10 Essential Decisions for Business Owners

10 Essential Decisions for Business Owners

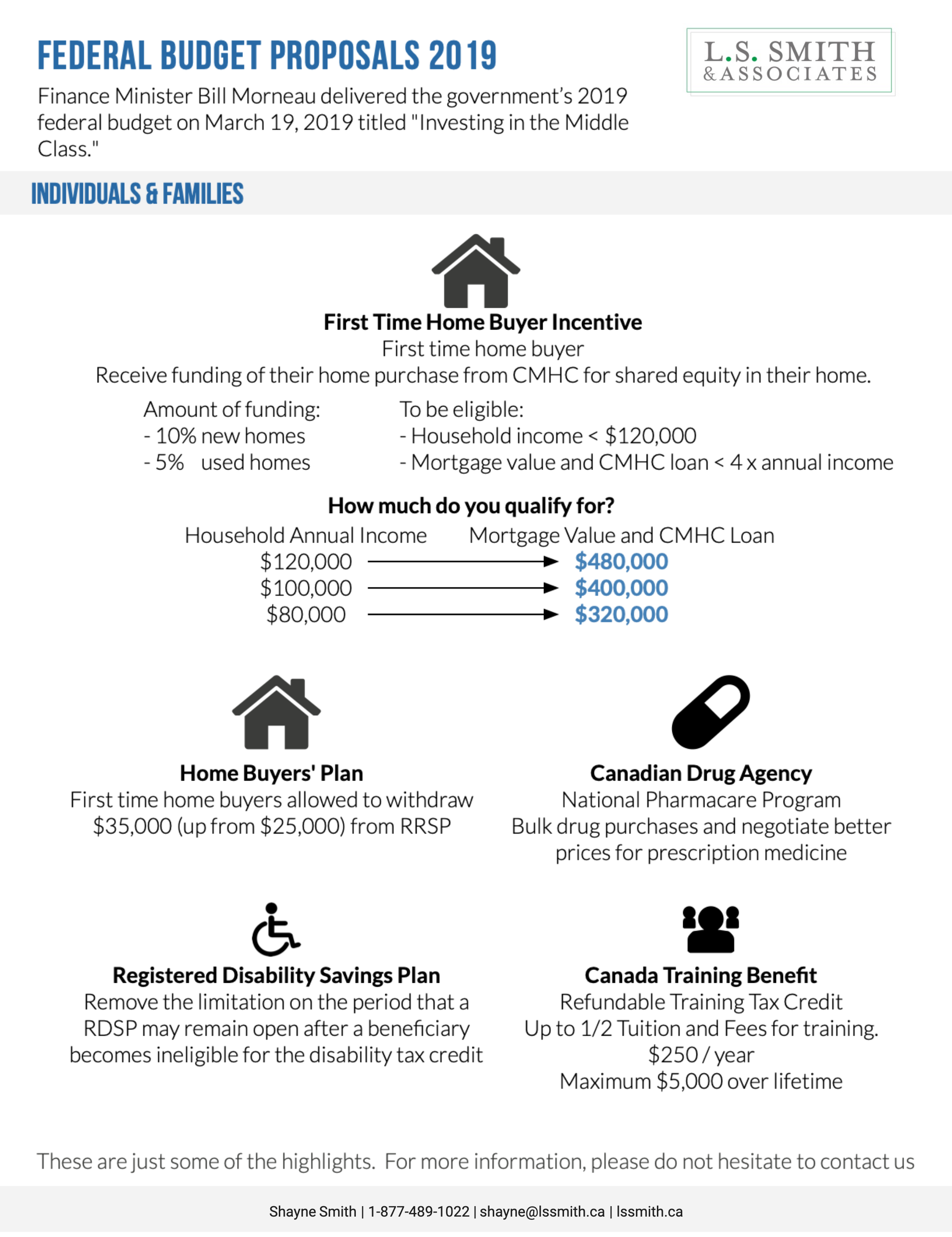

Business owners can be busy… they’re busy running a successful business, wearing lots of hats and making a ton of decisions. We’ve put together a list of 10 essential decisions for every business owner to consider.

10 essential decisions for a business owner from considering corporate structure to retirement and succession planning.

The essential questions include:

-

Best structure for your business (ex. Sole Proprietor, Corporation, Partnership)

-

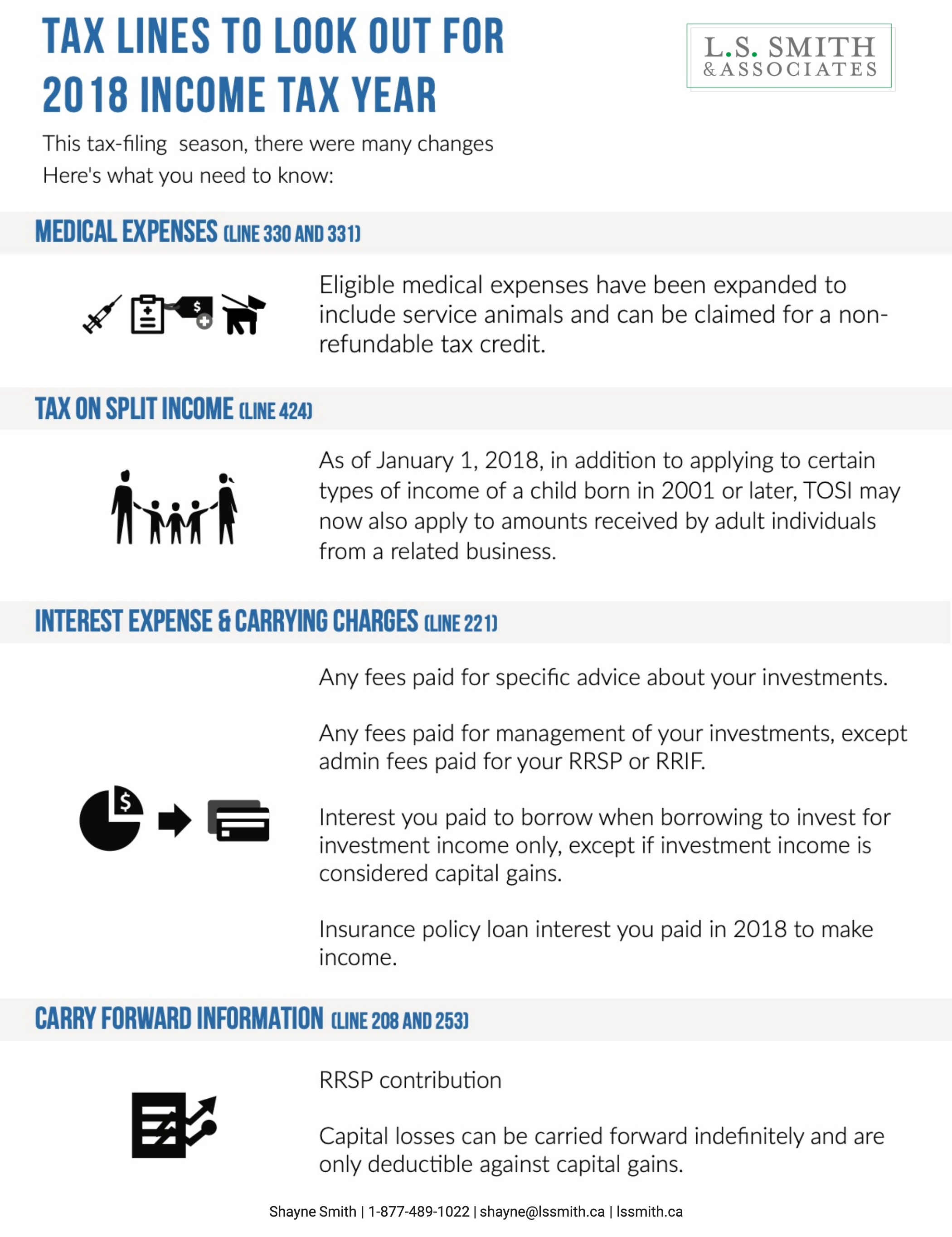

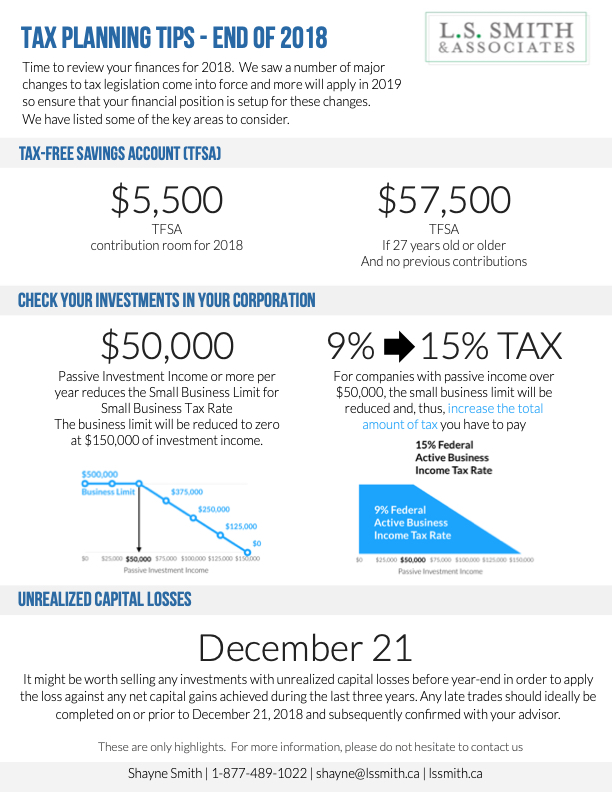

Reduce taxes

-

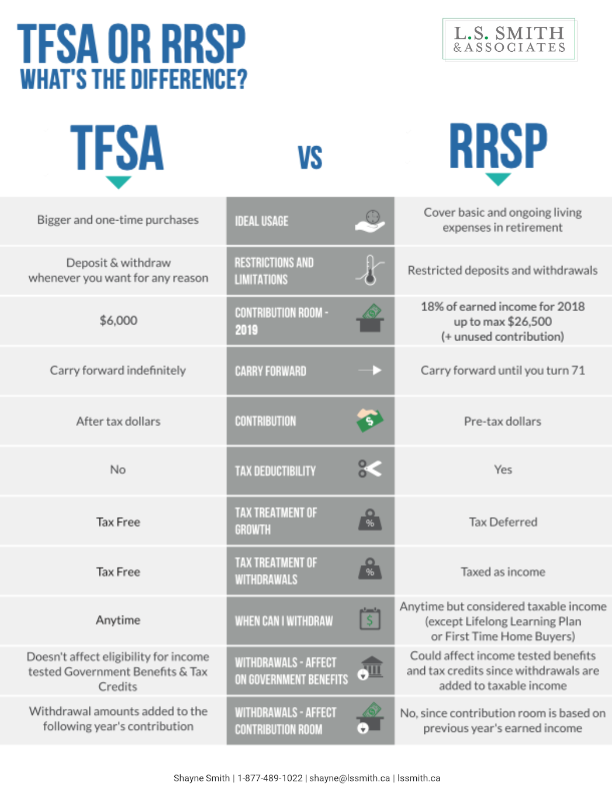

What to do with surplus cash

-

Build employee loyalty

-

Reduce risk

-

Deal with the unexpected

-

Retire from your business

-

Sell your business

-

Keep your business in the family

-

What to do when you’re retired

As a financial advisor, we are uniquely positioned to help business owners, talk to us about your situation and we can provide the guidance you need.