Financial Advice

An advisor can help you determine where you are today financially and where you want to go. An advisor can provide you guidance on how to reach your short, medium and long term financial goals.

Why work with a Financial Advisor?

-

Worry less about money and gain control.

-

Organize your finances.

-

Prioritize your goals.

-

Focus on the big picture.

-

Save money to reach your goals.

What can a Financial Advisor help you with?

Advisors can help you with accumulation and protection

Accumulation:

-

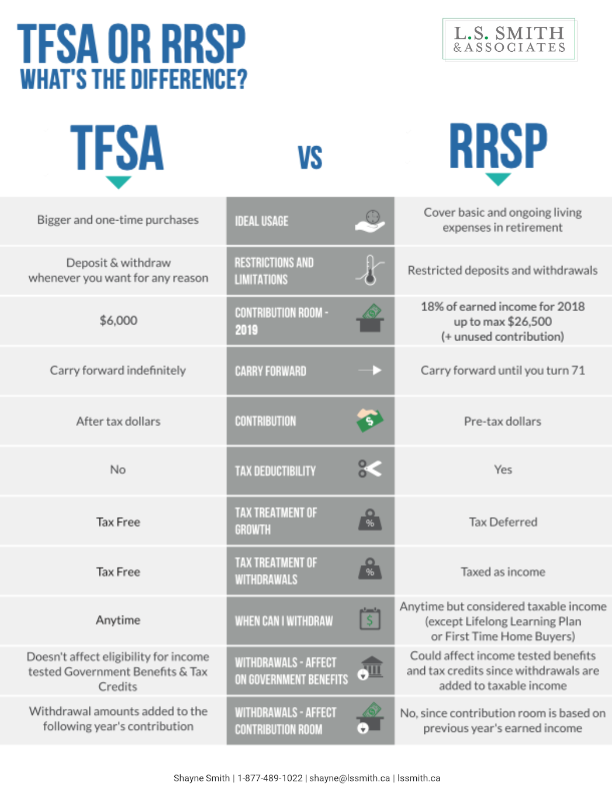

Cash Management – Savings and Debt

-

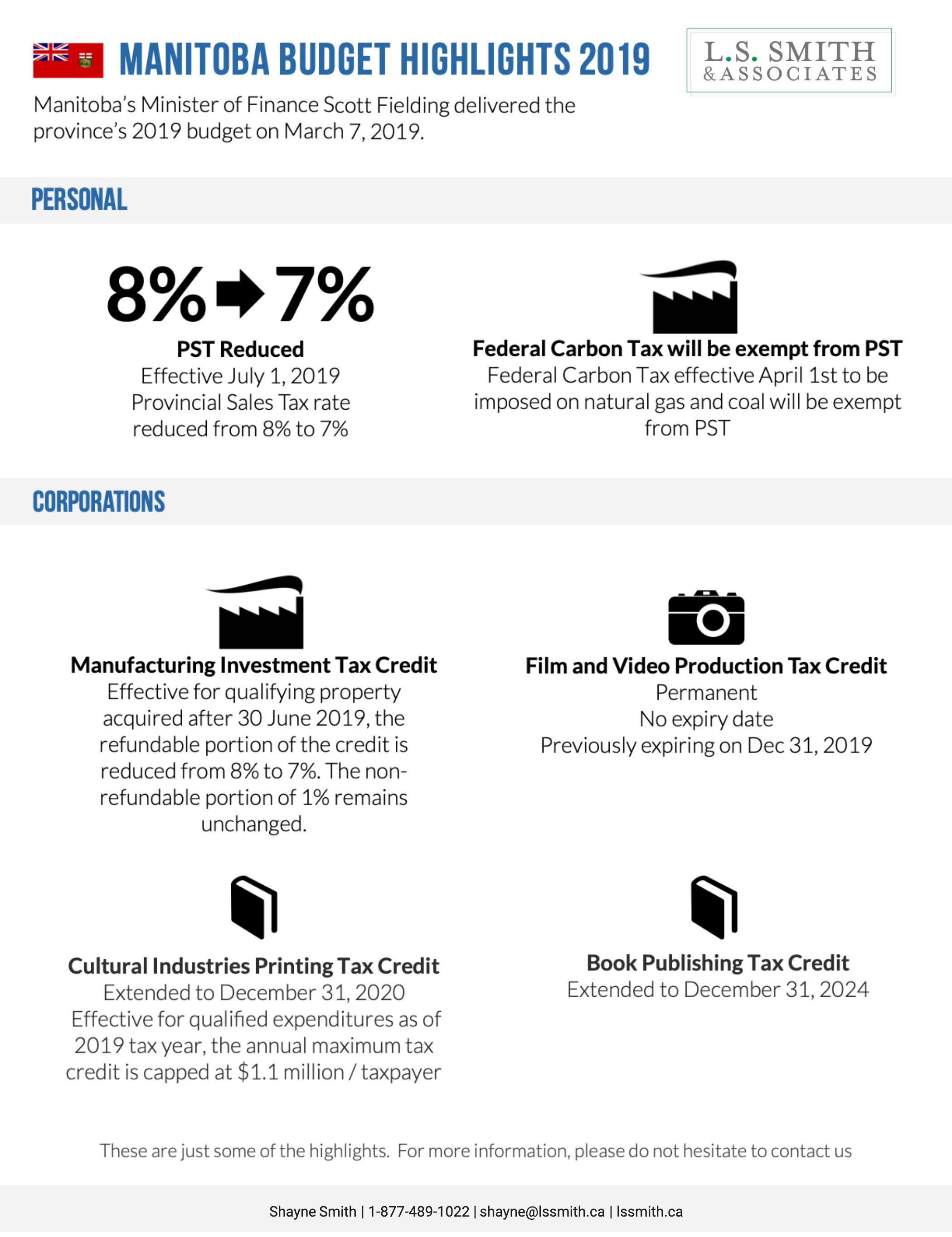

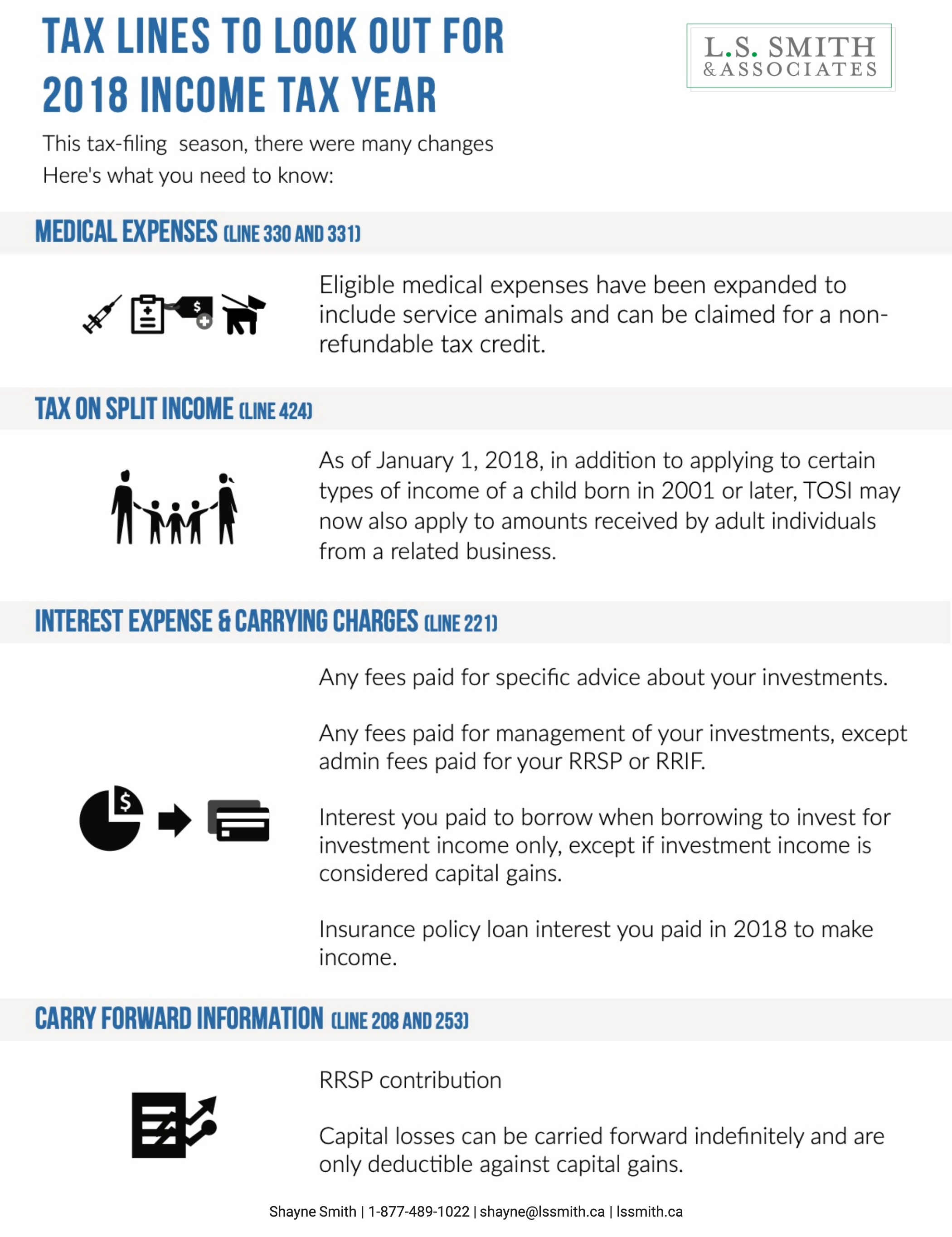

Tax Planning

-

Investments

Protection:

-

Insurance Planning

-

Health Insurance

-

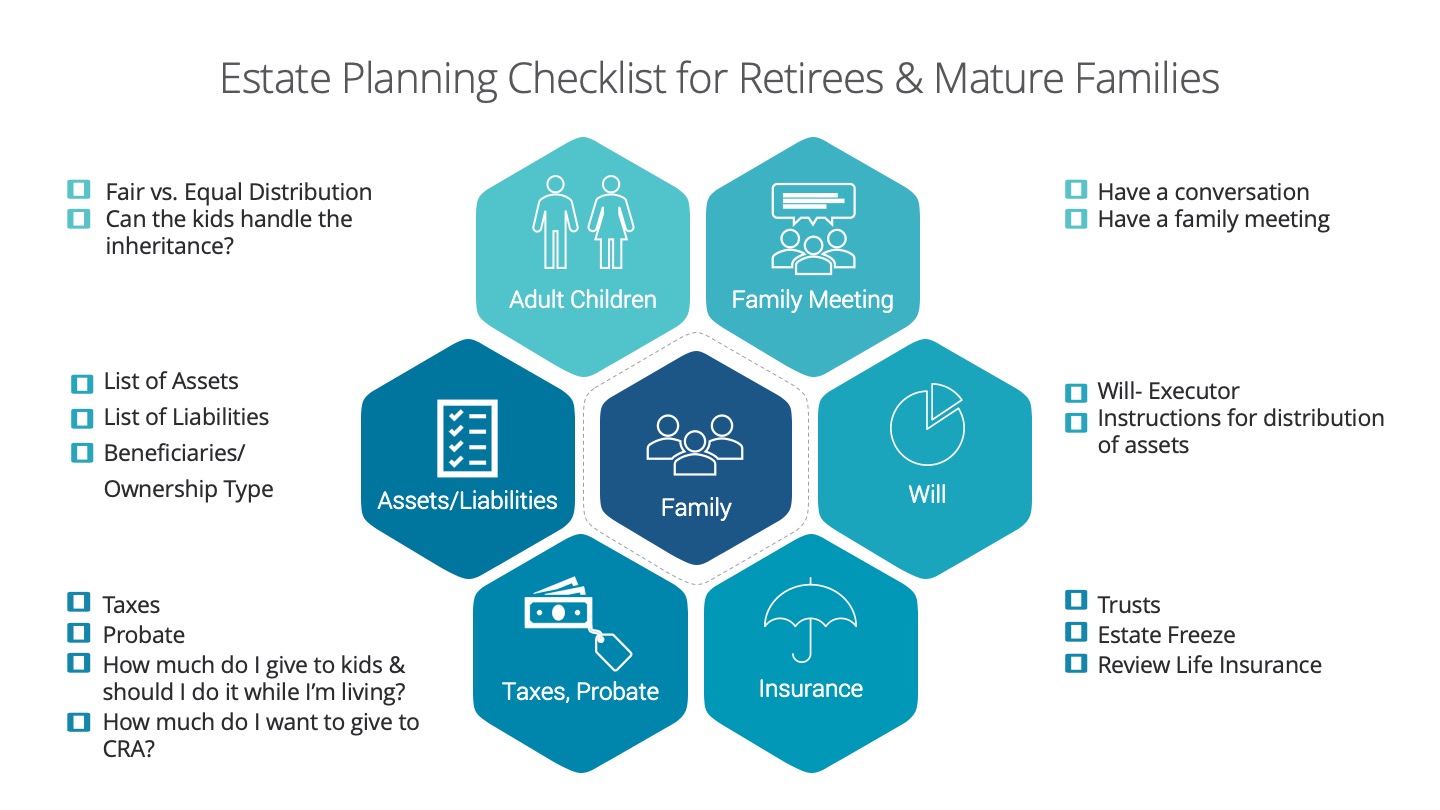

Estate Planning

How do you start?

-

Establish and define the financial advisor-client relationship.

-

Gather information about current financial situation and goals including lifestyle goals.

-

Analyze and evaluate current financial status.

-

Develop and present strategies and solutions to achieve goals.

-

Implement recommendations.

-

Monitor and review recommendations. Adjust if necessary.

Next steps…

-

Talk to us about helping you get your finances in order so you can achieve your lifestyle and financial goals.

-

Feel confident in knowing you have a plan to get to your goals.