Renewing Your Group Benefits Plan

When it’s time to renew your organization’s group benefits plan, it’s a chance to step back, take a close look, and ensure everything still makes sense for your team and budget. Each year, your provider will review past claims and usage to help adjust coverage and premiums, so the plan remains relevant. Here’s how to get the most out of this process.

Reviewing Your Benefits: Focus on What Matters

Take time to examine each part of your benefits package to see if it still meets the needs of your team:

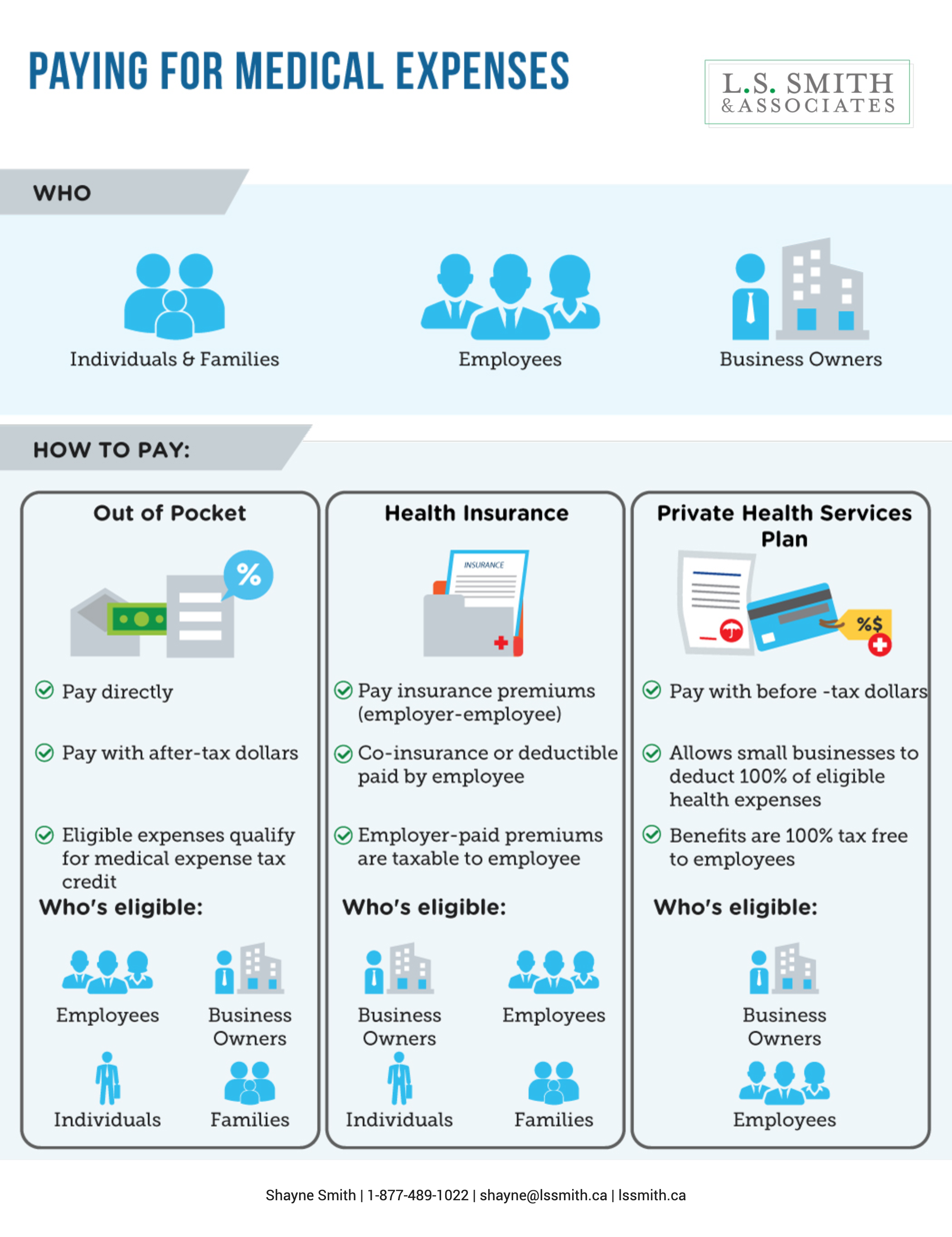

- Health Coverage: Look at what’s covered for prescription drugs, hospital care, and specialist visits. Are the current limits in line with what your team uses most?

- Dental Coverage: From cleanings to crowns, check that the plan covers routine and advanced dental needs. If usage is low, maybe it’s time for an update.

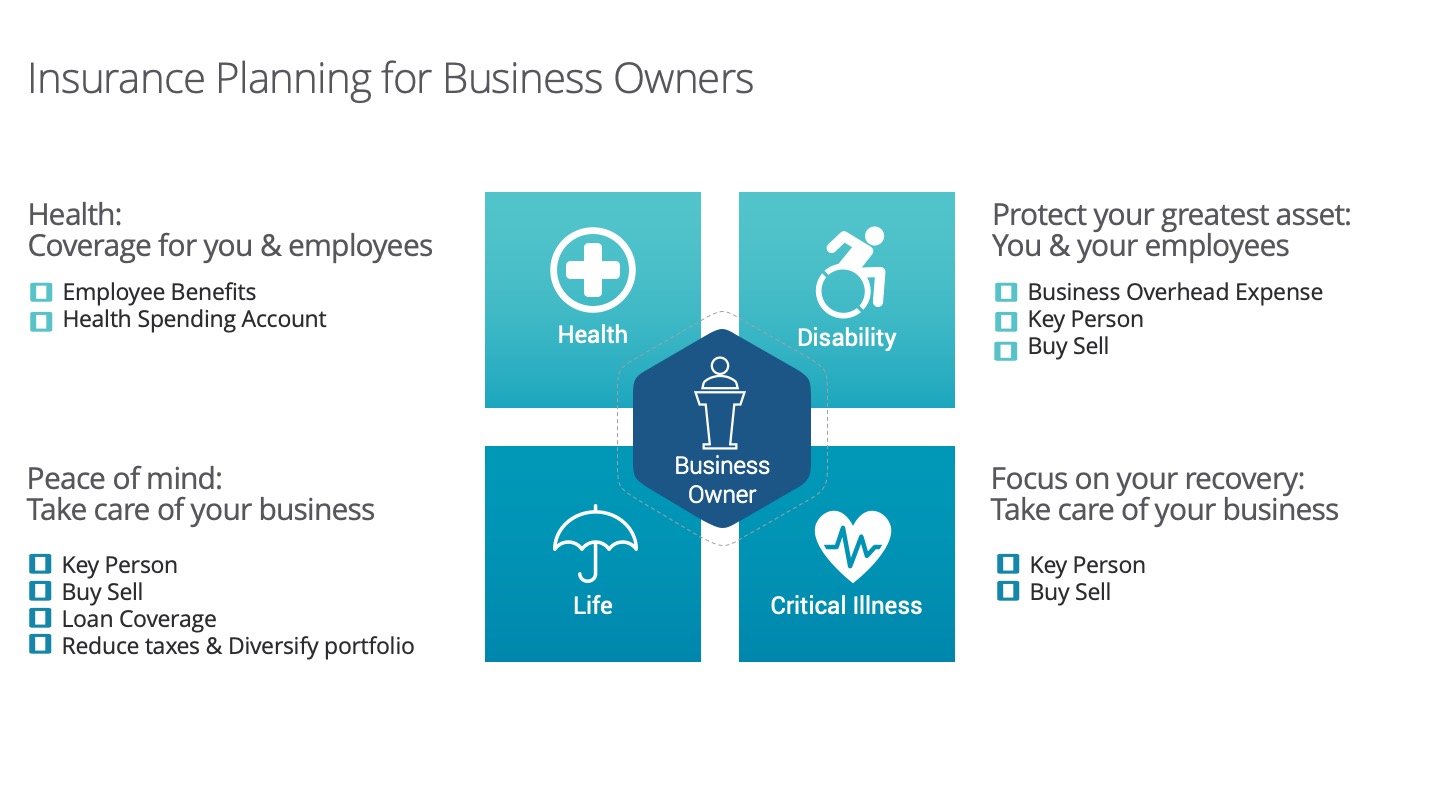

- Disability and Life Insurance: Disability insurance protects income during tough times, while life insurance gives peace of mind. Make sure coverage levels are right for your team.

- Critical Illness and Accident Insurance: These benefits can provide extra financial support for serious illnesses or accidents, with options for additional coverage if it’s a priority for employees.

Specialty Benefits That Add Flexibility

Consider adding options that give employees more control over their benefits:

- Health Care Spending Accounts (HCSAs): With HCSAs, employees have a set allowance to cover eligible health expenses. This flexibility lets employees pick and choose the coverage that fits their needs.

- Emergency Medical Coverage: This can be particularly valuable for employees who travel frequently, covering unexpected medical costs on the road.

- Retiree and Self-Employed Benefits: If you offer benefits for retirees or contractors, make sure these plans focus on the essentials, like prescriptions, dental, and vision, to keep things simple and effective.

Checking Value and Staying on Budget

Once you know what you’re covering, see if it aligns with what your team values most and if it’s worth the premium cost:

- Utilization Analysis: Look at which benefits are most used. If something like dental care isn’t being used much, that could mean there’s room to adjust.

- Employee Feedback: Ask employees directly what benefits do they find most valuable? This feedback can guide your decisions.

Making the Right Adjustments

When you have the full picture, it’s time to consider if adjustments would make the plan stronger or more efficient:

- Benefit Modifications: Maybe it’s time to add a health spending account, adjust critical illness coverage, or tweak other benefits to better reflect what employees want.

- Cost-Sharing Adjustments: Evaluate how the premium costs are split. Adjusting the cost share may help keep the plan sustainable for everyone.

With the right approach to your group benefits renewal, you can keep your plan valuable, easy to understand, and tailored to what your team needs most. This way, you’re not just offering a benefits package—you’re providing a solution that works.