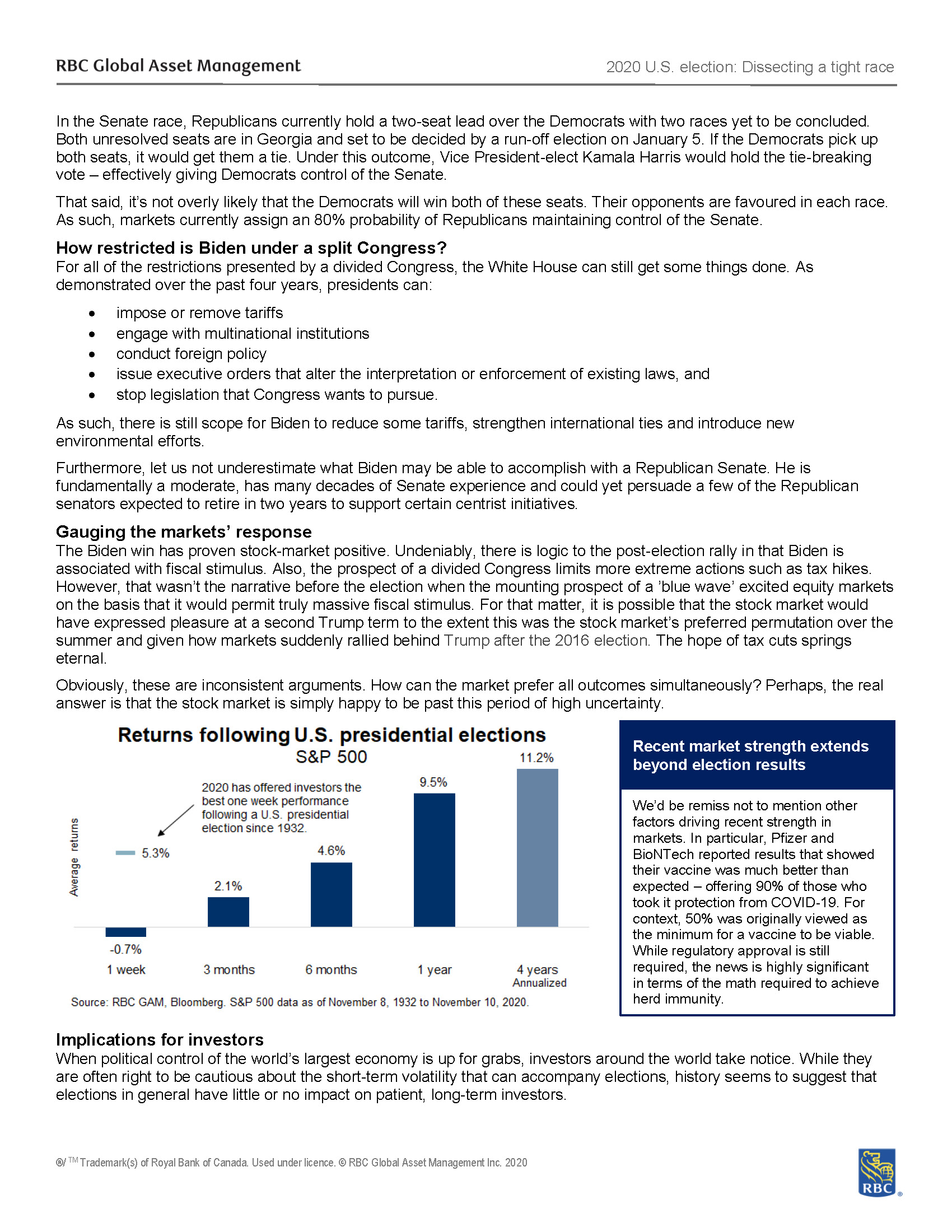

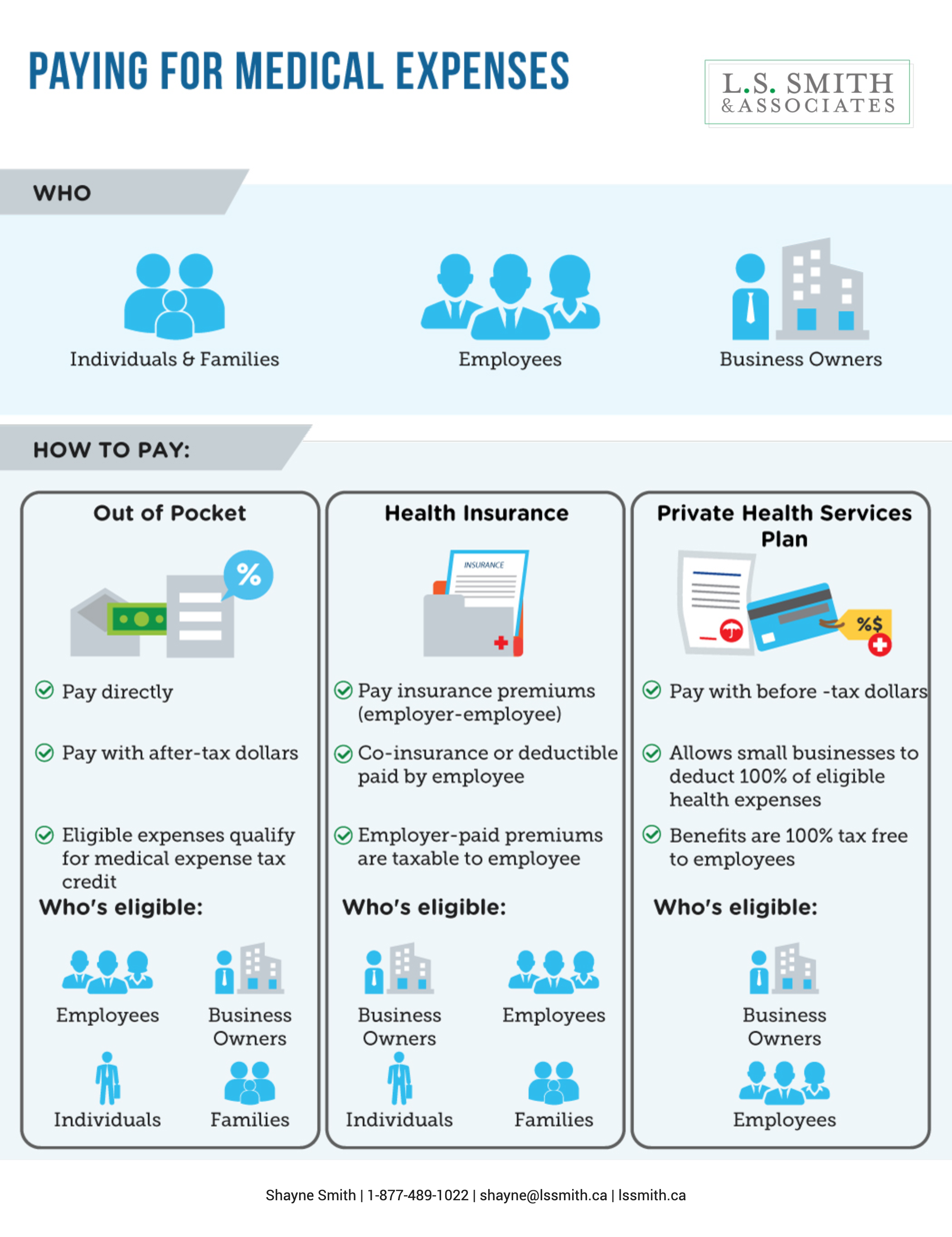

Paying for Medical Expenses

/in Blog, Business Owners, dental benefits, Group Benefits, health benefits, individuals /by L.S. Smith and Associates

Although we enjoy health care benefits in Canada, there are still some benefits that are not covered by the government. There are a number of ways to pay for these benefits such as directly paying out of pocket, using a health insurance plan or private health services plan or a combination of these structures.

As always, please consult us prior to implementing any of these strategies.

Applications for Canada Recovery Benefit now open!

/in 2020, Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners /by L.S. Smith and AssociatesThe Canada Recovery Benefit (CRB) is now open for applications.

As described on the Canada.ca website, the CRB gives income support to employed and self-employed individuals who are directly affected by COVID-19 and are not entitled to Employment Insurance (EI) benefits. The CRB is administered by the Canada Revenue Agency (CRA).

This program replaces the Canada Emergency Response Benefit (CERB) and, if eligible, provides $1,000 ($900 after taxes withheld) for a 2-week period.

If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

Eligibility

To be eligible for the CRB, you must meet all the following conditions for the 2-week period you are applying for:

-

During the period you’re applying for:

-

you were not working for reasons related to COVID-19 OR

-

you had a 50% reduction in your average weekly income compared to the previous year due to COVID-19

-

-

You did not apply for or receive any of the following:

-

Canada Recovery Sickness Benefit (CRSB)

-

Canada Recovery Caregiving Benefit (CRCB)

-

short-term disability benefits

-

workers’ compensation benefits

-

Employment Insurance (EI) benefits

-

Québec Parental Insurance Plan (QPIP) benefits

-

-

You were not eligible for EI benefits

-

You reside in Canada

-

You were present in Canada

-

You are at least 15 years old

-

You have a valid Social Insurance Number (SIN)

-

You earned at least $5,000 in 2019, 2020, or in the 12 months before the date you apply from any of the following sources:

-

employment income (total or gross pay)

-

net self-employment income (after deducting expenses)

-

maternity and parental benefits from EI or similar QPIP benefits

-

-

You have not quit your job or reduced your hours voluntarily on or after September 27, 2020, unless it was reasonable to do so

-

You were seeking work during the period, either as an employee or in self-employment

-

You have not turned down reasonable work during the 2-week period you’re applying for

You need all of the above to be eligible for the CRB.

New Canada Emergency Rent Subsidy | Wage Subsidy extended | CEBA additional $20,000 loan

/in 2020, Blog, Coronavirus, Coronavirus - Practice Owners /by L.S. Smith and AssociatesOn October 9th, the Federal Government announced the new Canada Emergency Rent Subsidy (CERS), the extension of the Canada Emergency Wage Subsidy (CEWS) and additional loans through the Canada Emergency Business Account (CEBA).

New Canada Emergency Rent Subsidy for businesses

The Canada Emergency Rent Subsidy (CERS) is the replacement for the Canada Emergency Commercial Rent Assistance (CECRA).

When launched, the new program will allow businesses to apply directly for rent relief through CRA. The original CECRA faced criticism because it required landlords to apply for the assistance and absorb a 25% reduction in rent which may explain the low uptake.

Prime Minister Justin Trudeau stated that the new rent subsidy will be available for businesses that continue to experience revenue decline due to COVID-19. From Canada.ca:

-

The new Canada Emergency Rent Subsidy, which would provide simple and easy-to-access rent and mortgage support until June 2021 for qualifying organizations affected by COVID-19. The rent subsidy would be provided directly to tenants, while also providing support to property owners. The new rent subsidy would support businesses, charities, and non-profits that have suffered a revenue drop, by subsidizing a percentage of their expenses, on a sliding scale, up to a maximum of 65 per cent of eligible expenses until December 19, 2020. Organizations would be able to make claims retroactively for the period that began September 27 and ends October 24, 2020.

-

A top-up Canada Emergency Rent Subsidy of 25 per cent for organizations temporarily shut down by a mandatory public health order issued by a qualifying public health authority, in addition to the 65 per cent subsidy. This follows a commitment in the Speech from the Throne to provide direct financial support to businesses temporarily shut down as a result of a local public health decision.

Allowing businesses to apply for the rent subsidy directly will make obtaining support for those in need as straightforward and simple as possible.

The new CERS is set to be available until June 2021.

Canada Emergency Wage Subsidy extended to June 2021

The Canada Emergency Wage Subsidy (CEWS) will continue to provide wage relief for employers until June 2021. As well, the subsidy will remain at the current rate of up to a maximum of 65% of eligible wages until December 19th and will not decrease on a sliding scale as previously planned.

Canada Emergency Business Account – additional $20,000 interest-free loan

The Canada Emergency Business Account (CEBA) will be expanded to provide an additional $20,000 loan with $10,000 forgivable if repaid by December 31, 2022. Additionally, the application deadline for CEBA is being extended to December 31, 2020. Businesses applying for the loan will be required to prove they have faced income loss caused by COVID-19.

Applications for Canada Recovery Sickness Benefit and Caregiving Benefit starts today!

/in Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Students /by L.S. Smith and AssociatesStarting October 5, 2020, the Government of Canada will be accepting online applications for the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

From Canada.ca:

Canada Recovery Sickness Benefit (CRSB)

The Canada Recovery Sickness Benefit (CRSB) gives income support to employed and self-employed individuals who are unable to work because they’re sick or need to self-isolate due to COVID-19, or have an underlying health condition that puts them at greater risk of getting COVID-19. The CRSB is administered by the Canada Revenue Agency (CRA).

If you’re eligible for the CRSB, you can receive $500 ($450 after taxes withheld) for a 1-week period.

If your situation continues past 1 week, you will need to apply again. You may apply up to a total of 2 weeks between September 27, 2020 and September 25, 2021.

Eligibility:

To be eligible for the CRSB, you must meet all the following conditions for the 1-week period you are applying for:

-

You are unable to work at least 50% of your scheduled work week because you’re self-isolating for one of the following reasons:

-

You are sick with COVID-19 or may have COVID-19

-

You are advised to self-isolate due to COVID-19

Who can advise you to self-isolate

-

You have an underlying health condition that puts you at greater risk of getting COVID-19.

Who can advise you to stay at home due to your health condition

-

-

You did not apply for or receive any of the following for the same period:

-

Canada Recovery Benefit (CRB)

-

Canada Recovery Caregiving Benefit (CRCB)

-

short-term disability benefits

-

workers’ compensation benefits

-

Employment Insurance (EI) benefits

-

Québec Parental Insurance Plan (QPIP) benefits

-

-

You reside in CanadaDefinition

-

You were present in Canada

-

You are at least 15 years old

-

You have a valid Social Insurance Number (SIN)

-

You earned at least $5,000 (before deductions) in 2019, 2020, or in the 12 months before the date you apply from any of the following sources:

-

employment income

-

self-employment income

-

maternity and parental benefits from EI or similar QPIP benefits

What counts towards the $5,000

-

-

You are not receiving paid leave from your employer for the same period

You need all of the above to be eligible for the CRSB.

Canada Recovery Caregiving Benefit (CRCB)

The Canada Recovery Caregiving Benefit (CRCB) gives income support to employed and self-employed individuals who are unable to work because they must care for their child under 12 years old or a family member who needs supervised care. This applies if their school, regular program or facility is closed or unavailable to them due to COVID-19, or because they’re sick, self-isolating, or at risk of serious health complications due to COVID-19. The CRCB is administered by the Canada Revenue Agency (CRA).

If you’re eligible for the CRCB, your household can receive $500 ($450 after taxes withheld) for each 1-week period.

If your situation continues past 1 week, you will need to apply again. You may apply up to a total of 26 weeks between September 27, 2020 and September 25, 2021.

Eligibility:

To be eligible for the CRCB, you must meet all the following conditions for the 1-week period you are applying for:

-

You are unable to work at least 50% of your scheduled work week because you are caring for a family member

-

You are caring for your child under 12 years old or a family member who needs supervised care because they are at home for one of the following reasons:

-

Their school, daycare, day program, or care facility is closed or unavailable to them due to COVID-19

-

Their regular care services are unavailable due to COVID-19

-

The person under your care is:

-

sick with COVID-19 or has symptoms of COVID-19

-

at risk of serious health complications if they get COVID-19, as advised by a medical professional

-

self-isolating due to COVID-19

-

Who can advise a person under your care to self-isolate

-

-

You did not apply for or receive any of the following for the same period:

-

Canada Recovery Benefit (CRB)

-

Canada Recovery Sickness Benefit (CRSB)

-

short-term disability benefits

-

workers’ compensation benefits

-

Employment Insurance (EI) benefits

-

Québec Parental Insurance Plan (QPIP) benefits

-

-

You reside in CanadaDefinition

-

You were present in Canada

-

You are at least 15 years old

-

You have a valid Social Insurance Number (SIN)

-

You earned at least $5,000 (before deductions) in 2019, 2020, or in the 12 months before the date you apply from any of the following sources:

-

employment income

-

self-employment income

-

maternity and parental benefits from EI or similar QPIP benefits

What counts towards the $5,000

-

-

You are the only person in your household applying for the benefit for the weekWhat is considered a household for this benefit

-

You are not receiving paid leave from your employer for the same period

You need all of the above to be eligible for the CRCB.

Canada Recovery Benefit (CRB)

The CRB provides $500 per week for up to 26 weeks for workers who have stopped working or had their income reduced by at least 50% due to COVID-19, and who are not eligible for Employment Insurance (EI).

Applications will open on October 12

ADVANTAGE ACCOUNT PROMOTION OCT 2020

/in 2020 Only, Blog /by L.S. Smith and Associates

I’m excited to share details on an exclusive, limited-time opportunity from Manulife Bank, which I believe would be a great complement to your current financial plan.

With this account, you’ll also receive:

-

A combined chequing and savings account to simplify everyday banking

-

A high rate of interest to help boost savings – higher than interest rates offered by other Canadian banks and credit unions

Easy online application – open your account in five minutes or less

Applying for an account online is easy and convenient; the process will likely take you five minutes or less to complete.

I’m happy to discuss the Advantage Account with you, and help you set up a new account so you can take advantage of this limited-time interest offer.

Promotional interest rate: 2.15%* (Current posted rate of 0.15% + additional promotional rate of 2.00%)

Promotional interest period: 4 months (120 days) from account opening

Application deadline: October 31, 2020

Eligible accounts: Personal, non-registered, $CDN Advantage accounts (individual or joint). New accounts only.

Maximum new balance: $250,000

Eligible deposits: Deposits must be new to Manulife Bank.

The Difference between Segregated Funds and Mutual Funds

/in Blog, Business Owners, Family, Retirees /by L.S. Smith and AssociatesSegregated Funds and Mutual Funds often have many of the same benefits such as:

-

Both are managed by investment professionals.

-

You can generally redeem your investments and get your current market value at any time.

-

You can use them in your RRSP, RRIF, RESP, RDSP, TFSA or non-registered account.

So what’s the difference? Who offers these products?

-

Segregated Funds: Life Insurance Companies

-

Mutual Funds: Investment Management Firms

Why is this important?

-

Since Segregated funds are offered by life insurance companies, they are individual insurance contracts. Which means….

-

Maturity Guarantees

-

Death Benefit Guarantees

-

Ability to Bypass Probate

-

Potential Creditor Protection

-

Resets

-

Mutual Funds do not have these features.

What are these features?

Maturity and Death Benefit Guarantees mean the insurance company must guarantee at least 75% of the premium paid into the contract for at least 10 years upon maturity or your death.

Resets means you have the ability to reset the maturity and death benefit guarantee at a higher market value of the investment.

Bypass Probate: since you name a beneficiary to receive the proceeds on your death, the proceeds are paid directly to your beneficiary which means it bypasses your estate and can avoid probate fees.

Potential Creditor Protection is available when you name a beneficiary within the family class, there are certain restrictions associated with this.

What are the fees?

-

Segregated Funds: Typically higher fees (MERS)

-

Mutual Funds: Typically lower fees

Contact us, and we can help you decide what makes sense for your financial situation.

Throne Speech: Recovery Plan Highlights

/in Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Students, disability /by L.S. Smith and AssociatesOn September 23rd, in a speech delivered by Governor General Julie Payette, Prime Minister Justin Trudeau outlined the Federal government’s priorities focused on four foundations:

-

Fighting the pandemic and saving lives;

-

Supporting people and businesses through the emergency “as long as it lasts, whatever it takes”;

-

“Building back better” by creating jobs and strengthening the middle class;

-

Standing up for Canadian values, including progress on reconciliation, gender equality, and systemic racism.

Below, we highlight the support programs that help those Canadians who are struggling financially due to the pandemic.

Canada Emergency Wage Subsidy extended to next summer

The Canada Wage Subsidy (CEWS) will be extended to summer 2021. Under new program criteria, businesses with ANY revenue decline will be eligible. However, the amount of the subsidy will be based on the revenue drop rather than the original 75%.

Canada Recovery Benefit increased to $500/week

The day after the Throne Speech, in a bid for opposition support, the federal government announced it will increase the new Canada Recovery Benefit (CRB) to $500/week for up to 26 weeks.

In order to qualify for this program, Canadians must be looking for work and had stopped working or had their income reduced by 50 per cent or more due to COVID-19, but are still making some money on their own.

Canada Recovery Sickness Benefit

The Canada Recovery Sickness Benefit (CRSB) will provide $500/week for up to 2 weeks for workers who are unable to work because they are sick or must isolate due to COVID-19.

Canada Recovery Caregiving Benefit

The Canada Recovery Caregiver Benefit will provide $500/week for up to 26 weeks per household to eligible workers who cannot work because they must provide care to children or family members due to the closure of schools, day cares or care facilities.

Creating a new Canadian Disability Benefit

The government pledged to bring in a new Canadian Disability Benefit (CDB) that will be modelled after the guaranteed income supplement (GIS) for seniors.

The CRB, CRSB, CRCB and CDB are pending the passage of legislation in the House of Commons and Senate.

CEBA extended to October 31st. Expanded to include more businesses.

/in 2020 Only, Blog, Coronavirus, Coronavirus - Practice Owners, Debt /by L.S. Smith and AssociatesOn August 31st, Deputy Prime Minister and Minister of Finance Chrystia Freeland announced the extension of the Canada Emergency Business Account (CEBA) to October 31st, 2020. This will give small businesses 2 additional months to apply for the $40,000 loan.

In addition, the Federal Government said it was working with financial institutions to make the CEBA program available to those with qualifying payroll or non-deferrable expenses that have so far been unable to apply due to not operating from a business banking account.

Apply online at the financial institution your business banks with:

-

TD: https://www.td.com/ca/en/personal-banking/covid-19/small-business-relief/

-

BMO: https://www.bmo.com/small-business/financial-relief-loc/#/login?PID=MBLBC&language=en

-

National Bank: https://www.nbc.ca/forms/business/covid-emergency-account.html

-

Canadian Western Bank: https://www.cwbank.com/en/news/2020/canada-emergency-business-account-now-available (via phone/email)

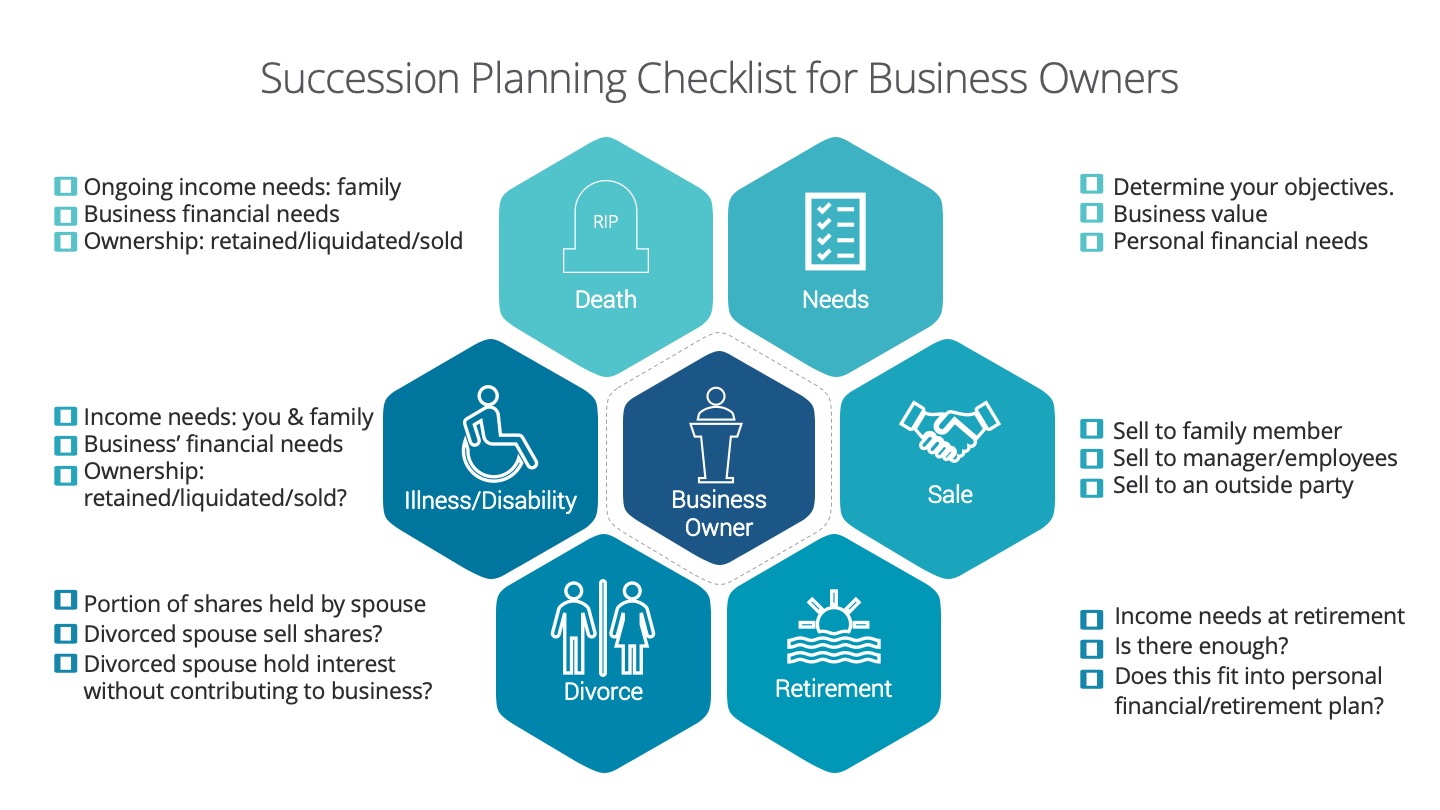

Succession Planning for Business Owners

/in Blog, Business Owners, Estate Planning, Family, life insurance /by L.S. Smith and Associates

Succession Planning for Business Owners

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

We created this infographic checklist to be used as a guideline highlighting main points to be addressed when starting to succession plan.

Needs:

-

Determine your objectives- what do you want? For you, your family and your business. (Business’ financial needs)

-

What are your shares of the business worth? (Business value)

-

What are your personal financial needs- ongoing income needs, need for capital (ex. pay off debts, capital gains, equitable estate etc.)

There are 2 sets of events that can trigger a succession plan: controllable and uncontrollable.

Controllable events

Sale: Who do you sell the business to?

-

Family member

-

Manager/Employees

-

Outside Party

-

There are advantages and disadvantages for each- it’s important to examine all channels.

Retirement: When do you want to retire?

-

What are the financial and psychological needs of the business owner?

-

Is there enough? Is there a need for capital to provide for retirement income, redeem or freeze shares?

-

Does this fit into personal/retirement plan? Check tax, timing, corporate structures, finances and family dynamics. (if applicable)

Uncontrollable Events

Divorce: A disgruntled spouse can obtain a significant interest in the business.

-

What portion of business shares are held by the spouse?

-

Will the divorced spouse consider selling their shares?

-

What if the divorced spouse continues to hold interest in the business without understanding or contributing to the business?

-

If you have other partners/shareholders- would they consider working with your divorced spouse?

Illness/Disability: If you were disabled or critically ill, would your business survive?

-

Determine your ongoing income needs for you, your spouse and family. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? Does the business have a savings or insurance program in place to address this?

Death: In the case of your premature death, what would happen to your business?

-

Determine your ongoing income needs for your dependents. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold by your estate? Does your will address this? Is your will consistent with your wishes? What about taxes?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? How will this affect your employees? Does the business have a savings or insurance program in place to address this?

Execution: It’s good to go through this with but you need to get a succession plan done. Besides having a succession plan, make sure you have an estate plan and buy-sell/shareholders’ agreement.

Because a succession plan is complex, we suggest that a business owner has a professional team to help. The team should include:

-

Financial Planner/Advisor (CFP)

-

Succession Planning Specialist

-

Insurance Specialist

-

Lawyer

-

Accountant/Tax Specialist

-

Chartered Life Underwriter (CLU)

Next steps…

-

Contact us about helping you get your succession planning in order so you can gain peace of mind that your business is taken care of.

Get in Touch

L.S. Smith & Associates

Shayne Smith

Insurance and Financial Advisor

Tel: (204) 489-1022

Toll Free: 1-877-489-1022

Email: Shayne@LSSmith.ca

7-549 Regent Avenue West

Winnipeg, MB

R2C 1R9

Latest News

Newsletter

About

I believe that financial planning is about more than just a piece of good advice or investment returns. It’s all about providing the guidance that people can trust on.