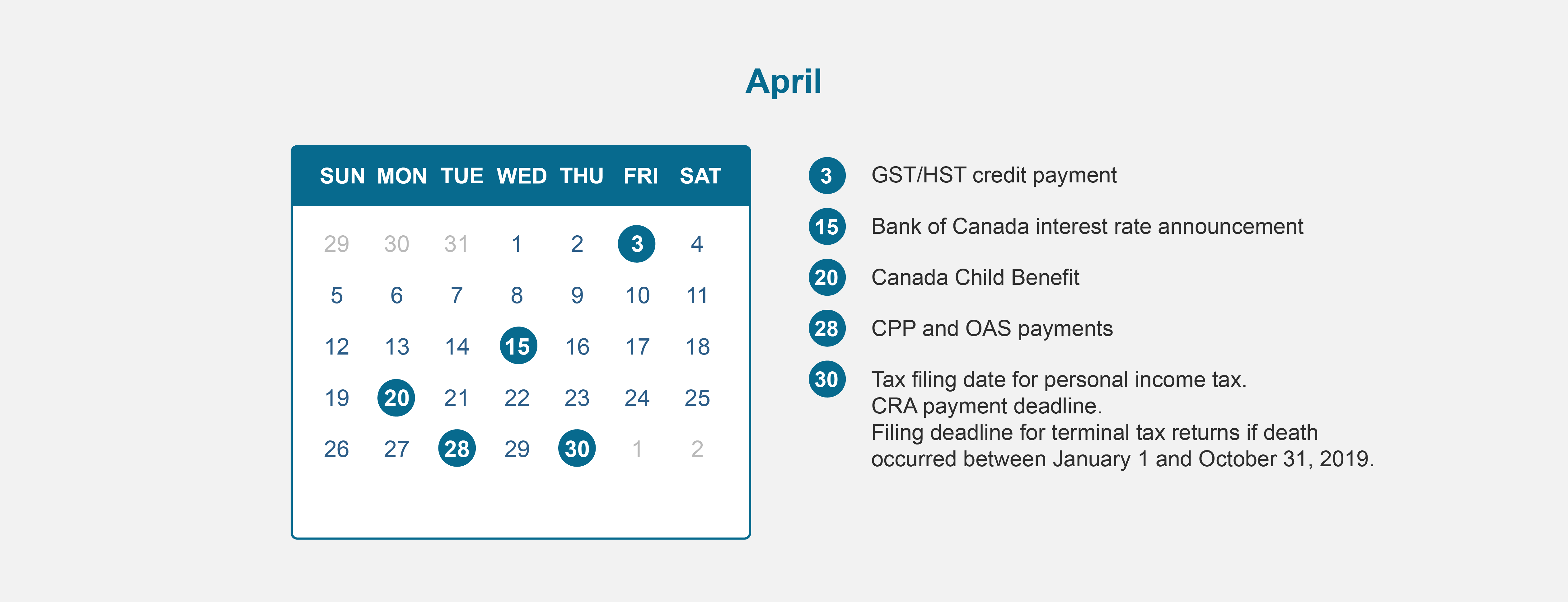

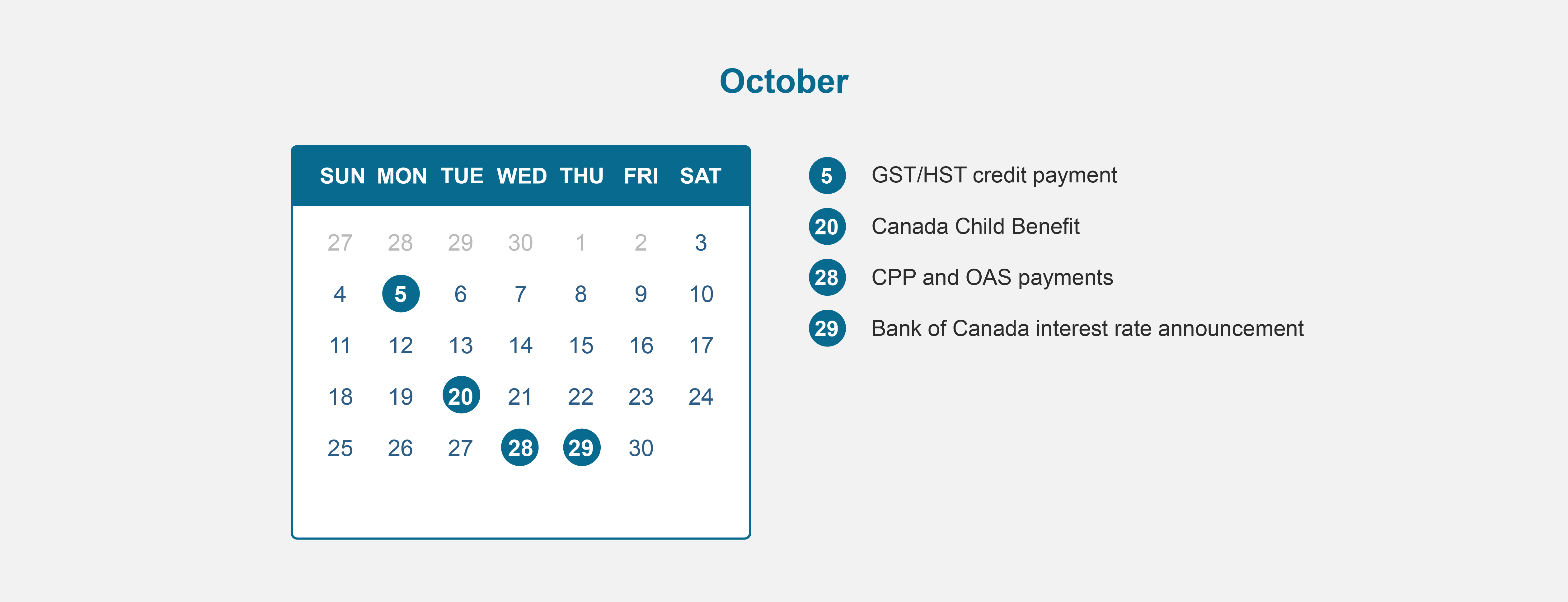

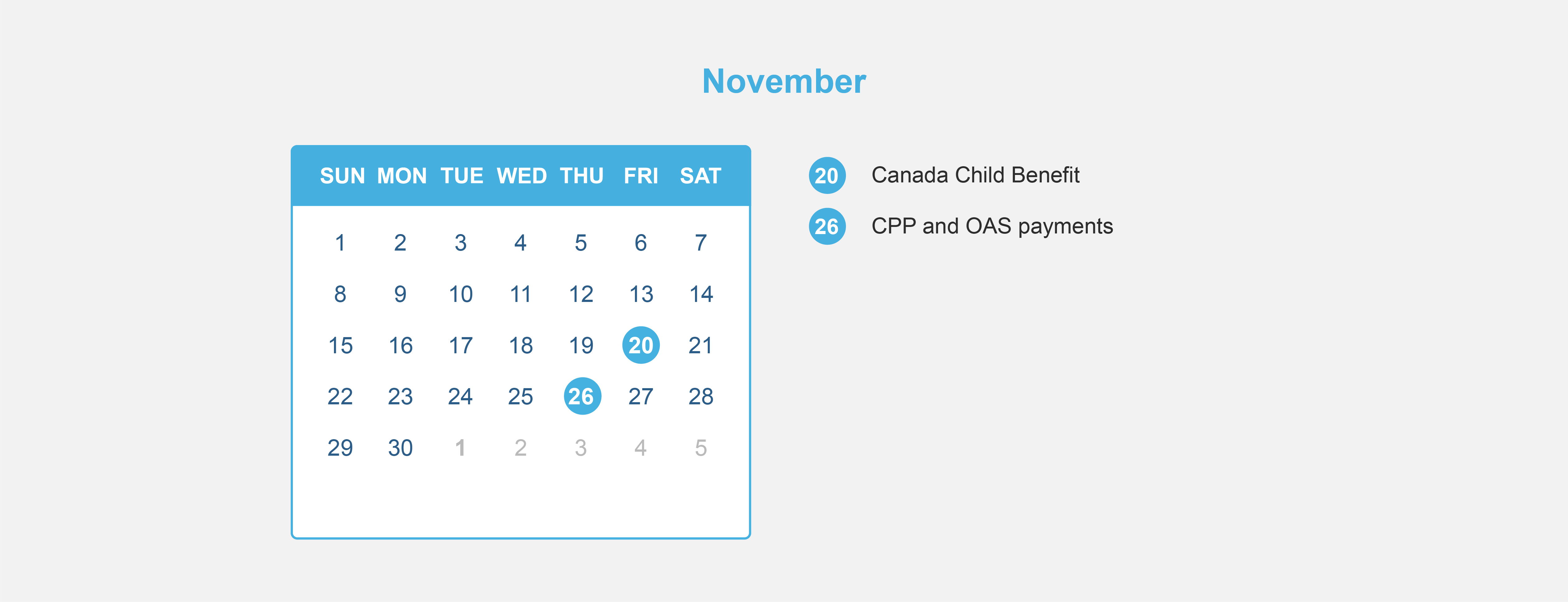

RRSP withdrawals are considered taxable income and can affect the following:

-

Income-tested tax credits such as Canada Child Tax Benefit, the Working Income Tax Benefit, the Goods and Services Tax Credit, and the Age Credit.

-

Government benefits including Old Age Security, Guaranteed Income Supplement and Employment Insurance.

How will a withdrawal impact my contribution room?

If you make a withdrawal from your TFSA, then the amount you withdrew will be added on top of your annual contribution room for the following calendar year. However, if you withdraw money from your RRSP, you do not open up additional contribution room.

The Takeaway

RRSPs and TFSAs can both be great savings vehicles. With this in mind, understanding the differences between these two types of tax-advantaged accounts can help you better plan for future purchases and your eventual retirement.