Manitoba Budget Highlights for 2020 and COVID-19 Supplement

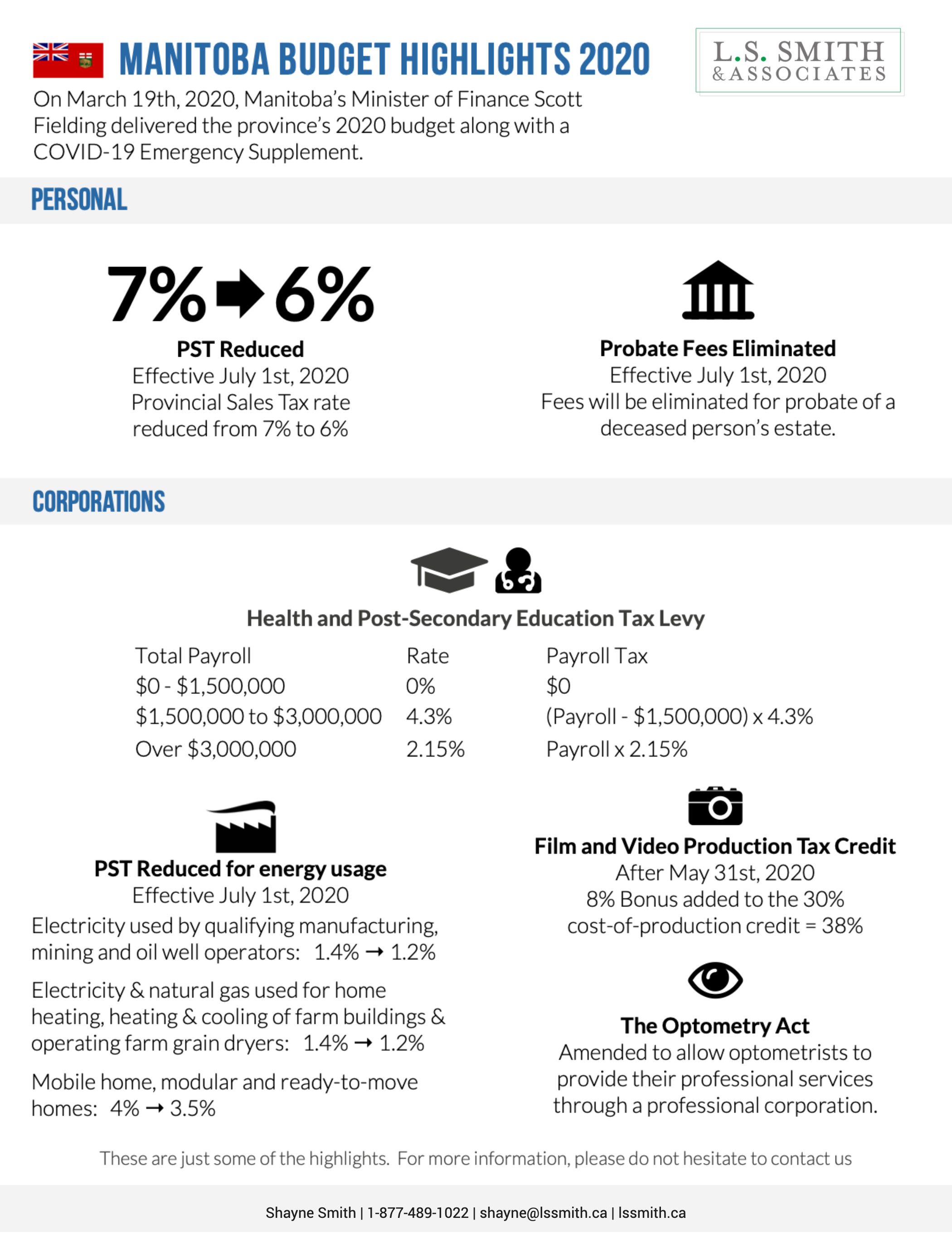

On March 19th, 2020, Manitoba’s Minister of Finance Scott Fielding delivered the province’s 2020 budget along with a COVID-19 Emergency Supplement. Some of the highlights include:

-

PST will be reduced from 7% to 6 %

-

Film and Video Production Tax Credit will be enhanced

-

Health and Post-Secondary Education Tax Levy threshold will be increased

-

Probate fees will be eliminated

-

Introduction of the Green Levy

Sales Tax Measures

Provincial sales tax (PST) rates

Effective July 1st, 2020, the Provincial Sales Tax will decrease from 7% to 6%. As well, the PST rates will be decreased on:

-

Electricity used by qualifying manufacturing, mining and oil well operators from 1.4% to 1.2%

-

Mixed uses of electricity and natural gas used for home heating, heating and cooling of farm buildings,

and operating farm grain dryers, will decrease from 1.4 per cent to 1.2 per cent.

-

Mobile home, modular and ready-to-move homes will decrease from 4% to 3.5%

-

Prorated vehicle tax rates for commercial trucking will be adjusted for the lower general retail sales tax

rate of 6 per cent.

Retail Sales Tax Exemption for Preparing Personal Income Tax Returns

The preparation of personal income tax returns will be exempted from retail sales tax effective October 1, 2020, as

was committed to under the Manitoba Government’s $2,020 Tax Rollback Guarantee. This ensures the preparation of personal income tax returns for the 2020 taxation year will be exempted from retail sales tax.

Tobacco Tax

The following tobacco tax rates will change, effective July 1, 2020:

-

cigarettes from 30.0¢ to 30.5¢ each

-

fine cut tobacco from 45.5¢ to 46.0¢ per gram

-

raw leaf tobacco from 27.5¢ to 28.0¢ per gram

-

other tobacco products from 29.0¢ to 29.5¢ per gram

This increase ensures the total retail price of tobacco will remain approximately the same once the sales tax rate decreases to six per cent on July 1, 2020.

Personal Tax Credits

Manufacturing Investment Tax Credit

Scheduled to expire on December 31, 2020, is made permanent.

This credit supports businesses by providing a seven per cent tax credit (six per cent refundable and a one per cent non-refundable) that acquire qualified plant, machinery and equipment for use in manufacturing or processing in Manitoba.

Mineral Exploration Tax Credit

Scheduled to expire on December 31, 2020, is extended for three years to December 31, 2023.

This credit supports Manitobans who invest in flow-through shares of qualifying mineral exploration companies engaged in mineral operations in Manitoba and is equal to 30 per cent of investments in flow-through shares.

Community Enterprise Development Tax Credit

Scheduled to expire on December 31, 2020, is extended for one year to December 31, 2021.

This program supports Manitoba resident investors to invest in business opportunities in their communities and assist community-based enterprise development projects to raise local equity capital by providing a 45 per cent refundable tax credit on eligible shares.

Cultural Industries Printing Tax Credit

Scheduled to expire on December 31, 2020, is extended for one year to December 31, 2021.

This tax credit promotes the growth of Manitoba’s printing industry, with a 35 per cent refundable credit on salary and wages paid to Manitoba employees.

Elimination of Probate Fees

When an estate of a deceased person requires probating, probate fees are payable on the value of that person’s estate. The current probate fee is $70 on the first $10,000 value of the estate and then $7 per $1,000 or portion of a $1,000 thereafter. Beginning on July 1, 2020, applications made to the Court of Queen’s Bench for the probate of an estate of a deceased person will no longer require the payment of any probate fees.

Green Levy

Manitoba will introduce a green levy at a flat rate of $25 per tonne of carbon dioxide equivalent (tCO2e) emissions, effective July 1, 2020. It will apply to gas, liquid, and solid fuel products intended for combustion (referred to as fuels).

Green Levy rate per unit for fuel types:

-

Gasoline: 5.30 ¢ / L

-

Diesel: 6.74 ¢ / L

-

Natural Gas: 4.74 ¢ / m³

-

Propane: 3.87 ¢ / L

The green levy on natural gas and coal will be exempt from PST

Business Measures

Health and Post-Secondary Education Tax Levy

Effective January 1, 2021, the exemption threshold is raised from $1.25 million to $1.5 million of annual remuneration. In addition, the threshold below which employers pay a reduced rate is raised from $2.5 million to $3.0 million.

Film and Video Production Tax Credit

Effective for principal photography that begins after May 31, 2020, a new Manitoba Production Company Bonus of eight per cent is added to the 30 per cent cost-of-production credit under the Film and Video Production Tax Credit, increasing the total cost-of-production credit up to 38 per cent.

Child Care Centre Development Tax Credit

Effective after budget day, the existing child care spaces limit is increased by 474 spaces, from 208 to 682 spaces, to support growing interest in work place child care. In addition, the maximum daily amount that can be charged is eliminated, allowing eligible corporations to partner with for-profit child care centres and permit non-profit child care centres developed under the tax credit, to establish parent fees that support their business.

Manufacturing Investment Tax Credit

Effective for qualifying property acquired and available for use after June 30, 2020, the refundable portion of the Manufacturing Investment Tax Credit is reduced from seven per cent to six per cent, to align with the sales tax rate reduction. The one per cent non-refundable portion is not impacted by this change.

The Optometry Act

Amendments will be made to allow optometrists to provide their professional services through a professional corporation.

COVID-19 EMERGENCY SUPPLEMENT

Rainy Day Fund Re-Investment

Manitoba’s Rainy Day Fund is currently funded to $571 million. The balance will grow to $800 million before the end of this month, and to $872 million by the end of the 2020/21 fiscal year.

Federal Support

The federal government has committed $500 million of aid to provinces and territories, of which $18 million will be available to Manitoba. It has indicated that further aid is likely to be forthcoming, and has also announced that $10 billion in credit will be made available for businesses through the Business Development Bank of Canada and the Export Development Bank of Canada. Manitoba will work with the federal government to identify business sectors that require assistance as a result of harm caused by COVID-19.

For the full details of the budget and the COVID-19 Emergency Supplement, follow the links below: