The Difference between Segregated Funds and Mutual Funds-Infographic

Segregated Funds and Mutual Funds often have many of the same benefits such as:

-

Both are managed by investment professionals.

-

You can generally redeem your investments and get your current market value at any time.

-

You can use them in your RRSP, RRIF, RESP, RDSP, TFSA or non-registered account.

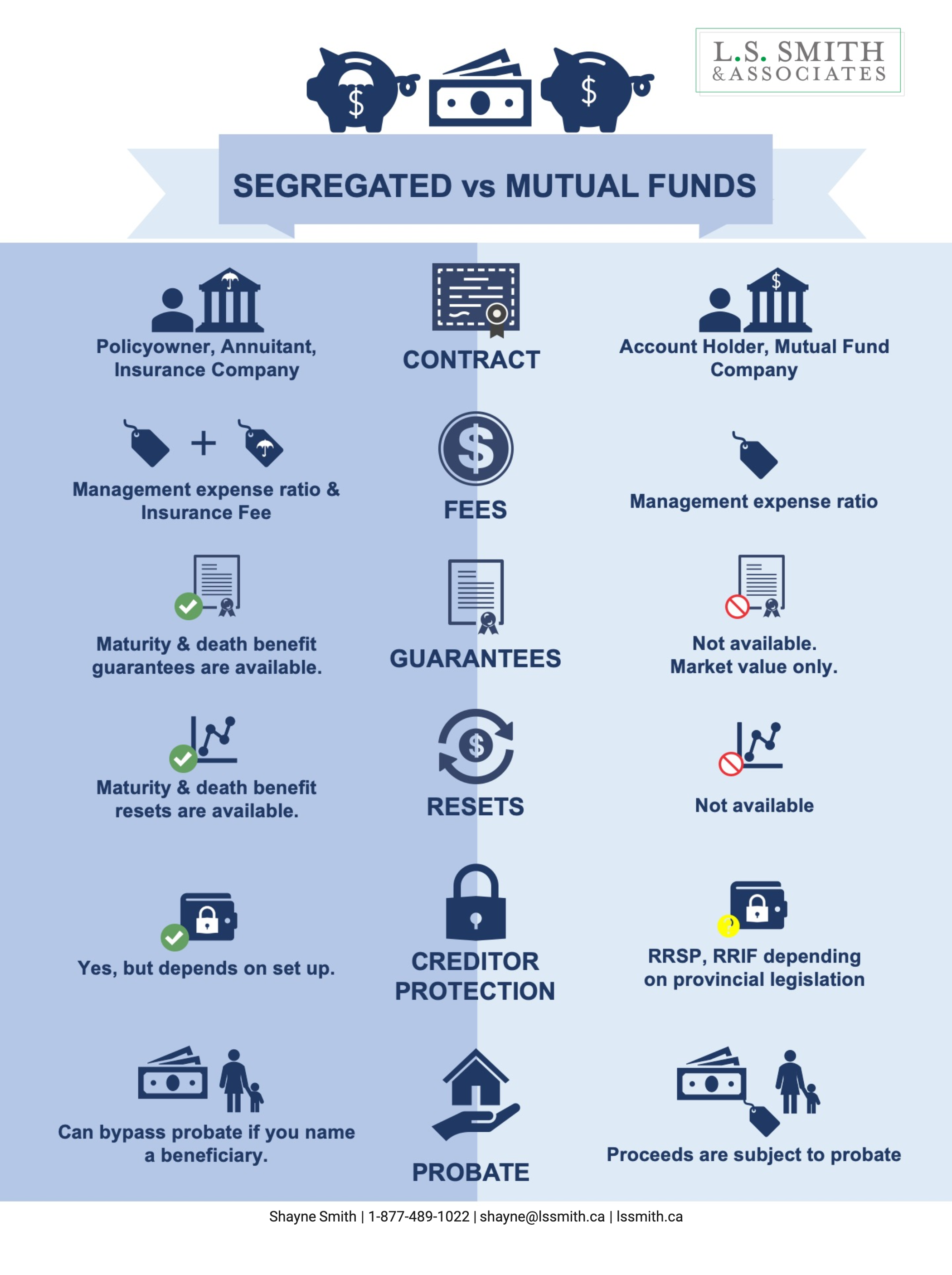

There are key differences including:

-

Contract

-

Fees

-

Guarantees

-

Resets

-

Creditor Protection

-

Probate

Contract:

-

Segregated Funds: Policy owner, Annuitant and Life Insurance company

-

Mutual Funds: Account holder, Mutual fund and Investment Company

Fees

-

Segregated Funds: Management Expense Ratio & Insurance Fee (Typically higher)

-

Mutual Funds: Management Expense Ratio

Why is this important?

-

Since Segregated funds are offered by life insurance companies, they are individual insurance contracts. Which means….

-

Maturity Guarantees

-

Death Benefit Guarantees

-

Maturity and death benefit resets

-

Potential Creditor Protection (depends on the setup)

-

Ability to Bypass Probate

Mutual Funds do not have these features with the exception of possible creditor protection of RRSP, RRIF dependant on provincial legislation.

What are these features?

Maturity and Death Benefit Guarantees mean the insurance company must guarantee at least 75% of the premium paid into the contract for at least 15 years upon maturity or your death.

Resets means you have the ability to reset the maturity and death benefit guarantee at a higher market value of the investment.

Potential Creditor Protection is available when you name a beneficiary within the family class, there are certain restrictions associated with this.

Bypass Probate: since you name a beneficiary to receive the proceeds on your death, the proceeds are paid directly to your beneficiary which means it bypasses your estate and can avoid probate fees.

We can help you decide what makes sense for your financial situation.