A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Canada Emergency Response Benefit

For the CERB, if you are paying yourself a non-eligible dividend from your corporation, an individual can now count this income towards the $5,000 income requirement to be eligible for CERB.

From canada.ca:

If I am in receipt of dividends am I eligible for the Canada Emergency Response Benefit?

“Yes, as long as the dividends are non-eligible dividends (generally, those paid out of corporate income taxed at the small business rate).

An individual could count this income towards the $5,000 income requirement to be eligible for CERB.”

https://www.canada.ca/en/services/benefits/ei/cerb-application/questions.html

Canada Emergency Wage Subsidy

For the CEWS, the Federal Government is adjusting the qualifying income reduction and the period to measure against:

- When comparing March 2020 to March 2019, qualifying income reduction reduced to 15% to account for ½ month, April and May remain at 30% qualifying income reduction OR

- Option of comparing against January and February 2020, qualifying income reduction is 30%

“Companies will now have the option of using January and February of this year as reference points to show a 30% loss. And businesses will only need to show a 15% decline in revenue in March instead of 30% because most of us only felt the impact of COVID-19 until half way through the month”

– Prime Minister Justin Trudeau

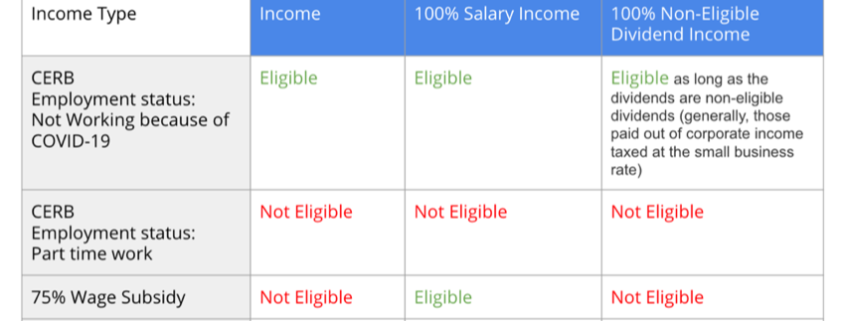

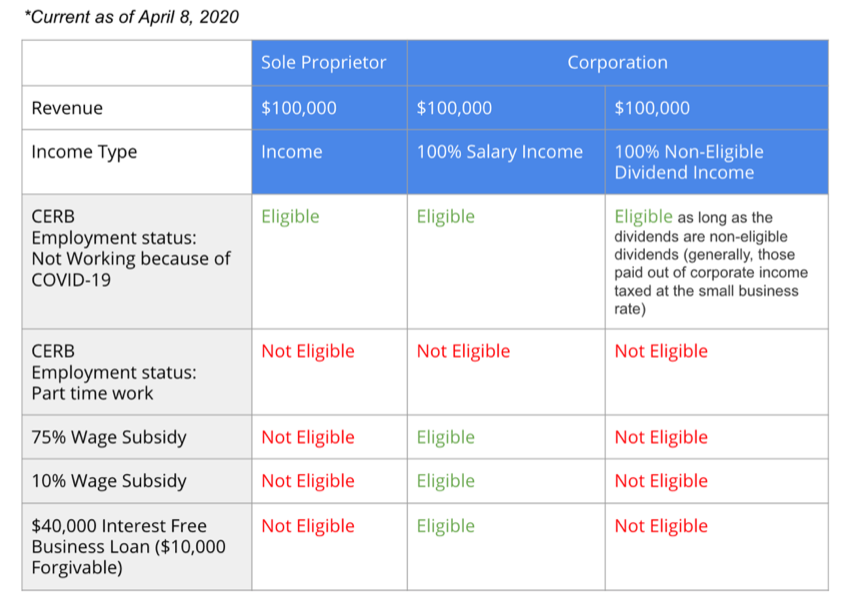

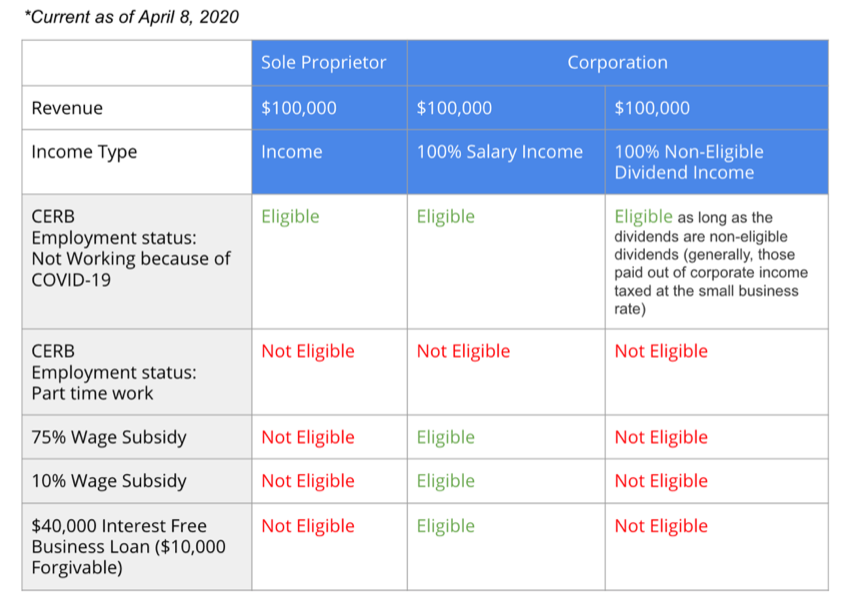

We continue to receive questions from Solo Small Business Owners asking whether they qualify for the government programs available. We created the chart below for:

- Canada Emergency Response Benefit (CERB): $500/week for up to 16 weeks

- Canada Emergency Wage Subsidy (CEWS): 75% Wage Subsidy

- 10% Wage Subsidy

- Canada Emergency Business Account (CEBA): $40,000 Interest Free Business Loan ($10,000 Forgivable)

The chart is based on an example of 3 small businesses earning $100,000 in revenue but structured in 3 different ways:

- Sole Proprietor: earnings paid out as 100% self-employed business income

- Corporation: earnings paid out as 100% salary

- Corporation: earnings paid out as 100% non-eligible dividend

The government is continually adjusting these programs to meet the needs of struggling business owners so check back often for updates.

For the full details, go to: https://www.canada.ca/en/department-finance/economic-response-plan.html#businesses

Canada Summer Jobs Program

For businesses hiring students, Ottawa boosts student job wage subsidy to 100%. The temporary changes to the program for this year include:

- an increase to the wage subsidy, so that private and public sector employers can also receive up to 100% of the provincial or territorial minimum hourly wage for each employee

- an extension to the end date for employment to February 28, 2021

allowing employers to adapt their projects and job activities to support essential services

- allowing employers to hire staff on a part-time basis

These changes will help youth stay connected to the labour market, save money for their future, and find quality jobs in safe, inclusive, and healthy work environments.