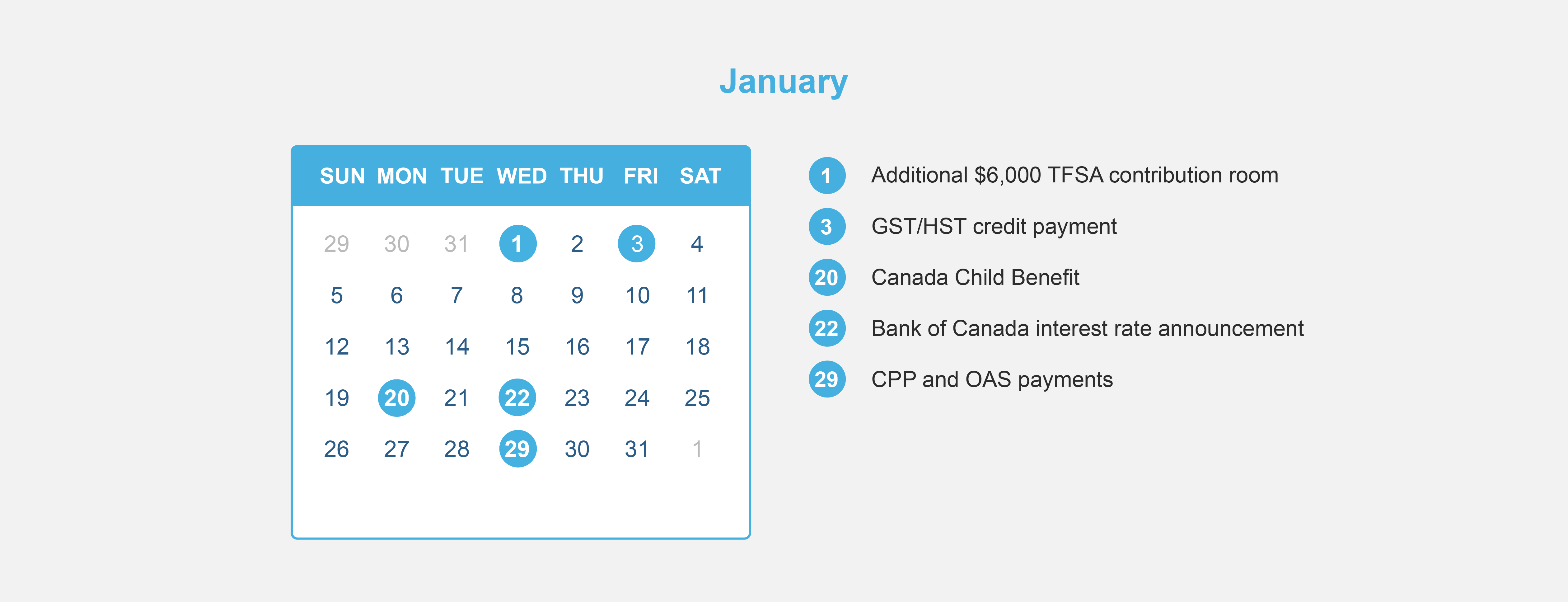

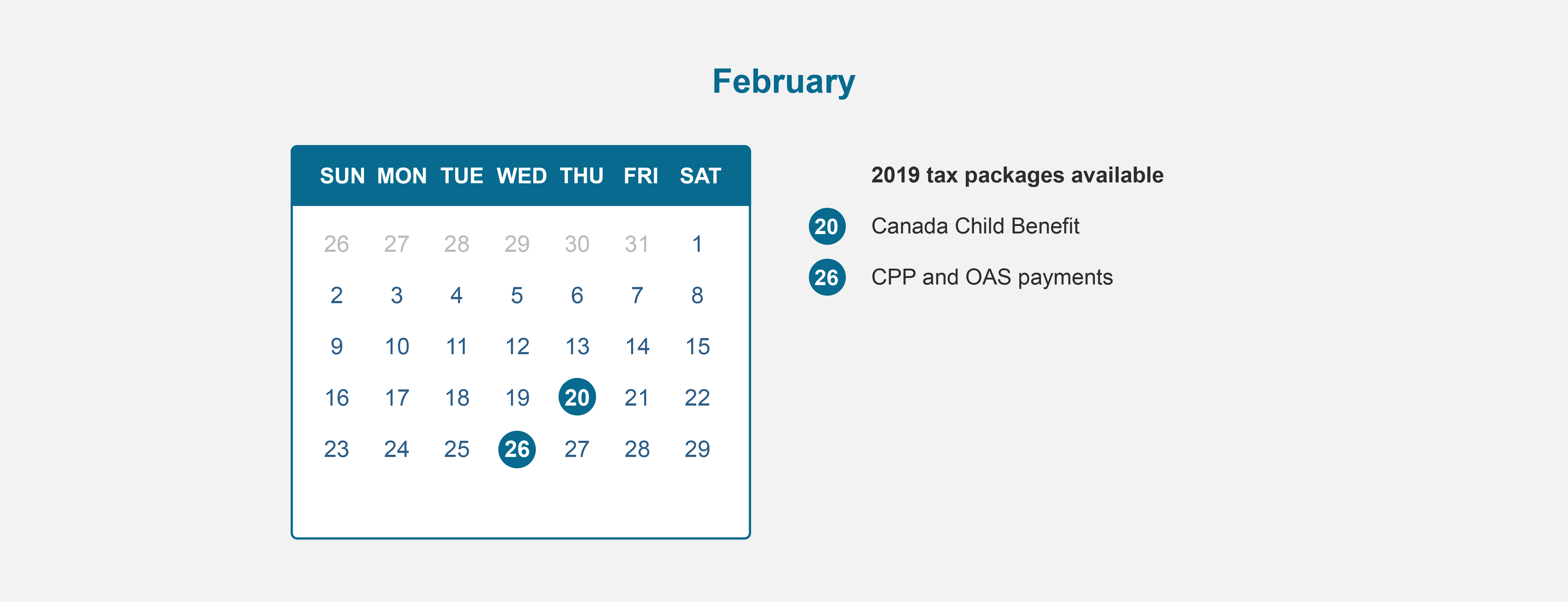

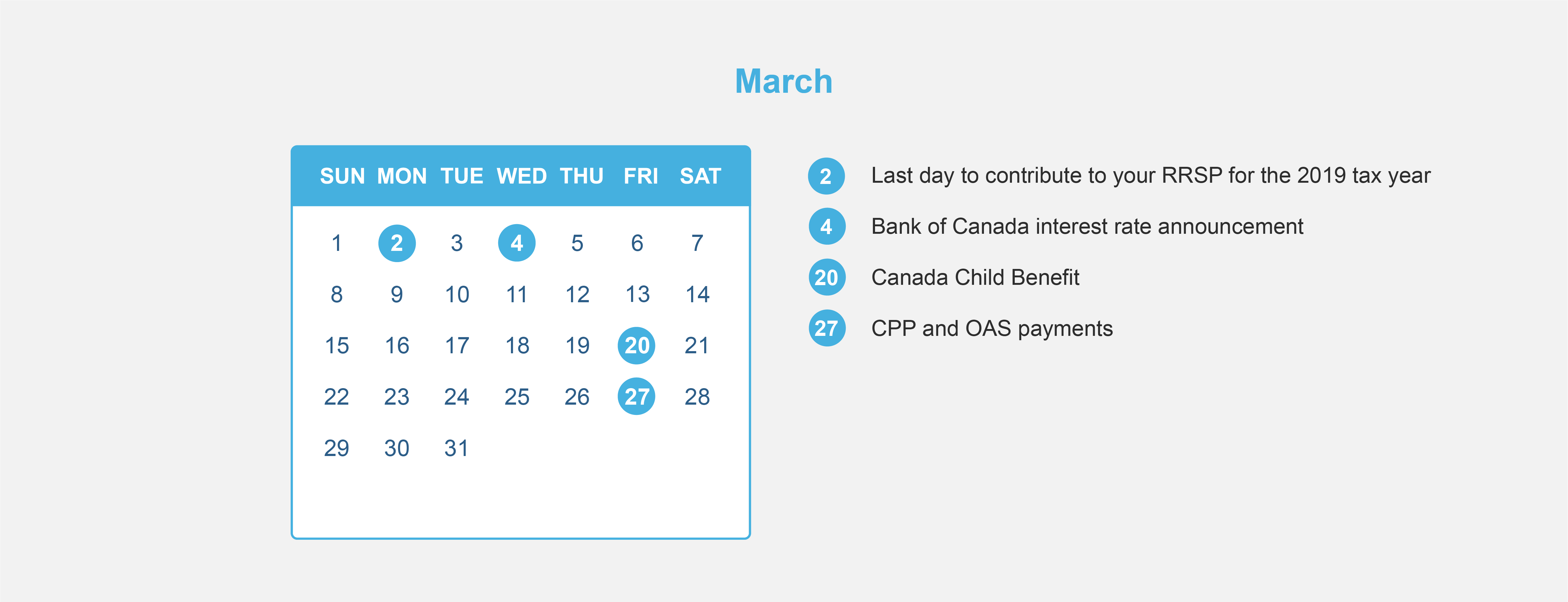

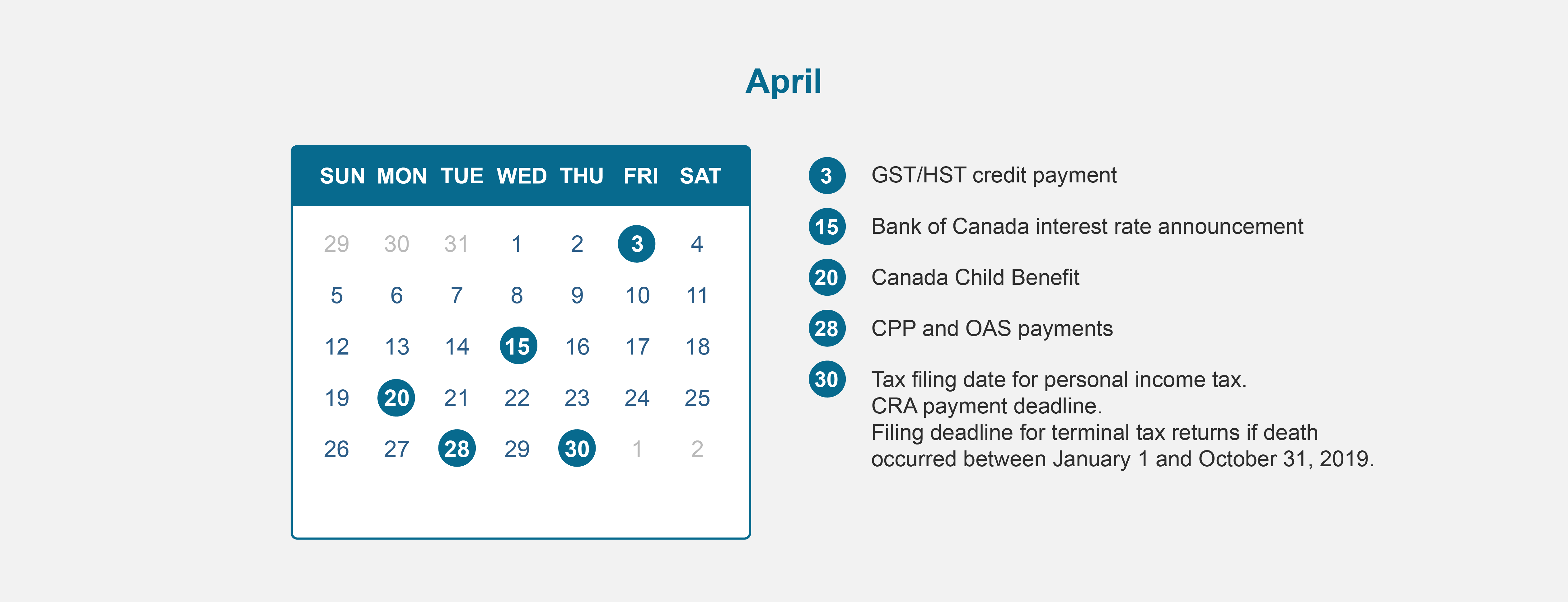

2020 Financial Calendar

2020 Financial Calendar

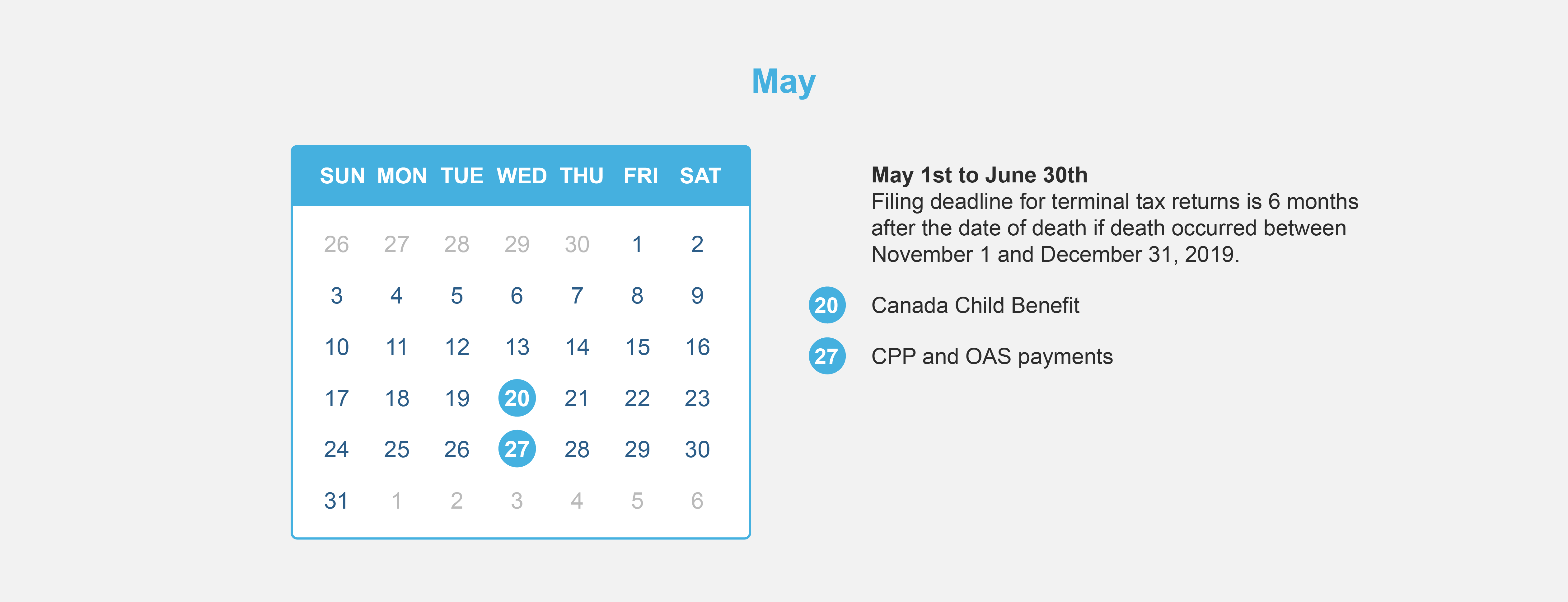

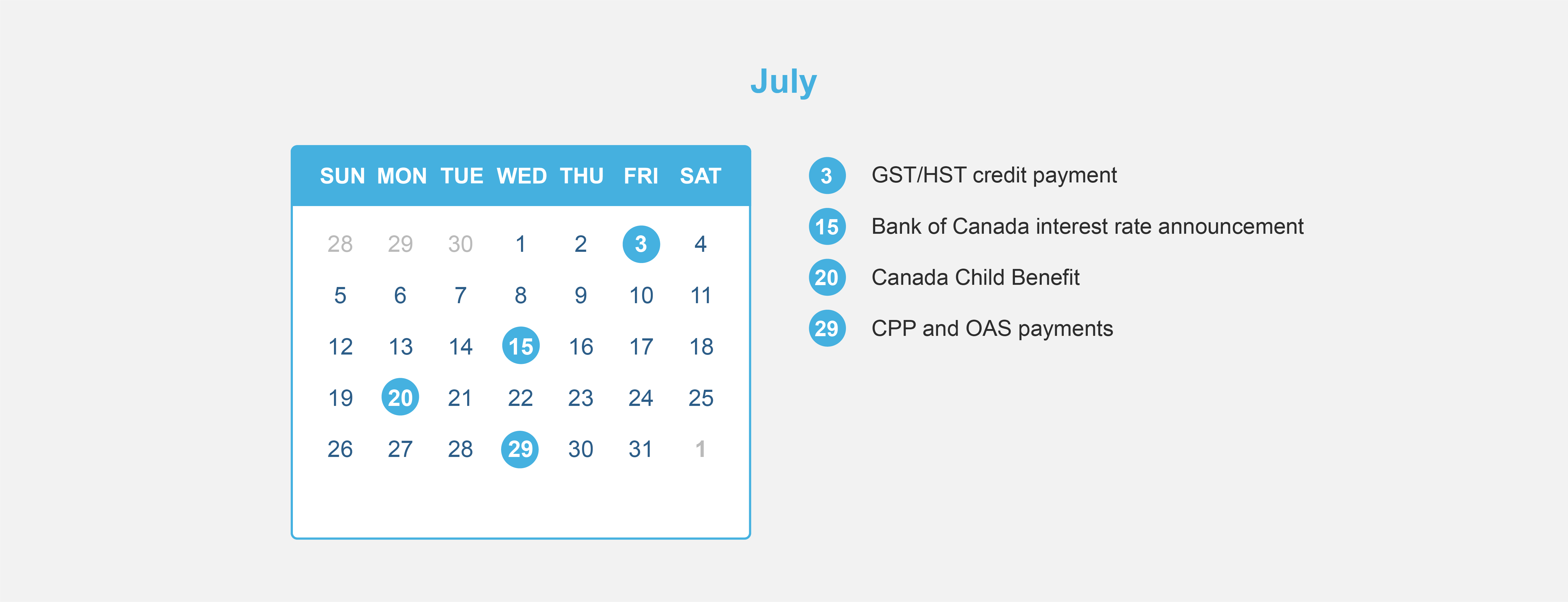

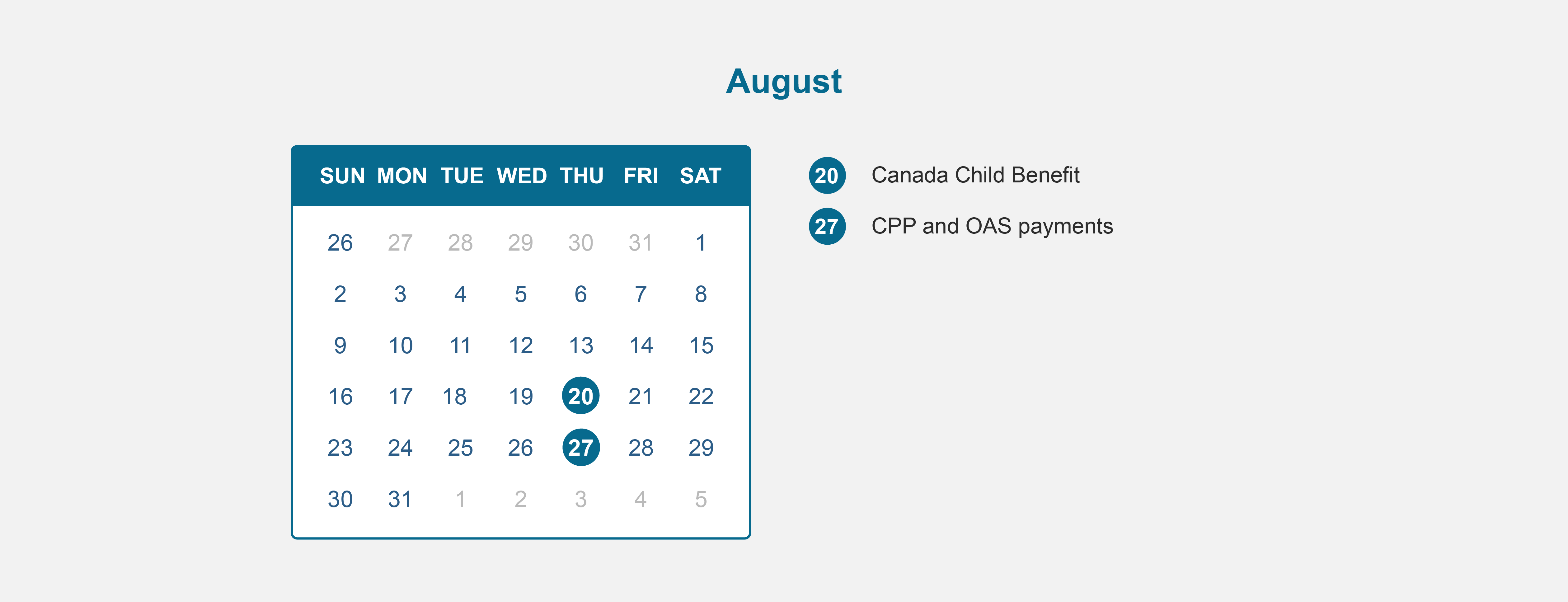

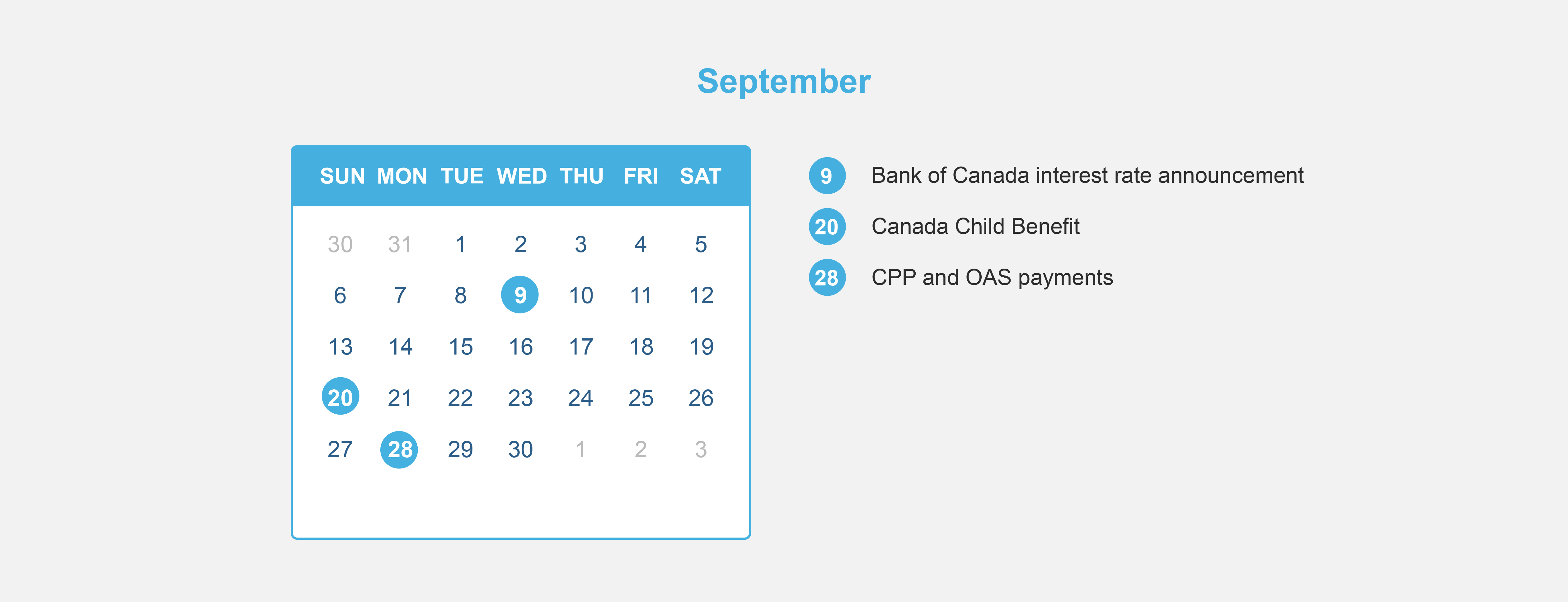

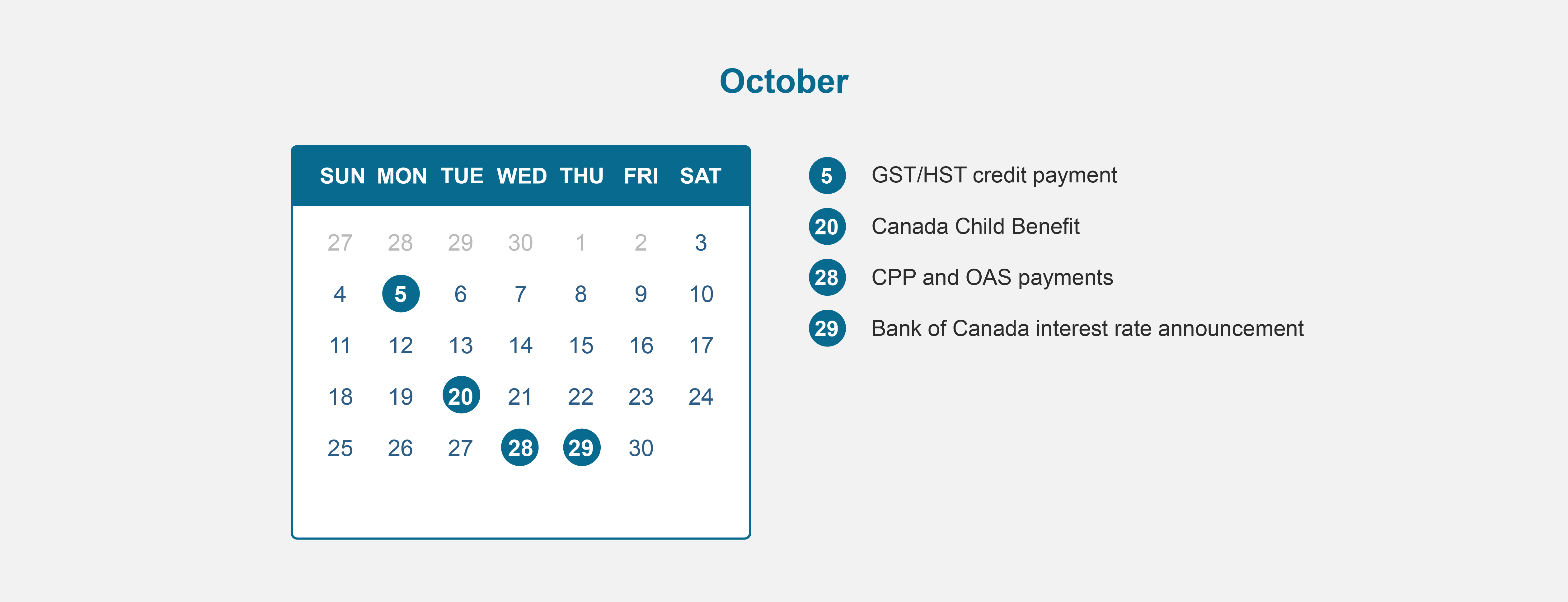

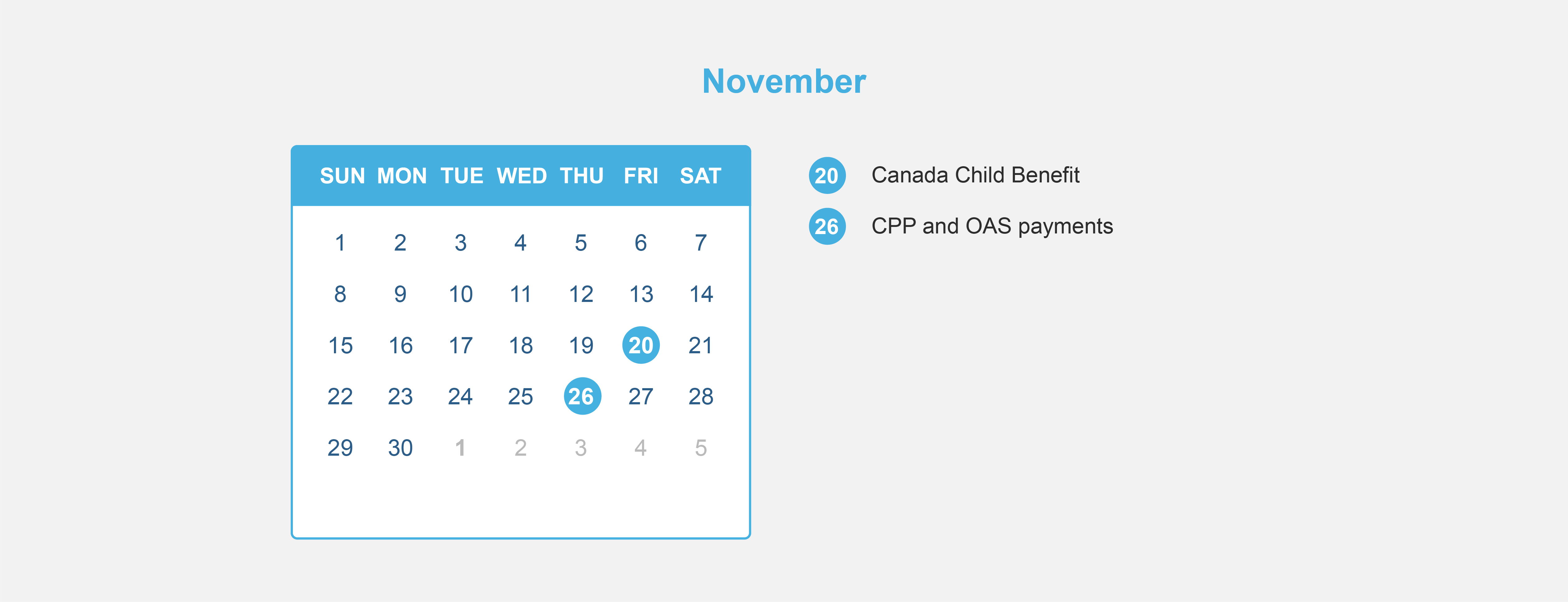

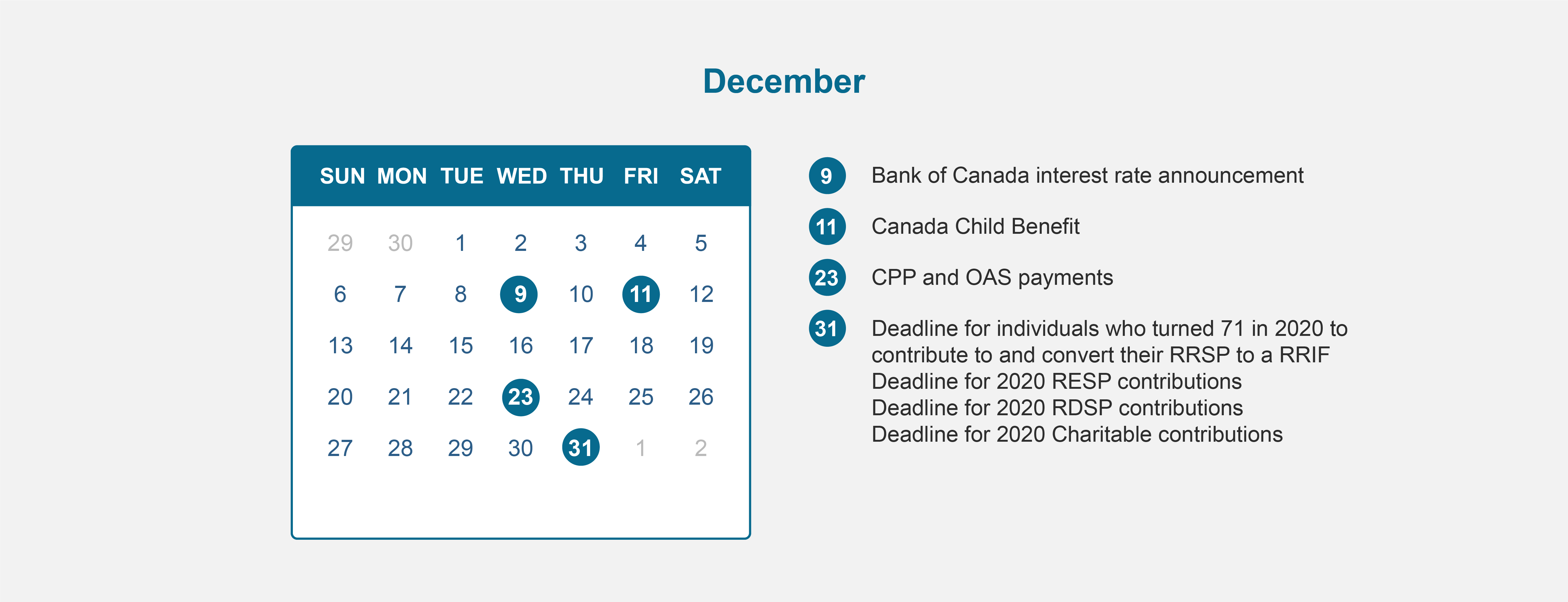

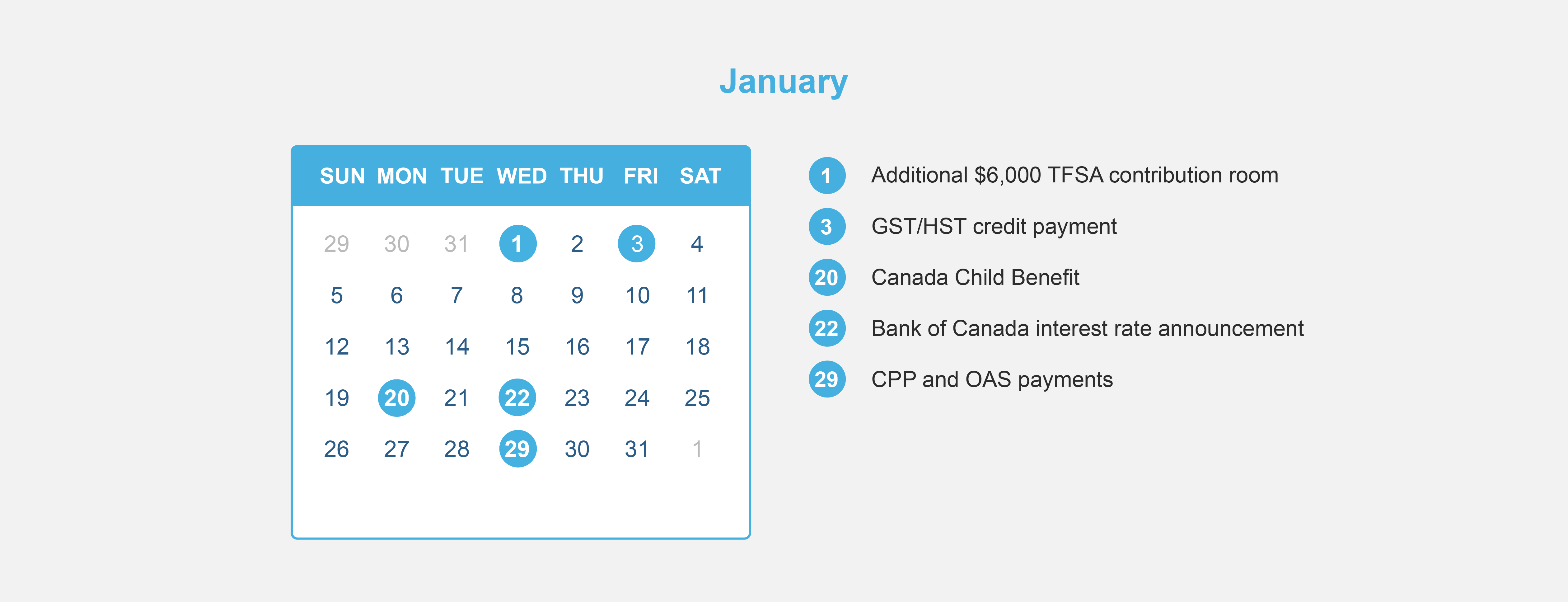

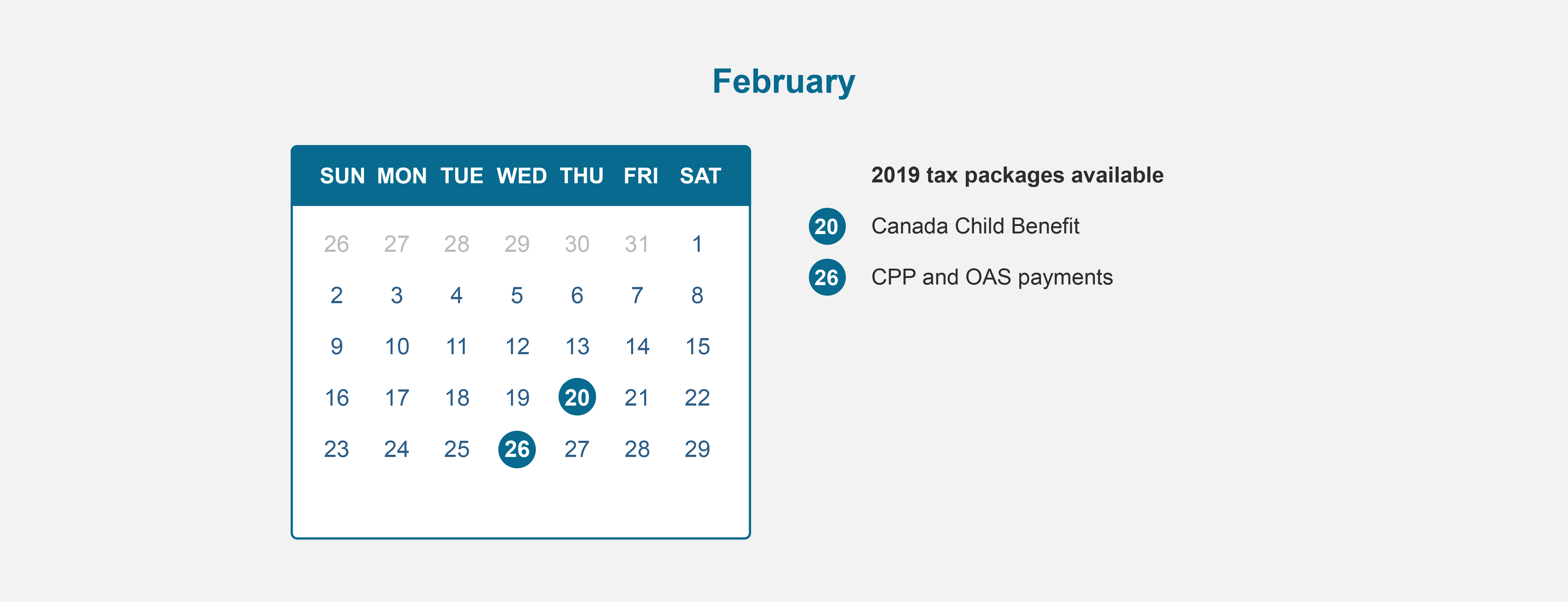

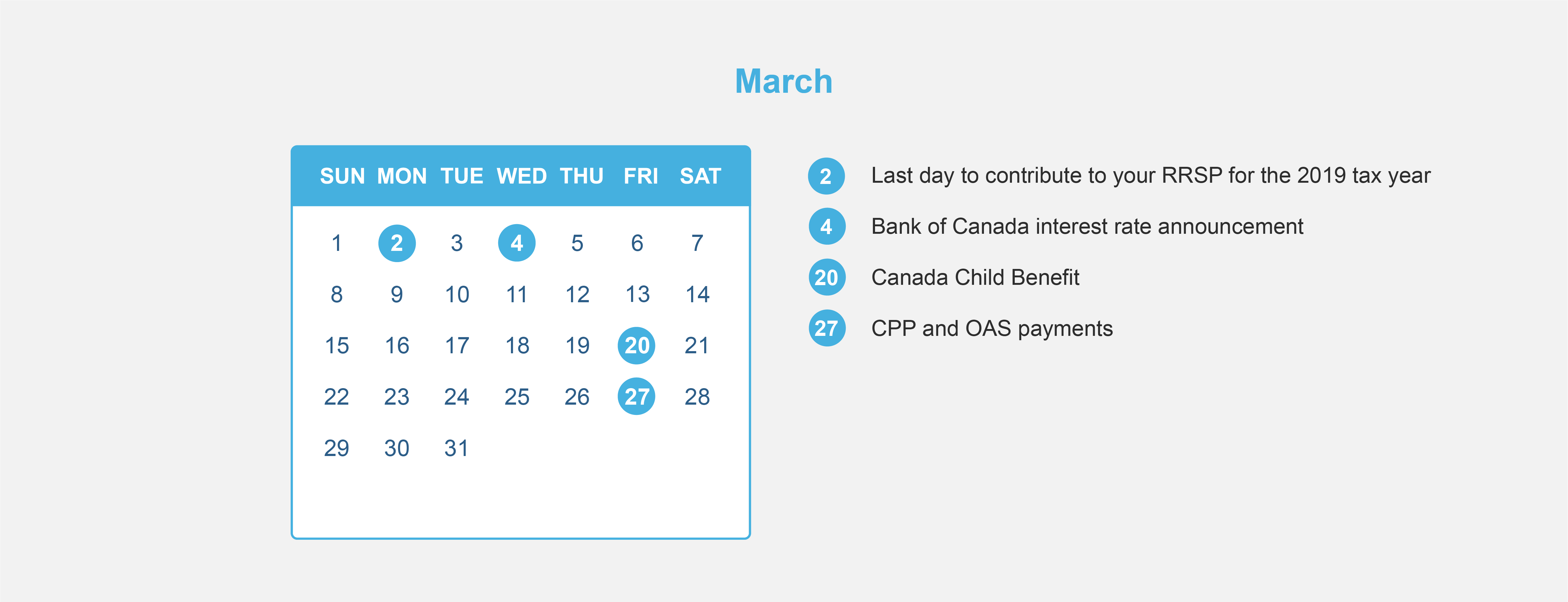

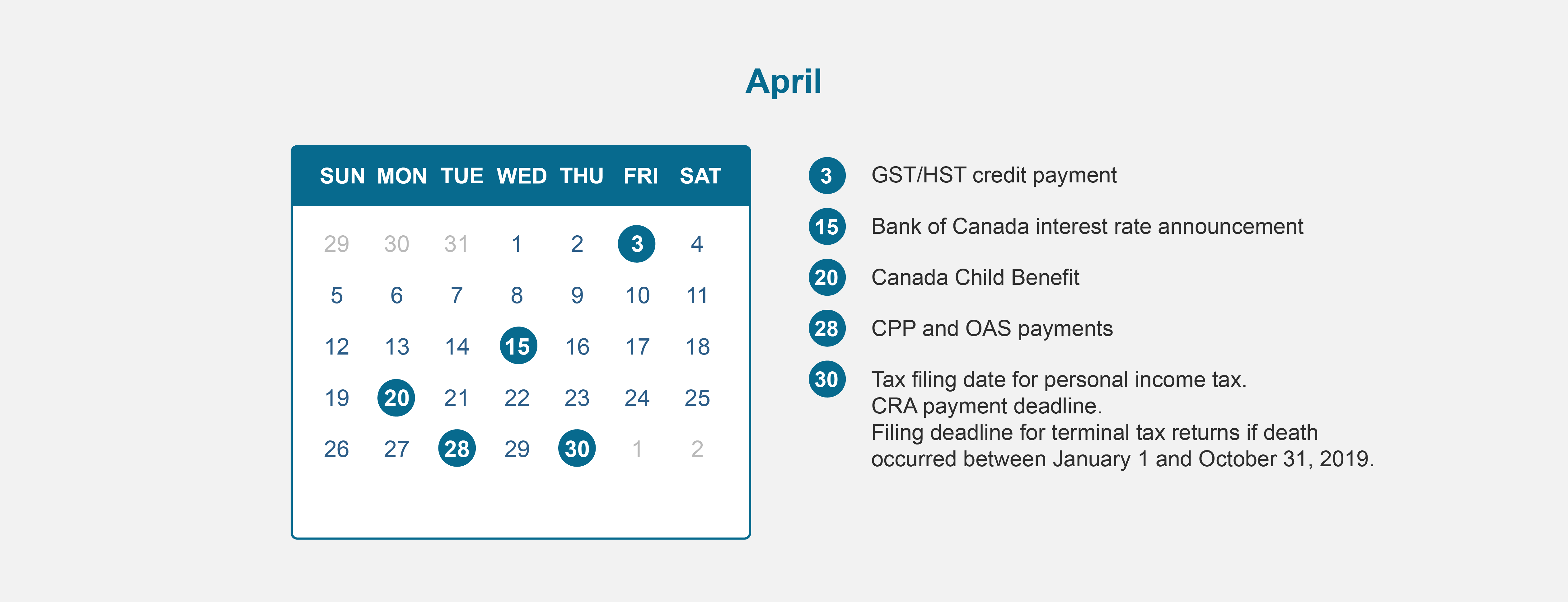

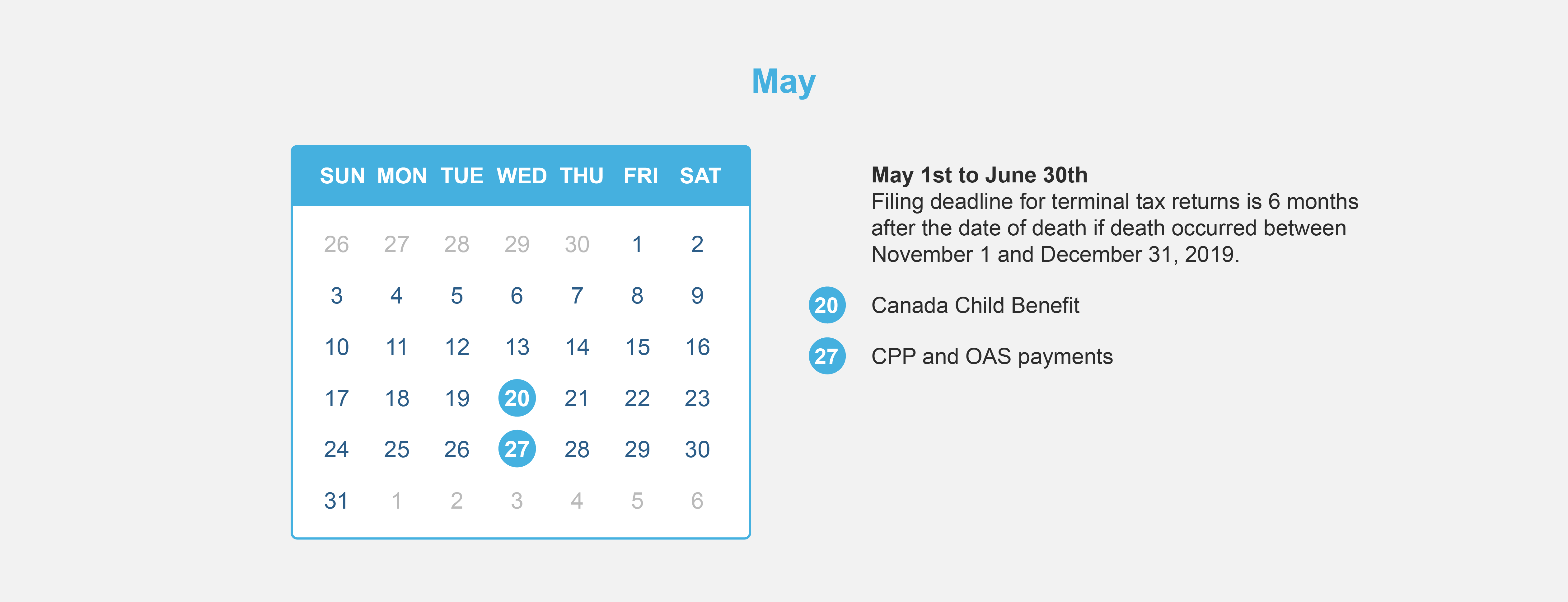

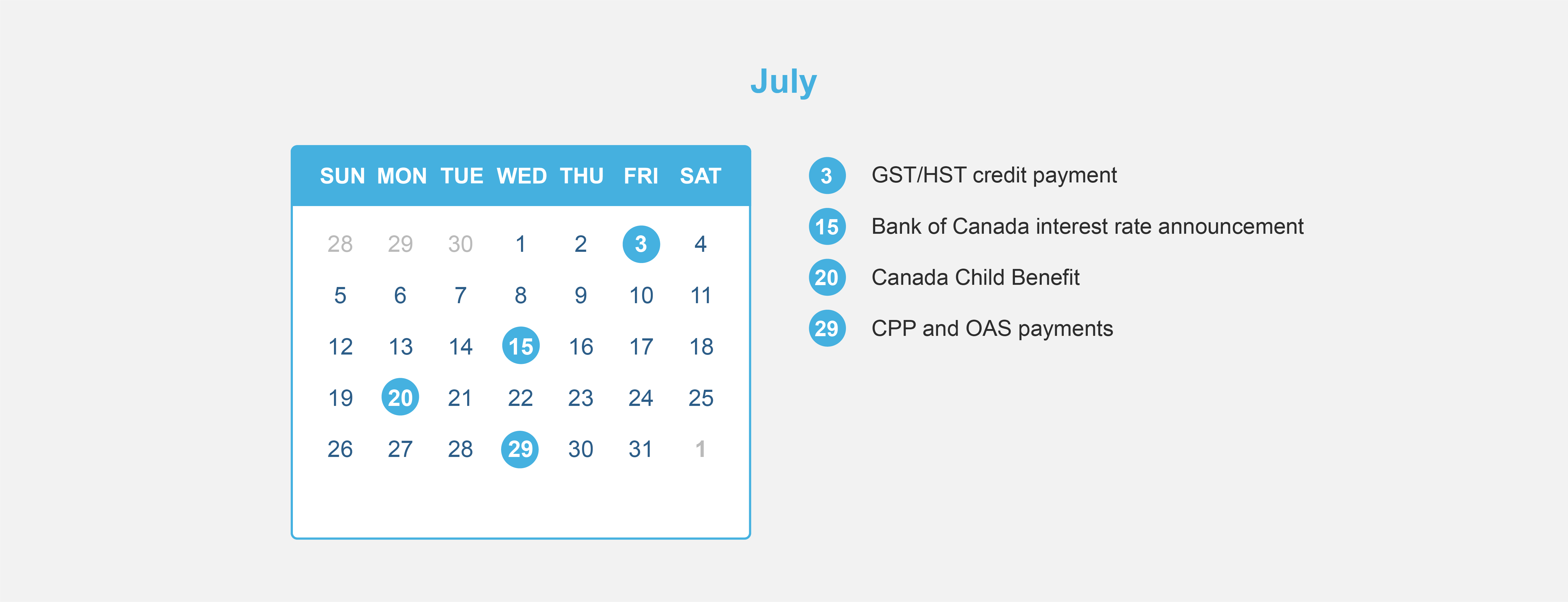

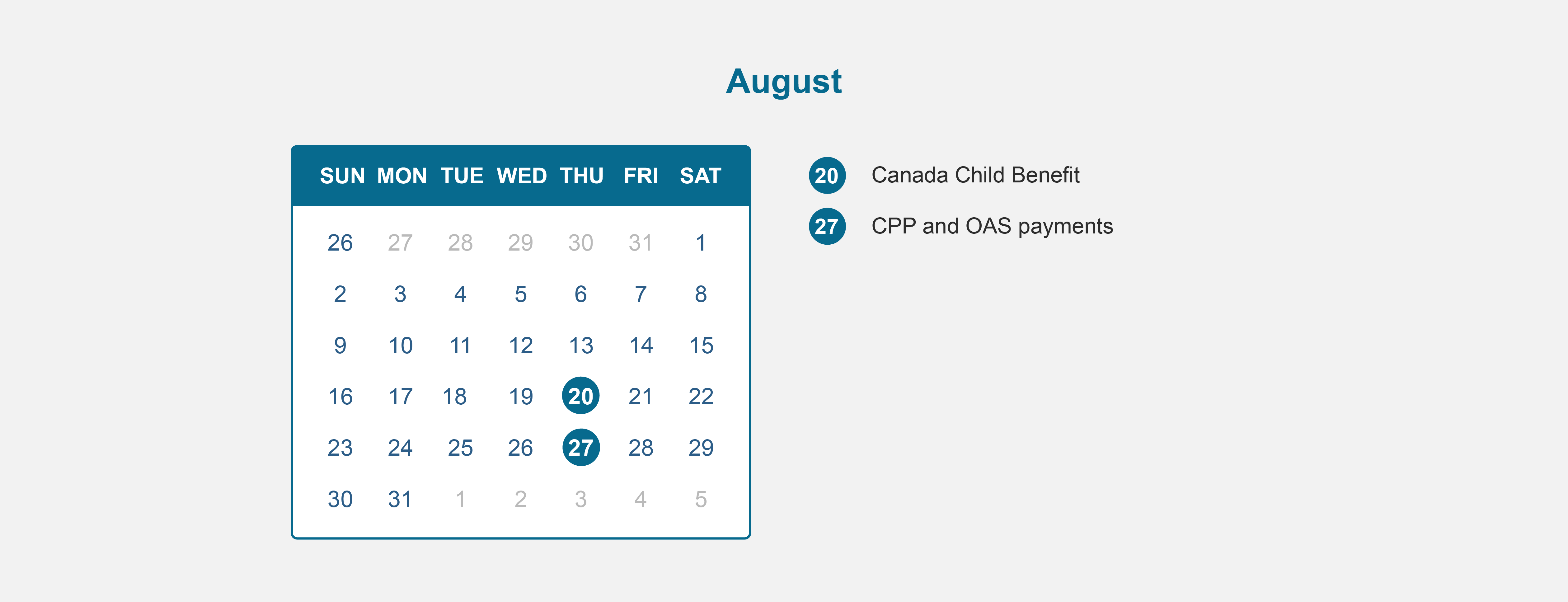

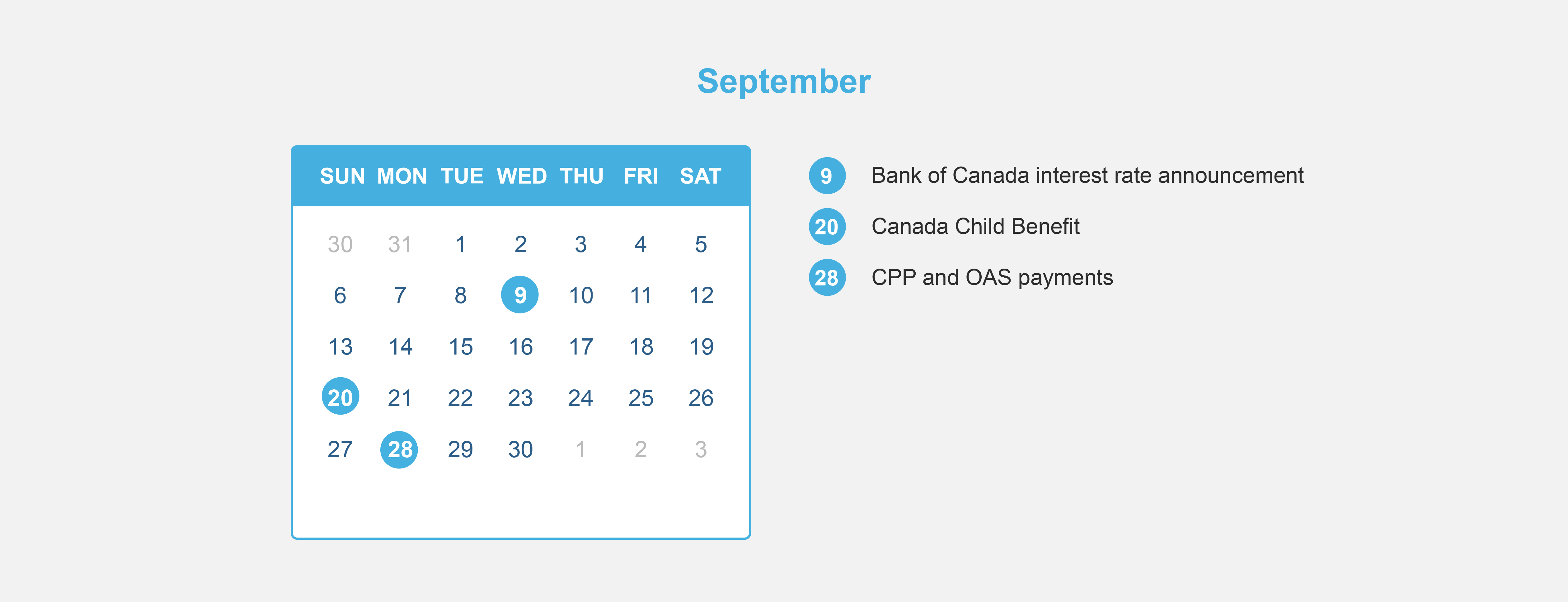

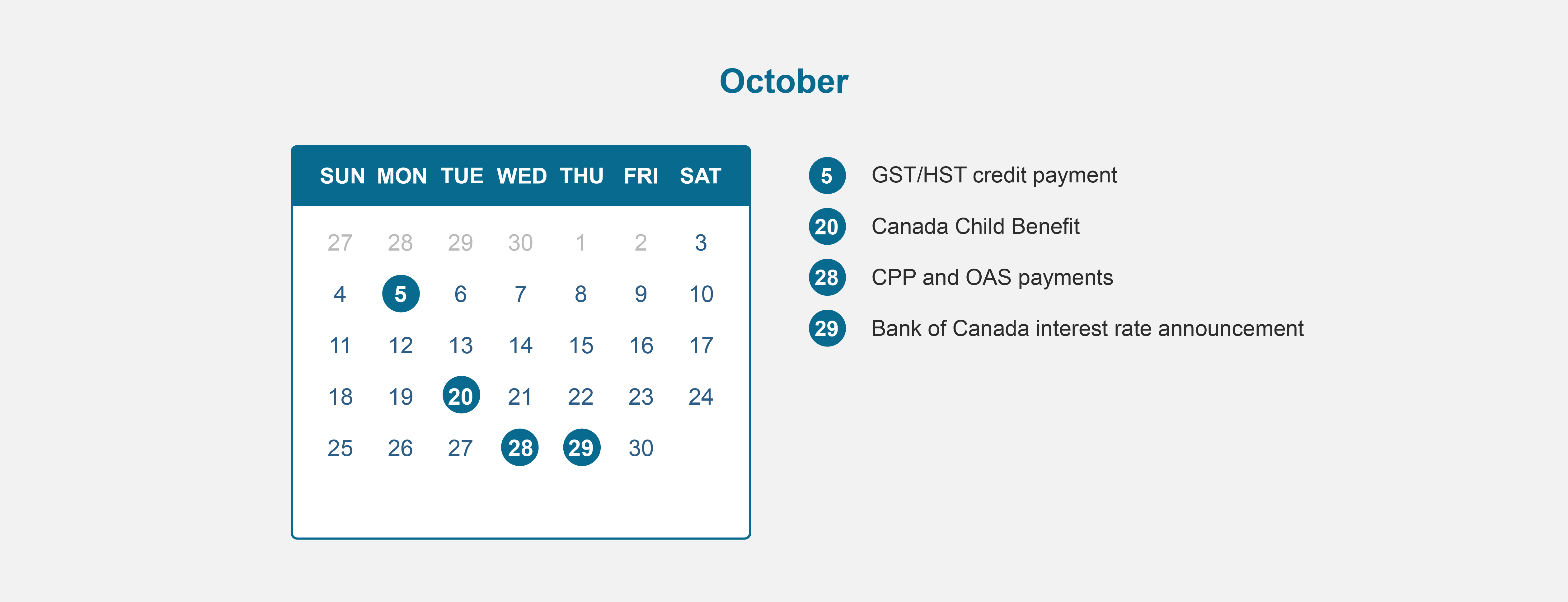

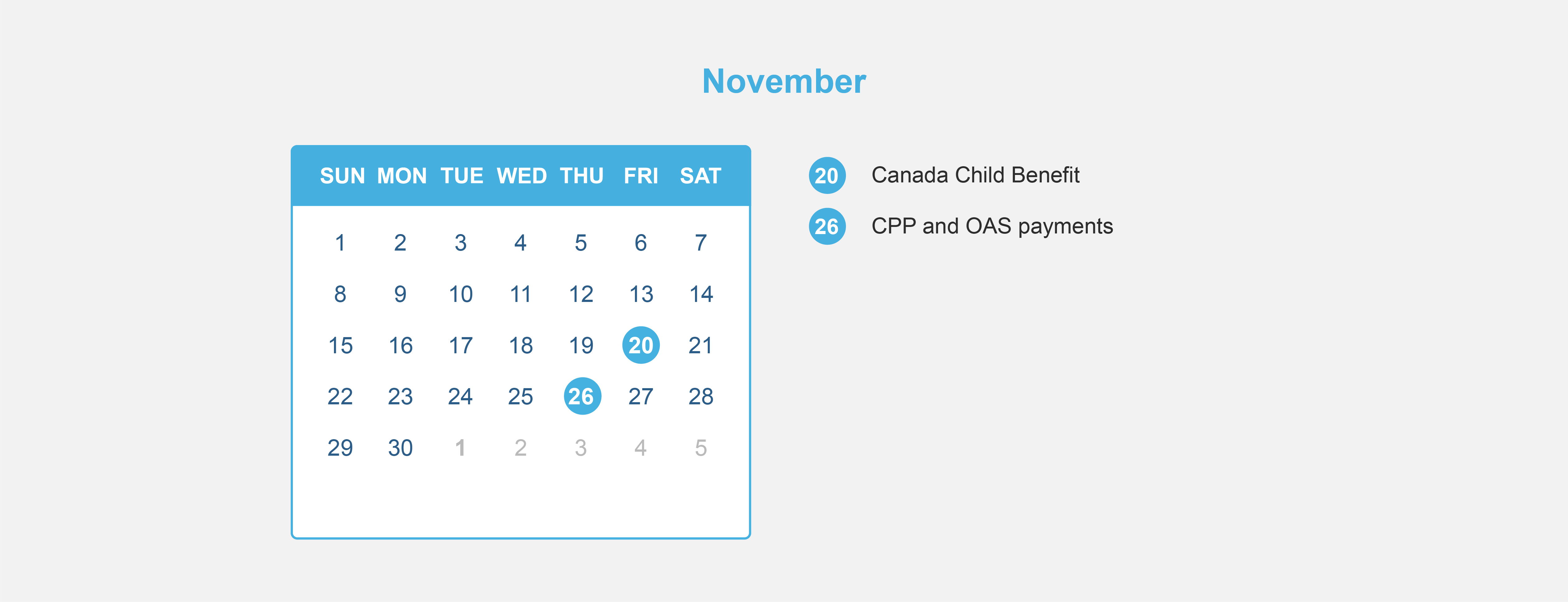

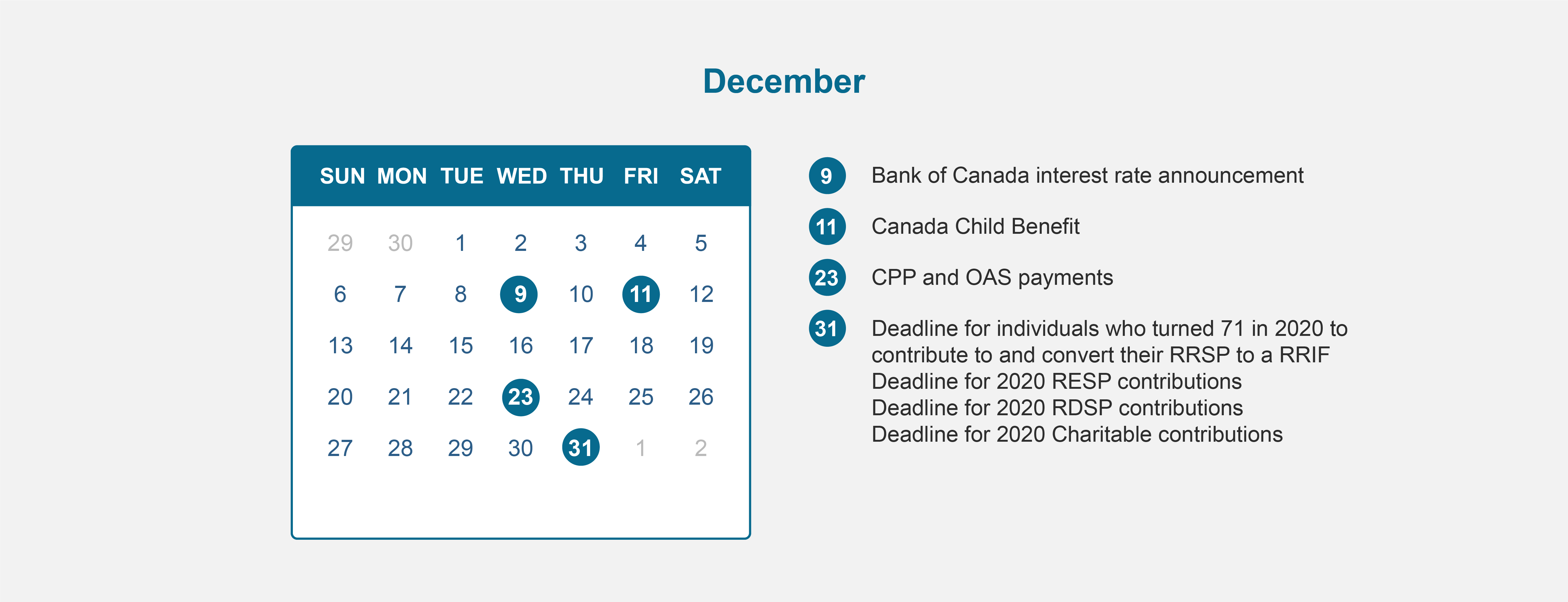

Financial Calendar for 2020 – All the dates you need to know to maximize your benefits!

Financial Calendar for 2020 – All the dates you need to know to maximize your benefits!

Now that we are nearing year end, it’s a great time to review your business finances. With the federal election over and no major business tax changes for this year, 2019 is a good year to make sure you are effectively tax planning. Please keep in mind that your business may be affected by the recent tax on split income (TOSI) and the passive investment income rules given they came into effect in 2018. These rules can be complicated, please don’t hesitate to consult us and your accountant to determine how this can affect your business finances.

We are also assuming that your corporate year end is December 31, however if it’s not, this is useful when your business year end comes up.

Below, we have listed some of the key areas to consider and provided you with some useful guidelines to make sure that you cover all of the essentials. We have divided our tax planning tips into 4 sections:

Tax checklist

Remuneration

Business tax

Estate

Remuneration

☐ Salary/Dividend mix

☐ Accruing your salary/bonus

☐ Stock option plan

☐ Tax-free amounts

☐ Paying family members

Business Tax

☐ Claiming the small business deduction

☐ Shareholder loans

☐ Passive investment income: eligible/ineligible dividends

☐ Corporate reorganization

Estate

☐ Will review

☐ Succession plan

☐ Lifetime capital gains exemption

What’s your salary/dividend mix?

Individuals who own incorporated businesses can elect to receive their income as either salary or as dividends. Your choice will depend on your own situation consider the following factors:

Your current and future cash flow needs

Your personal income level

The corporation’s income level

TOSI rules

Passive investment income rules

Please also consider the difference between salary and dividends:

Salary

✓ Provides RRSP contribution

✓ Reduces corporate tax bill

• Payroll tax

• Canada Pension Plan (CPP) contribution

• Employment Insurance contribution

Dividend

• Doesn’t provide RRSP contribution

• Doesn’t reduce corporate tax bill

• No tax withholdings

• No Canada Pension Plan contribution

• No Employment Insurance contribution

✓ Receive up to $50,000 of ineligible dividends at a low tax rate depending on province

As part of this, it’s worth considering ensuring that you receive a salary high enough to take full advantage of the maximum RRSP annual contribution that you can make. For 2019, salaries of $151,278 will provide the maximum RRSP room of $27,230 for 2020.

Is it worth accruing your salary or bonus this year?

You could consider accruing your salary and / or bonus in the current year but delaying payment of it until the following year. If your company’s year-end is December 31, your corporation will benefit from a deduction for the year 2019 and the source deductions are not required to be remitted until actual salary or bonus payment in 2020.

Stock Option Plan

If your compensation includes stock options, please check if you will be affected by the new proposed stock option rules. This caps the amount of certain employee stock options eligible for the stock option deduction at $200,000 after December 31, 2019. The rules will not affect you if your stock options are granted by a Canadian controlled private corporation.

Tax Free Amounts

If you own your corporation, pay tax-free amounts if you can. Here are some ways to do so:

Pay yourself rent if the company occupies space in your home.

Pay yourself capital dividends if your company has a balance in its capital dividend account.

Return “paid-up capital” that you have invested in your company

Do you employ members of your family?

Employing and paying salary to family members who undertake work for your incorporated business is worth considering as you could receive a tax deduction against the salary that you pay them, providing that said salary is “reasonable” in relation to the work done. In 2019, the individual can earn up to $12,069 and pay no federal tax. This also provides the individual with RRSP contribution room, CPP and allow for child-care deductions. Bear in mind additional costs that are incurred when employing someone, such as payroll taxes and contributions to CPP.

Claiming the Small Business Deduction

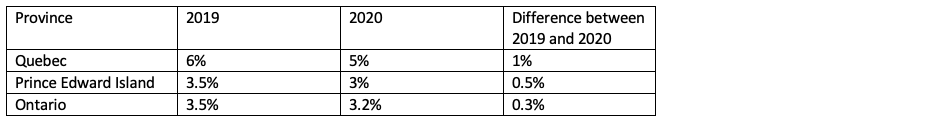

Are you able to claim a small business deduction? The federal small business tax rate decreased from 9% in 2019 (from 10% in 2018) and not anticipated to increase in 2020. From a provincial level, there will be changes in the following provinces:

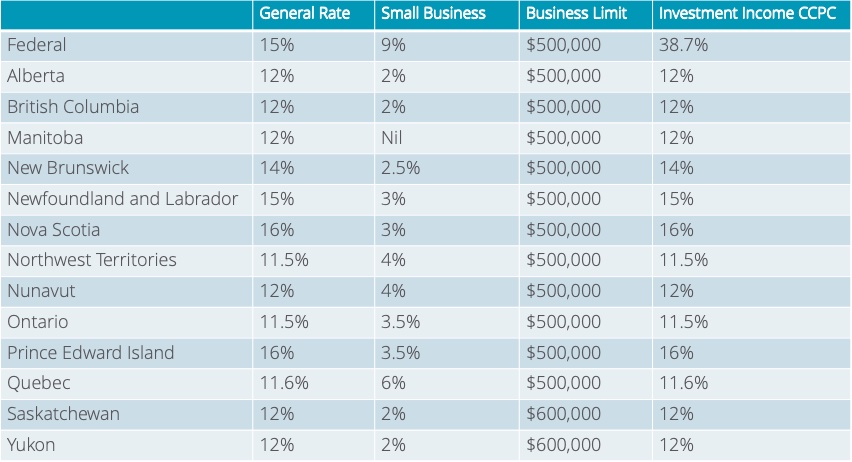

Small Business Tax Rate

Therefore, a small business deduction in 2019 is worth more than in 2020 for these provinces.

Should you repay any shareholder loans?

Loaning funds from your corporation at a low or zero interest rate means that you are considered to have benefited from a taxable benefit at the CRA’s 2% interest rate, less actual interest that you pay during the year or thirty days after it. You need to include the loan in your income tax return, unless it is repaid within one year after the end of your corporation’s taxation year.

For example, if your company has a December 31st year-end and it loaned you funds on November 1, 2019, you must repay the loan by December 31, 2020, otherwise you will need to include the loan as taxable income in your 2019 personal tax return.

Passive investment income

If your corporation has a December year- end, then 2019 will be the first taxation year that the new passive investment income rules may apply to your company.

New measures were introduced in the 2018 federal budget relating to private businesses which also earn passive investment income in a corporation that also operates an active business.

There are two key parts to this, as follows:

Limiting access to dividend refunds. Essentially, a private company will be required to pay ineligible dividends in order to receive dividend refunds on some taxes which, in the past, could have been refunded when an eligible dividend was paid.

Limiting the small business deduction. This means that, for the companies mentioned above, the small business deduction can be reduced at a rate of $5 for every $1 over between $50,000 and $150,000 of investment income, or eliminated if investment income exceeds $150,000. Please note that Ontario and New Brunswick have indicated that they will not follow the federal rules.

If your corporation earns both active business and passive investment income, you should contact us and your accountant directly to determine if there are any planning opportunities to minimize the impact of the new passive investment income rules.

Think about when to pay dividends and dividend type

When choosing to pay dividends in 2019 or 2020, you should consider the following:

Difference between the yearly tax rate

Impact of tax on split income

Impact of passive investment income rules

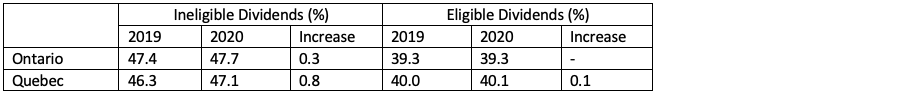

With the exception of 2 provinces, Quebec and Ontario, the combined top marginal tax rates will not be changing from 2019 to 2020 on a provincial level. Therefore, it will not make a difference if you choose to pay in 2019 or 2020.

Combined Marginal Tax Rate

In Quebec and Ontario, because there are slight increases in the combined marginal tax rate, there are potential tax savings available if you choose to pay dividends in 2019 rather than in 2020.

When deciding to pay a dividend, you will need to decide to pay out eligible or ineligible dividends, you should consider the following:

Dividend refund claim limits: Eligible refundable dividend tax on hand (ERDTOH) vs Ineligible Refundable dividend tax on hand (NRDTOH)

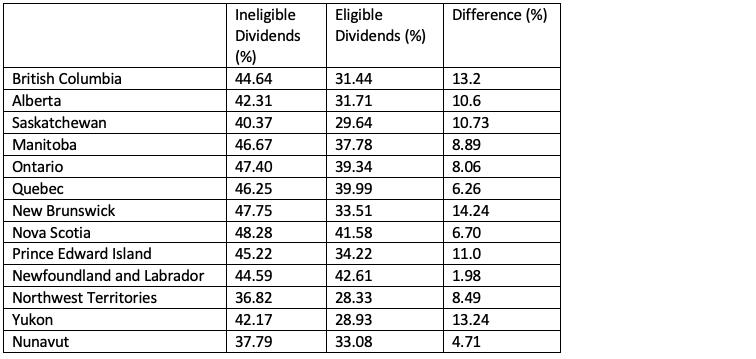

Personal marginal tax rate of eligible vs. ineligible dividends

Given the passive investment income rules, typically, it makes sense to pay eligible dividends to deplete the ERDTOH balance before paying ineligible dividends. (Please note that ineligible dividends can also trigger a refund from the ERDTOH account.)

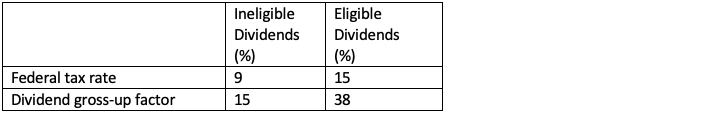

Eligible dividends are taxed at a lower personal tax rate than ineligible dividends (based on top combined marginal tax rate). However, keep in mind, when ineligible dividends are paid out, they are subject to the small business deduction, therefore the dividend gross-up is 15% while eligible dividends that are subject to the general corporate tax rate have a dividend gross-up is 38%. It’s important to talk to a professional to determine what makes the most sense when determining the type of dividend to pay out of your corporation.

Combined Personal Top Marginal Tax Rate on Dividends

Corporate Federal Tax Rate and Gross-up factor

Corporate Reorganization

It might be time to revisit your corporate structure given the changes to private corporation rules on income splitting and passive investment income to provide more control on the distribution of dividend income. Another reason to reassess your structure is to segregate investment assets from your operating company for asset protection. (Keep in mind you don’t want to trigger TOSI, so make sure you structure this properly.) If you are considering succession planning, this is the time to evaluate your corporate structure as well.

Ensure your will is up to date

In particular, if your estate plan includes an intention for your family members to inherit your business, ensure that this plan is tax effective following new tax legislation from January 1, 2016. In addition, review your will to make sure that any private company shares that you intend to leave won’t be affected by the new TOSI rules.

Succession plan

Consider a succession plan to ensure your business is transferred to your children, key employees or outside party in a tax efficient manner.

Lifetime Capital Gains Exemption

If you sell your qualified small business corporation shares, you can qualify for the lifetime capital gains exemption (In 2019, the exemption is $866, 912) where the gain is completely exempt from tax. The exemption is a lifetime cumulative exemption; therefore, you don’t have to claim the entire amount at once.

The issues we discussed above can be complex. Contact us and your accountant if you have any questions, we can help.

One of the financial planning issues that business owners face is how to access their corporate earnings in a tax efficient way.

There are 5 standard methods:

Salary

Dividend

Shareholder Loans

Transfer Personal Assets

Income Splitting

There are also unique ways utilizing life insurance and critical illness insurance to access your retained earnings. Please contact us to learn how we can get more money in your pocket than in the government’s.

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success.

Have a written plan which merges life priorities with financial resources.

Consolidate your income-producing assets with one advisor.

Layer different sources of income in the most efficient manner.

Structure income in order to preserve valuable tax credits and government benefits.

Create efficient cash flow by investing your income-producing assets wisely.

Implement efficient solutions for health-cost risks and wealth transfer strategies.

Talk to us about a complimentary comprehensive review of your retirement plan.

Financial Planning for business owners is often two-sided: personal financial planning and planning for the business.

Business owners have access to a lot of financial tools that employees don’t have access to; this is a great advantage, however it can be overwhelming too. A financial plan can relieve this.

A financial plan looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them. For you, personally and for your business.

Worry less about money and gain control.

Organize your finances.

Prioritize your goals.

Focus on the big picture.

Save money to reach your goals.

For a business owner, personal and business finances are connected. Therefore both sides should be addressed: Personal and Business.

There are 2 main sides your business financial plan should address: Growth and Preservation

Growth:

Cash Management- Managing Cash & Debt

Tax Planning- Finding tax efficiencies

Retaining & Attracting Key Talent

Preservation:

Investment- either back into the business or outside of the business

Insurance Planning/Risk Management

Succession/Exit Planning

There are 2 main sides your financial plan should address: Accumulation and Protection

Accumulation:

Cash Management – Savings and Debt

Tax Planning

Investments

Protection:

Insurance Planning

Health Insurance

Estate Planning

Establish and define the financial planner-client relationship.

Gather information about current financial situation and goals including lifestyle goals.

Analyze and evaluate current financial status.

Develop and present strategies and solutions to achieve goals.

Implement recommendations.

Monitor and review recommendations. Adjust if necessary.

Talk to us about helping you get your finances in order so you can achieve your lifestyle and financial goals.

Feel confident in knowing you have a plan to get to your goals.

What happens when the children grow up and they are no longer dependent on their parents? What happens to your other “baby”- the business? Estate planning for business owners deals with the personal and business assets. Business succession planning is different because it deals with your business assets only and can also take place while you’re alive. You need to have an estate plan regardless if you have a succession plan or not. Estate planning for business owners is typically more complicated because the estate plan needs to deal with:

Complex business and personal relationships

Bigger and more intricate estates

Tax issues

Business Succession

When putting an estate plan for a business owner together, one of the most difficult conversations is around fair or equal distribution of assets. What if one of the children are working in the business how do you treat them? Before you begin putting a plan in place, we always encourage open conversation and a family meeting between the parents and children to provide context behind decisions and therefore it minimizes the surprises and provides an opportunity for children to express their concerns.

We’ve put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we’re here to help and provide guidance.

Adult Children

Fair vs Equal (also known as Equitable vs Equal) – like what’s considered to be fair may not necessarily be equal. ex. Should the daughter that’s been working in the family business for 10 years receive the same shares as the son who hasn’t worked in the family business at all?

Are the adult children responsible enough to handle the inheritance? Or would they spend it all?

Who works in the family business? Is it all the kids or just one of them?

Family Meeting

Encourage open conversation with parents and kids so context can be provided behind the decisions, there are no surprises and allows the kids to express their interests and concerns.

Facilitate a family meeting with both generations, this will help promote ongoing family unity after death and decrease the chances of resentment later.

Start looking at considerations for a succession plan for the business. (This needs to be documented separately.)

Assets/Liabilities

What are your assets? Create a detailed list of your assets such as:

Home, Real Estate, Investments- Non registered, TFSA, RRSP, RDSP, RESP, Company Pension Plan, Insurance Policy, Property, Additional revenue sources, etc…

What about shares in your business? How does this need to be addressed?

What are your liabilities? Create a detailed list of your liabilities such as:

Mortgage, Loans (personal, student, car), Line of Credit, Credit card, Other loans (payday, store credit card, utility etc.)

Did you personally guarantee any business loans and how does this need to be addressed?

Understand your assets-the ownership type (joint, tenants in common, sole etc.), list who are the beneficiaries are for your assets

Understand your liabilities- are there any cosigners?

Make sure you have a will that:

Assigns an executor.

Provide specific instructions for distribution of all assets.

Consider a power of attorney for use when you’re incapacitated or otherwise unable to handle your affairs.

Always choose 2 qualified people for each position and communicate with them.

Taxes and Probate

How much are probate and taxes? (Income tax earned from Jan 1 to date of death + Taxes on Non Registered Assets + Taxes on Registered Assets, Taxes on Business Shares)

Are there any outstanding debts to be paid?

You’ve worked your whole life- how much of your hard earned money do you want to give to CRA?

How much money do you want to to give to your kids while you’re living?

Consider the following:

The use of trusts.

The use of an estate freeze if you wish to gift while you’re living.

The use of a holdco for effective tax planning.

Once you determine the amount of taxes, probate, debt, final expenses and gifts required, review your life insurance coverage to see if it meets your needs or if there’s a shortfall.

Execution:It’s good to go through this but you need to do this. Besides doing it yourself, here’s a list of the individuals that can help:

Financial Planner/Advisor (CFP)

Estate Planning Specialist

Insurance Specialist

Lawyer

Accountant/Tax Specialist

Chartered Life Underwriter (CLU)

Chartered Executor Advisor (CEA)

Contact us about helping you get your estate planning in order so you can gain peace of mind that your family is taken care of.

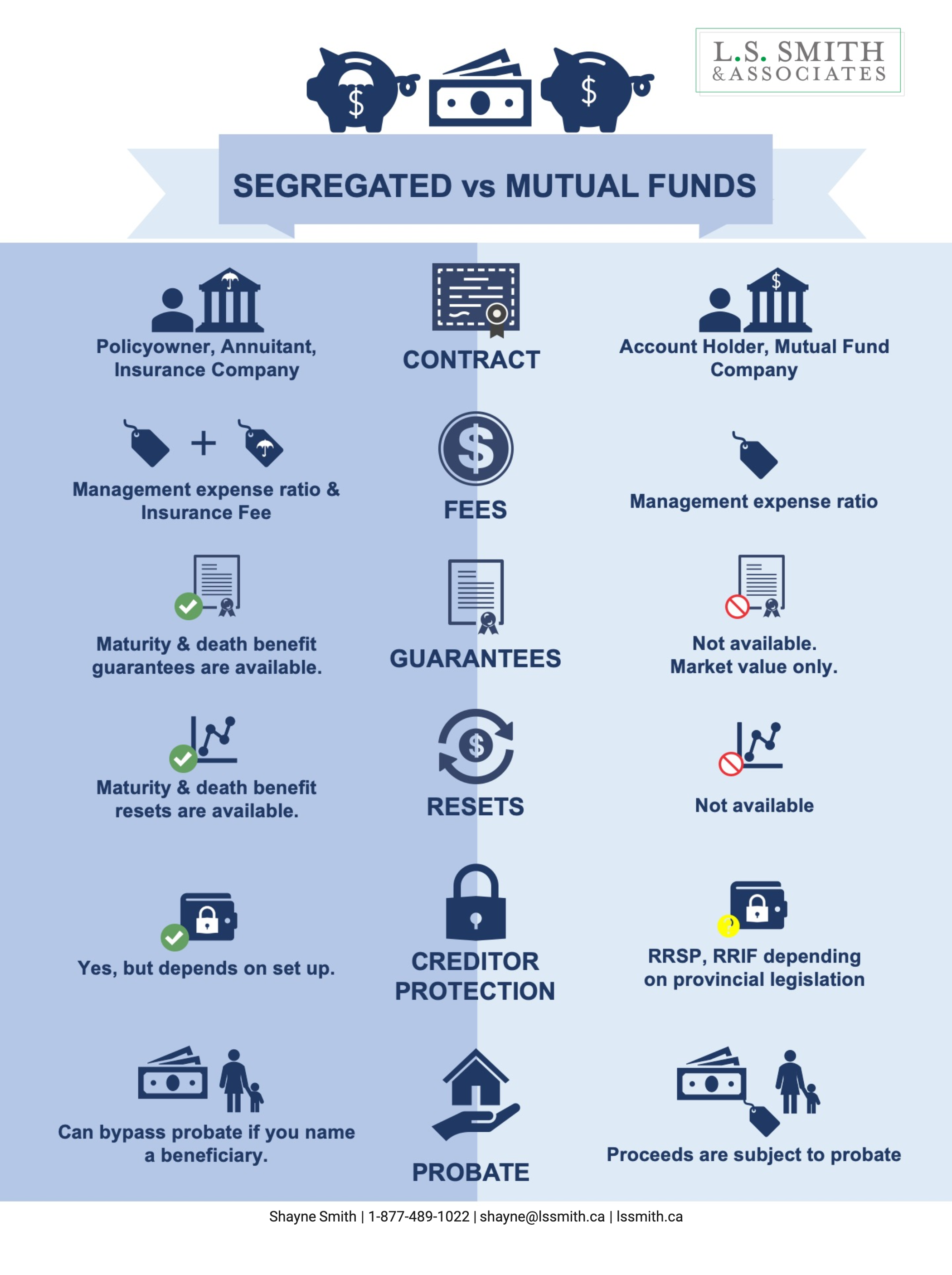

Segregated Funds and Mutual Funds often have many of the same benefits such as:

Both are managed by investment professionals.

You can generally redeem your investments and get your current market value at any time.

You can use them in your RRSP, RRIF, RESP, RDSP, TFSA or non-registered account.

There are key differences including:

Contract

Fees

Guarantees

Resets

Creditor Protection

Probate

Contract:

Segregated Funds: Policy owner, Annuitant and Life Insurance company

Mutual Funds: Account holder, Mutual fund and Investment Company

Fees

Segregated Funds: Management Expense Ratio & Insurance Fee (Typically higher)

Mutual Funds: Management Expense Ratio

Why is this important?

Since Segregated funds are offered by life insurance companies, they are individual insurance contracts. Which means….

Maturity Guarantees

Death Benefit Guarantees

Maturity and death benefit resets

Potential Creditor Protection (depends on the setup)

Ability to Bypass Probate

Mutual Funds do not have these features with the exception of possible creditor protection of RRSP, RRIF dependant on provincial legislation.

What are these features?

Maturity and Death Benefit Guarantees mean the insurance company must guarantee at least 75% of the premium paid into the contract for at least 15 years upon maturity or your death.

Resets means you have the ability to reset the maturity and death benefit guarantee at a higher market value of the investment.

Potential Creditor Protection is available when you name a beneficiary within the family class, there are certain restrictions associated with this.

Bypass Probate: since you name a beneficiary to receive the proceeds on your death, the proceeds are paid directly to your beneficiary which means it bypasses your estate and can avoid probate fees.

We can help you decide what makes sense for your financial situation.

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as:

building and protecting your savings

providing for loved ones

planning for retirement

What’s the purpose of the investment? First, think about what you’ll be doing with your savings. This will help dictate what savings vehicle is best suited for your situation. Then consider the following factors:

Taxes: As a small business owner, you have access to the small business tax rate which is typically lower than your personal tax rate. (See table below.) Also, as of January 1, 2019, the Federal Budget decreased the small business limit for corporations with a set threshold of income generated from passive investments.

2019 Corporate Income Tax Rates

Timing: You can control the timing of the payout which means you could potentially defer paying out the money until you need it and determine if you’d like to pay it out as salary or dividend.

Creditor Protection: Sometimes, investments held inside a corporation can be vulnerable to creditors, therefore you may want to consider using a holding company or trust or pay out money to yourself personally. This can be complex and requires professional advice.

Capital Gains Exemption: If your investment grows too large, it may endanger your qualification for the lifetime capital gains exemption that ‘s available when shares of a qualified small business corporation are sold or transferred.

For business owners, before investing personally or corporately, it’s certainly worth seeking professional advice to ensure that it suits your individual circumstances.

Business owners can be busy… they’re busy running a successful business, wearing lots of hats and making a ton of decisions. We’ve put together a list of 10 essential decisions for every business owner to consider.

10 essential decisions for a business owner from considering corporate structure to retirement and succession planning.

The essential questions include:

Best structure for your business (ex. Sole Proprietor, Corporation, Partnership)

Reduce taxes

What to do with surplus cash

Build employee loyalty

Reduce risk

Deal with the unexpected

Retire from your business

Sell your business

Keep your business in the family

What to do when you’re retired

As a financial advisor, we are uniquely positioned to help business owners, talk to us about your situation and we can provide the guidance you need.

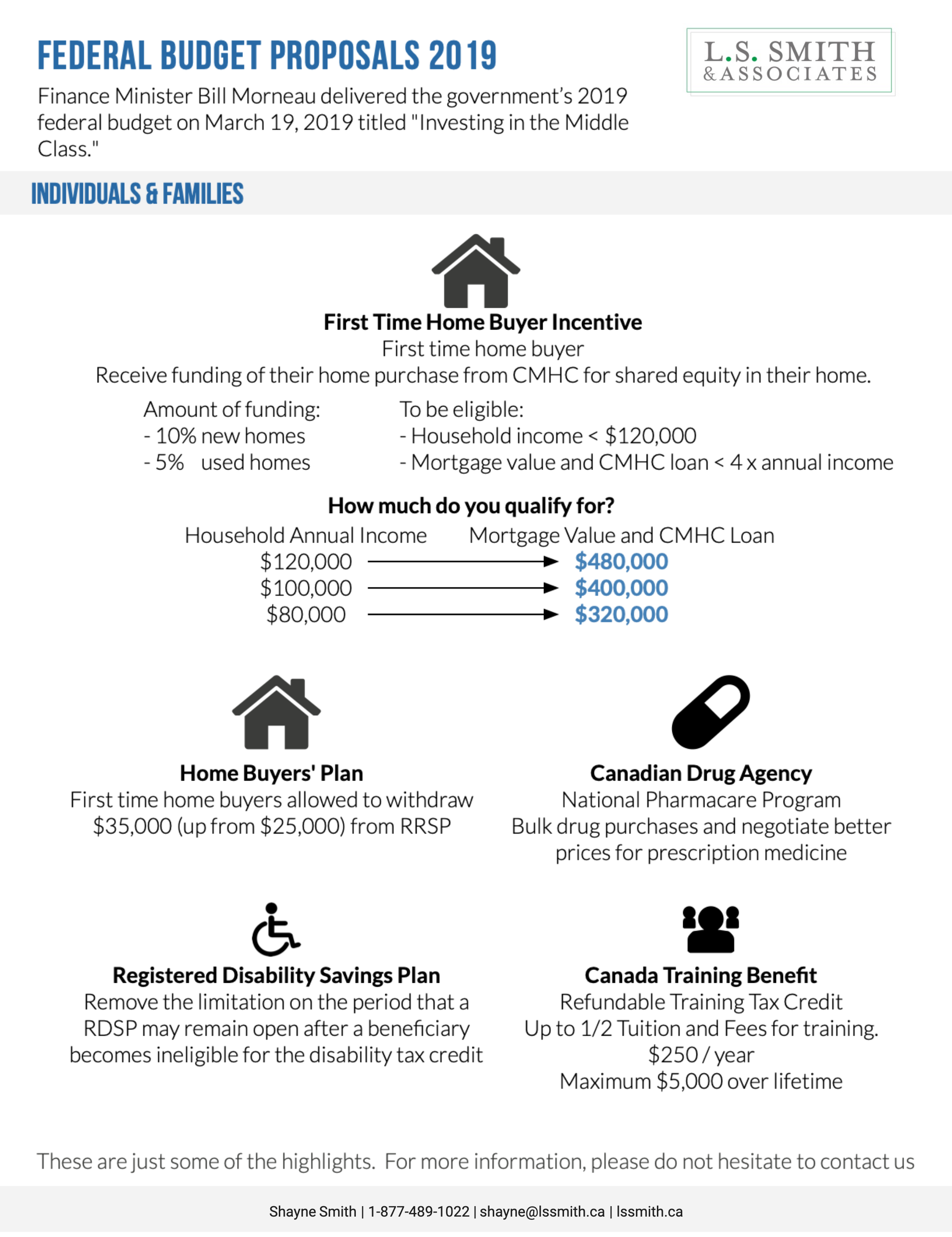

The 2019 budget is titled “Investing in the Middle Class. Here are the highlights from the 2019 Federal Budget.

We’ve put together the key measures for:

Individuals and Families

Business Owners and Executives

Retirement and Retirees

Farmers and Fishers

Home Buyers’ Plan

Currently, the Home Buyers’ Plan allows first time home buyers to withdraw $25,000 from their Registered Retirement Savings Plan (RRSP), the budget proposes an increase this to $35,000.

First Time Home Buyer Incentive

The Incentive is to provide eligible first-time home buyers with shared equity funding of 5% or 10% of their home purchase price through Canada Mortgage and Housing Corporation (CMHC).

To be eligible:

Household income is less than $120,000.

There is a cap of no more than 4 times the applicant’s annual income where the mortgage value plus the CMHC loan doesn’t exceed $480,000.

The buyer must pay back CMHC when the property is sold, however details about the dollar amount payable is unclear. There will be further details released later this year.

Canada Training Benefit

A refundable training tax credit to provide up to half eligible tuition and fees associated with training. Eligible individuals will accumulate $250 per year in a notional account to a maximum of $5,000 over a lifetime.

Canadian Drug Agency

National Pharmacare program to help provinces and territories on bulk drug purchases and negotiate better prices for prescription medicine. According to the budget, the goal is to make “prescription drugs affordable for all Canadians.”

Registered Disability Savings Plan (RDSP)

The budget proposes to remove the limitation on the period that a RDSP may remain open after a beneficiary becomes ineligible for the disability tax credit. (DTC) and the requirement for medical certification for the DTC in the future in order for the plan to remain open.

This is a positive change for individuals in the disability community and the proposed measures will apply after 2020.

Intergenerational Business Transfer

The government will continue consultations with farmers, fishes and other business owners throughout 2019 to develop new proposals to facilitate the intergenerational transfers of businesses.

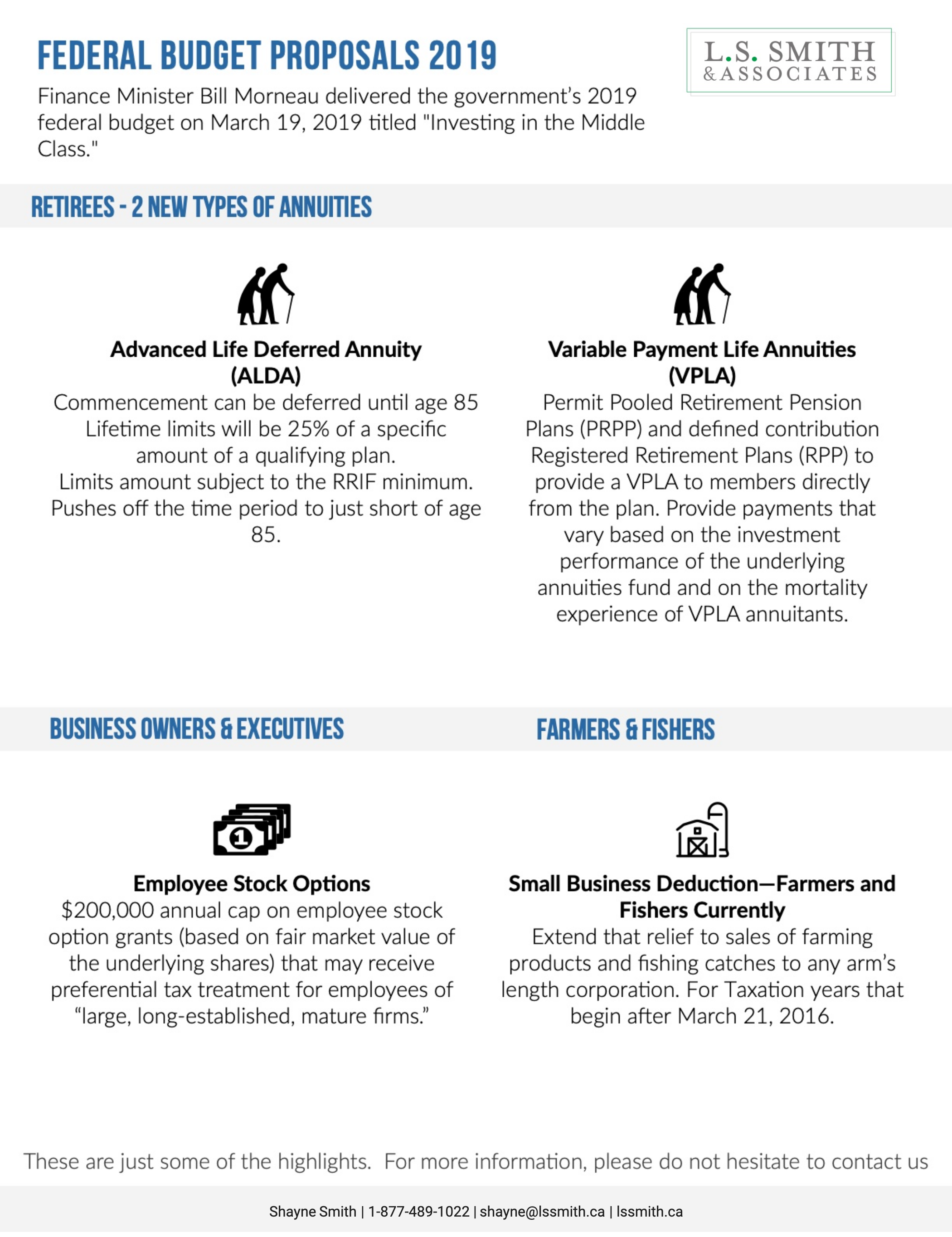

Employee Stock Options

The introduction of a $200,000 annual cap on employee stock option grants (based on Fair market value) that may receive preferential tax treatment for employees of “large, long-established, mature firms.” More details will be released before this summer.

Additional types of Annuities under Registered Plans

For certain registered plans, two new types of annuities will be introduced to address longevity risk and providing flexibility: Advanced Life Deferred Annuity and Variable Payment Life Annuity.

This will allow retirees to keep more savings tax-free until later in retirement.

Advanced Life Deferred Annuity (ALDA): An annuity whose commencement can be deferred until age 85. It limits the amount that would be subject to the RRIF minimum, and it also pushes off the time period to just short of age 85.

Variable Payment Life Annuity (VPLA): Permit Pooled Retirement Pension Plans (PRPP) and defined contribution Registered Retirement Plans (RPP) to provide a VPLA to members directly from the plan. A VPLA will provide payments that vary based on the investment performance of the underlying annuities fund and on the mortality experience of VPLA annuitants.

Small Business Deduction

Farming/Fishing will be entitled to claim a small business deduction on income from sales to any arm’s length purchaser. Producers will be able to market their grain and livestock to the purchaser that makes the most business sense without worrying about potential income tax issues. This measure will apply retroactive to any taxation years that began after March 21, 2016.

To learn how the budget affects you, please don’t hesitate to contact us.

L.S. Smith & Associates

Shayne Smith

Insurance and Financial Advisor

Tel: (204) 489-1022

Toll Free: 1-877-489-1022

Email: Shayne@LSSmith.ca

7-549 Regent Avenue West

Winnipeg, MB

R2C 1R9

I believe that financial planning is about more than just a piece of good advice or investment returns. It’s all about providing the guidance that people can trust on.