You've worked hard for your money, we understand that. We take the time understand your financial goals and educate you on solid solutions to grow and protect your wealth. We consider your needs, goals and dreams to implement a strategy to help your financial future and provide you with peace of mind.

Families

Customized solutions based on you, plans for to accumulate and protect your wealth.

Business Owners

Strategies to help increase your personal cash flow, keep key employees and protect your business.

Employee Benefits

Employee benefits to attract and retain key employees.

Latest News

What is Critical Illness Insurance?

More people are surviving serious medical issues such as cancer, a heart attack, or a stroke. And while this is good news if a critical illness happens to you – your recovery may come with costs that you don’t have the money to cover.

This is where critical illness insurance can play a crucial role. Our article covers the key things you need to know about critical illness insurance:

• What critical illness insurance is.

• What you can use the money from critical illness insurance payout for.

• How you can get critical illness insurance.

First Home Savings Account (FHSA): What You Need to Know

Are you looking to buy your first home in Canada? The First Home Savings Account (FHSA) could help make it happen. This savings plan allows first-time home buyers to save up to $40,000 tax-free, with contributions being tax-deductible. In this article and infographic, we cover everything you need to know about FHSA, including eligibility requirements, contributions and deductions, qualifying investments, withdrawals, and transfers.

Emotions and Investing

Investor emotions often rise and fall with the market. This post outlines the emotional cycle many investors experience and offers practical ways to manage reactions, avoid costly mistakes, and stick to a long-term investment strategy. A helpful read for anyone feeling unsure in today’s markets.

Personal Life Insurance Planning

Wondering which type of life insurance is right for you? This article breaks down what each option covers, how it works, and what it’s commonly used for—so you can feel confident protecting your family’s future.

Insurance Planning

Insurance is often thought of as an optional extra in the area of personal and business finance – a “nice to have” which can offer protection if things go wrong but certainly not as an important asset in its own right. However, it’s true to say that intelligent insurance planning is a strategy which can protect the vital asset of your ability to earn an income – perhaps the most important asset that you have.

Tax Tips for Filing Your 2024 Income Tax Return

Get ahead of tax season! Discover what’s new for 2024—from increased CPP contributions and Home Buyers’ Plan changes to key deductions and credits. Maximize your refund and avoid costly mistakes.

Bank of Canada Announces Interest Rate Cut Amid Economic Uncertainty

The Bank of Canada has cut interest rates to 2.75%, reflecting ongoing economic challenges and trade uncertainties.

Market volatility is normal, but staying disciplined and diversified helps manage risk over the long term.

If you have questions or concerns, please reach out—we're here to help.

#BankOfCanada #InterestRates #MarketVolatility #FinancialWellbeing

2025 Canadian Controlled Private Corporation Tax Rates

Stay updated on 2024-2025 Canadian corporate tax rates for CCPCs. Small business rates start at 9%, active business varies, and investment income is 38.7%.

2025 Canada Money Facts

2025 Canada Money Facts – Get the latest TFSA, RRSP, FHSA, CPP, OAS, and RESP limits. Stay informed on savings, pensions, and benefits for the year ahead!

Understanding Taxes Payable at Death in Canada

Discover how taxes impact your estate in Canada and explore strategies to minimize the burden. Learn how to manage earned income, deemed disposition, and withdrawals at death to preserve your legacy.

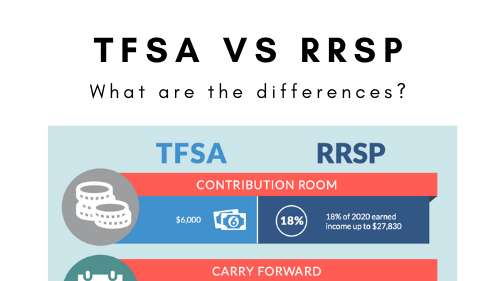

TFSA vs RRSP 2025

When looking to save money in a tax-efficient manner, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) can offer significant tax benefits. The main difference between the two is that TFSAs are ideal for short-term goals, such as saving for a down payment on a house or a vacation, as its growth is entirely tax-free, while RRSPs are more suitable for long-term goals such as retirement. When comparing deposit differences, TFSAs have a limit of $7,000 for the current year, while RRSPs have a limit of 18% of your pre-tax income from the previous year, with a maximum limit of $32,490. In terms of withdrawals, TFSAs have no conversion requirements and withdrawals are tax-free, while RRSPs must be converted to a Registered Retirement Income Fund (RRIF) at age 71 and withdrawals are taxed as income.

How Tariffs Affect Your Wallet: A Canadian Perspective on the US–Canada Trade War

The US–Canada trade war is hitting home, raising prices on everyday goods and shaking the economy. With tariffs on both sides, what does this mean for your wallet? Learn how trade policies impact your cost of living, investments, and financial future.

TFSA vs RRSP 2025

When looking to save money in a tax-efficient manner, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) can offer significant tax benefits. The main difference between the two is that TFSAs are ideal for short-term goals, such as saving for a down payment on a house or a vacation, as its growth is entirely tax-free, while RRSPs are more suitable for long-term goals such as retirement. When comparing deposit differences, TFSAs have a limit of $7,000 for the current year, while RRSPs have a limit of 18% of your pre-tax income from the previous year, with a maximum limit of $32,490. In terms of withdrawals, TFSAs have no conversion requirements and withdrawals are tax-free, while RRSPs must be converted to a Registered Retirement Income Fund (RRIF) at age 71 and withdrawals are taxed as income.

Retirement Planning for Business Owners

Retirement planning can be a complex process for us all, but if you are the owner of a small business it may can get even more complicated, due to the various factors and circumstances that you have to take into consideration. A common mistake made by small business owners is reinvesting extra money to grow their business, at the expense of putting it aside to save for their retirement.

2025 Financial Calendar

Managing your finances effectively begins with staying informed about important dates and deadlines throughout the year. This comprehensive guide outlines key financial milestones, including tax deadlines, benefit payment schedules, and contribution opportunities, to help you stay organized and on track. Whether you're planning for tax season, reviewing your investments, or ensuring timely payments, this calendar provides everything you need to navigate the year with confidence. Take a moment to familiarize yourself with these essential details and set yourself up for a smooth and successful 2025.

2025 Financial Calendar

Managing your finances effectively begins with staying informed about important dates and deadlines throughout the year. This comprehensive guide outlines key financial milestones, including tax deadlines, benefit payment schedules, and contribution opportunities, to help you stay organized and on track. Whether you're planning for tax season, reviewing your investments, or ensuring timely payments, this calendar provides everything you need to navigate the year with confidence. Take a moment to familiarize yourself with these essential details and set yourself up for a smooth and successful 2025.

2024 Year-End Tax Tips and Strategies for Business Owners

Discover essential 2024 tax strategies tailored for business owners! From optimizing compensation and preserving the Small Business Deduction to maximizing the Lifetime Capital Gains Exemption, these tips can help save on taxes while planning for your business's future.

2024 Personal Year End Tax Tips

Get ready for tax season with our 2024 guide! Discover actionable tips for families, retirees, students, and investors, including insights on TFSAs, RRSPs, capital gains changes, and much more. Don’t miss these strategies to make the most of your tax year.

The Health Spending Account for Business Owners and Incorporated Professionals

Discover a game-changing solution to manage medical expenses efficiently - the Health Spending Account. As a business owner, reduce tax burdens and provide tax-free benefits to yourself and employees. No monthly premiums, cost-effective, and hassle-free reimbursement process. Unlock the full potential of your healthcare budget now.

Renewing Your Group Benefits Plan

Is it time to renew your group benefits plan? Discover how to maximize this opportunity by refining health, dental, and specialty coverages, staying on budget, and keeping your team’s priorities at the forefront.

Understanding Taxes Payable at Death in Canada

Discover how taxes impact your estate in Canada and explore strategies to minimize the burden. Learn how to manage earned income, deemed disposition, and withdrawals at death to preserve your legacy.

Understanding the Registered Education Savings Plan (RESP)

Unlock the power of an RESP to secure your child’s educational future. Learn how tax-deferred growth, government grants, and flexible contribution options can ease the burden of rising post-secondary costs. Plan today for a brighter tomorrow!

Getting Ready for Money Emergencies

Facing unexpected financial emergencies? An emergency fund acts as your financial safety net, ensuring peace of mind without dipping into savings or incurring debt. Start small, build steadily.

Protecting Key Talent using Group Benefits

Discover the secrets to retaining your organization's most valuable employees and gaining a competitive edge in today's dynamic job market. Learn how group benefits play a crucial role in fostering a knowledgeable and engaged workforce. From comprehensive health coverage to career development opportunities, this article unveils the keys to a sustainable future. Don't miss out on the chance to build a stronger, more prosperous tomorrow for your company. Read on and unlock the potential of group benefits!

Empowering Your Family’s Financial Future: A Comprehensive Guide to Budgeting

Secure your family's financial future with effective budgeting. Learn how to gain financial clarity, achieve your goals, and prepare for emergencies in our comprehensive guide.

Exploring the Value of Group Benefit Plans for Your Employees

Unlock the potential of group benefits! Enhance employee well-being, reduce turnover, and boost your business with customized plans. Learn more.

Stay Ahead in 2024: A Comprehensive Checklist for Federal Tax Updates

Explore the upcoming 2024 Canadian tax changes affecting investors, business owners, and high-net-worth individuals. From capital gains adjustments to new incentives, stay informed with our comprehensive checklist.

2024 Federal Budget Highlights

On April 16, 2024, Canada's Deputy Prime Minister and Finance Minister, Chrystia Freeland, presented the federal budget.

While there are no changes to federal personal or corporate tax rates, the budget introduces:

• An increase in the portion of capital gains subject to tax, rising from 50% to 66.67%, starting June 25, 2024. However, individual gains up to $250,000 annually will retain the 50% rate.

• The lifetime exemption limit for capital gains has been raised to $1.25 million. Additionally, a new one-third inclusion rate is set for up to $2 million in capital gains for entrepreneurs.

• The budget confirms the alternative minimum tax changes planned for January 1, 2024 but lessens their impact on charitable contributions.

• This year's budget emphasizes making housing more affordable. It provides incentives for building rental properties specifically designed for long-term tenants.

• Introduces new support measures to aid people buying their first homes.

• Costs for specific patents and tech equipment and software can now be written off immediately.

• Canada carbon rebate for small business

Manitoba’s 2024 Budget Highlights

Manitoba's 2024 budget introduces vital tax changes and credits, including a new Homeowners Affordability Tax Credit and enhanced Fertility Treatment Tax Credit, aiming to support individuals and businesses alike

Tax tips to know before filing your 2023 income tax

Unlock the secrets to maximizing your 2023 tax returns with our essential guide. From the new Advanced Canada Workers Benefit to crucial deductions for families, ensure you're not leaving money on the table this tax season.

Setting Up Your Employee Benefits Program

In today's competitive business landscape, establishing an effective employee benefits program is paramount. Such a program not only attracts and retains top talent but also underscores your organization's dedication to the overall well-being of its employees. This guide outlines the crucial steps to set up a successful benefits program.

TFSA vs RRSP – 2024

When looking to save money in a tax-efficient manner, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) can offer significant tax benefits. The main difference between the two is that TFSAs are ideal for short-term goals, such as saving for a down payment on a house or a vacation, as its growth is entirely tax-free, while RRSPs are more suitable for long-term goals such as retirement. When comparing deposit differences, TFSAs have a limit of $7,000 for the current year, while RRSPs have a limit of 18% of your pre-tax income from the previous year, with a maximum limit of $31,560. In terms of withdrawals, TFSAs have no conversion requirements and withdrawals are tax-free, while RRSPs must be converted to a Registered Retirement Income Fund (RRIF) at age 71 and withdrawals are taxed as income.

2024 Financial Calendar

Stay ahead in 2024 with our comprehensive financial calendar! From tax filing to benefit distributions, we guide you through key dates like the $7,000 TFSA contribution and $8,000 First Home Savings Account. Bookmark now for a financially savvy year!

2023 Year-End Tax Tips and Strategies for Business Owners

Maximize your tax benefits as a business owner in 2023! Learn key strategies for salary vs. dividends, passive investments, and more.

2023 Personal Year-End Tax Tips

Maximize your tax savings! Discover expert tips on investments, family deductions, retirement, and more in our latest article.

Understanding Target Loss Ratio and Your Group Benefits Plan

Unlock the mysteries of your group benefits plan! Discover how the target loss ratio (TLR) can influence your premiums and what it means for your company's future. Dive in now!

Understanding Registered Education Savings Plans (RESPs) in Canada

Dive into the details of Registered Education Savings Plans (RESPs)! This guide covers how RESPs work, eligibility criteria, benefits, and government grants such as the Canada Education Savings Grant. Learn how to open an RESP and safeguard your child's educational future.

The Five Steps to Insurance Planning

It’s essential to have enough insurance to give you peace of mind and make sure you are sufficiently insured. Working with an insurance agent can help make sure you are adequately insured.

The five steps to insurance planning are:

• Finding an insurance agent

• Meeting with your insurance agent

• Reviewing your insurance options

• Purchasing insurance

• Filing a claim (when necessary)

An insurance agent can help you understand your policy covers, how much your deductible will be, and all the steps involved in filing a claim.

Understanding Tax-Free Savings Accounts (TFSAs)

A Tax-Free Savings Account is a powerful tool to help you achieve your financial goals. Whether you're saving for a new home, planning for retirement, or investing in your children's education, a TFSA can be a valuable part of your financial strategy. The flexibility and tax advantages it offers make it a great choice for many Canadians.

Remember, the sooner you start, the more time your investments have to grow tax-free. Every dollar counts when you're planning for the future, and a TFSA can help you make the most of your savings.

Don't wait until tomorrow to start planning for your future. Contact us today to begin your journey to financial security today.

Retirement Planning

Most of us understand the benefits of sensible retirement planning but when it comes to actually creating your personal retirement strategy and putting it into effect it doesn’t feel quite as straightforward. The reality is that, while there are lots of variables to consider, it isn’t as difficult to create an effective plan for retirement as you may think.

First Home Savings Account (FHSA): What You Need to Know

Are you looking to buy your first home in Canada? The First Home Savings Account (FHSA) could help make it happen. This savings plan allows first-time home buyers to save up to $40,000 tax-free, with contributions being tax-deductible. In this article and infographic, we cover everything you need to know about FHSA, including eligibility requirements, contributions and deductions, qualifying investments, withdrawals, and transfers.

Group Insurance vs Individual Life Insurance

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand the that there are important differences when it comes to group life insurance vs. self owned life insurance.

Tax Tips You Need To Know Before Filing Your 2022 Taxes

It’ll be time to file your 2022 taxes soon, and you must take advantage of every tax credit and deduction you can! Our article covers the following:

• Canada Workers Benefit.

• Claiming home office expenses.

• The tax deduction for zero-emissions vehicles.

• Return Of Fuel Charge Proceeds To Farmers Tax Credit.

• Eligible Educator School Supply Tax Credit.

Why A Buy-Sell Agreement Is Vital For Your Business

A buy-sell agreement is a legally binding document that sets out what must happen to a business if one or more of the owners is no longer involved. It is crucial for businesses as it protects both shareholders and the business itself in the event of a partner's departure. A buy-sell agreement provides many benefits, including maintaining business continuity, minimizing disputes between remaining co-owners and the family of the departing owner, decreasing stress and uncertainty for all business owners, and protecting business assets and liquidity with a solid financial and tax plan.

Federal Budget 2023 Highlights

On March 28, 2023, the Federal Government released their 2032 budget. This article highlights the following financial measures:

• New transfer options associated with Bill C-208 for intergenerational transfer.

• New rules for employee ownership trusts.

• Changes to how the Alternative Minimum Tax is calculated.

• Improvements to Registered Education Savings Plans.

• Expanding access to Registered Disability Savings Plans.

• Grocery rebate.

• Deduction for tradespeople tool expenses.

• Automatic tax filing.

• New Canadian Dental Care Plan.

Manitoba 2023 Budget Highlights

On March 7, 2023, Manitoba’s Minister of Finance delivered the province’s 2023 budget, focusing on these areas:

• Investing in stronger communities.

• Expanding healthcare coverage.

• Providing infrastructure support.

Budget 2023 includes no personal or corporate tax rate changes, but some temporary corporate tax credits have been made permanent. In addition, Manitoba’s basic personal amount has increased to $15,000, and two tax bracket thresholds will also be increasing.

Essential tips and tricks for paying less tax and keeping more of your retirement income

It’s important to make the most of your retirement income. To do so, you need to be aware of what income is and isn’t taxable, and also how to make the most of the tax breaks you’re entitled to. This article outlines the four main steps you need to take to ensure you keep as much of your retirement income as possible:

1. Make a financial plan.

2. Split your pension income.

3. Buy an annuity.

4. Be aware of retirement-related tax breaks.

TFSA versus RRSP – What you need to know to make the most of them in 2023

When looking to save money in a tax-efficient manner, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) can offer significant tax benefits. The main difference between the two is that TFSAs are ideal for short-term goals, such as saving for a down payment on a house or a vacation, as its growth is entirely tax-free, while RRSPs are more suitable for long-term goals such as retirement. When comparing deposit differences, TFSAs have a limit of $6,500 for the current year, while RRSPs have a limit of 18% of your pre-tax income from the previous year, with a maximum limit of $30,780. In terms of withdrawals, TFSAs have no conversion requirements and withdrawals are tax-free, while RRSPs must be converted to a Registered Retirement Income Fund (RRIF) at age 71 and withdrawals are taxed as income.

2023 Financial Calendar

Welcome to our 2023 financial calendar! This calendar is designed to help you keep track of important financial dates and deadlines, such as tax filing and government benefit distribution. You can bookmark this page for easy reference or add these dates to your personal calendar to ensure you don't miss any important financial obligations.

2022 Year End Tax Tips and Strategies for Business Owners

The end of 2022 is quickly approaching – which means for business owners, it's time to review tax tips and strategies to maximize your benefits.

2022 Personal Year-End Tax Tips

The end of 2022 is quickly approaching – which means it’s time to get everything in order, so you’re ready when it comes time to file your taxes.

We’ve broken this article into the following sections to make it easy to find the tax tips you’re looking for:

• Investment considerations, including how to best contribute to TFSAs, RRSPs, and RDSPs.

• Families, including how to claim childcare expenses and make the most of RESPs.

• Retirees, including essential details about applying for CPP and OAS.

Do you have enough for retirement?

Many of us dream of the day that we can retire and have the time to ourselves that we have dreamed of for so many years. But, to have a genuinely contented and relaxing retirement, you need to ensure that you have the means to afford it. So, now's the best time to consider the three critical stages of retirement planning.

1) Accumulation

2) Pre-retirement

3) Retirement

Why Insurance Is So Important If You’re A Single Parent

Being a single parent is a lot of responsibility. Learn how the right types of insurance can provide you and your family with the financial protection they need.

The Five Steps to Investment Planning

An investment advisor can help you figure out what the right investment choices are for you.

The five steps to investment planning are:

• Meeting your investment advisor

• Determining your goals and expectations

• Developing your investment plan

• Implementing your investment plan

• Monitoring the plan

The sooner you start planning for retirement, the sooner you can get there! An investment advisor can help you get there quicker.

The Six Steps to Financial Planning

A certified financial planner is trained to focus on all aspects of your finances – everything from your taxes to retirement savings.

The six steps to financial planning are:

• Meeting your financial planner

• Determining your goals and expectation

• Reviewing your current financial state

• Developing a financial plan

• Implementing a financial plan

• Monitoring the plan

A certified financial planner will develop a plan that works for you both today and in the future.

Don’t lose all your hard-earned money to taxes

It’s essential to manage your tax planning properly – both while you are living and for after your death. You want as much of your money as possible to go to your beneficiaries, not the government. Our article contains three tips to help you do that:

1. Learn how to make the most of the lifetime capital gains exemption.

2. Figure out ways to decrease your end-of-life tax bill.

3. Look into Immediate Financing Arrangements.

Five Ways To Withdraw Money From Your Business In A Tax-Efficient Manner

You have worked long and hard to build up your business, and now you are ready to withdraw money from your business' bank account. But you don't want to get hit with a huge tax bill. So here are 5 ways to withdraw money from your business in a tax-efficient manner.

Estate Freeze

No business owner likes to think about handing over the business they've built from the ground up. But the fact of the matter is, you will have to do it eventually. Even more concerning, what if you were to become ill or incapacitated? Making a decision of this magnitude during trying times would not be ideal.

For the business owner, an estate freeze can be an integral part of your estate planning strategy. The purpose of an estate freeze is to lock-in (freeze) the value of the business, freeing the successor from the tax liability that may arise should the business' value increase.

Permanent versus Term Life Insurance – What are the Differences?

You know you need life insurance – but you’re not sure which kind is best for you. There are two main kinds of life insurance:

• Permanent, which lasts for your entire life. Premiums can be more expensive, but you can also use the policy to build up cash value.

• Term, which is only good for a set amount of time. Premiums are less expensive, and you cannot build up cash value – but coverage is easy to get and understand.

We can help you determine which type of insurance is best for you and how much it will cost you.

2022 Manitoba Budget Highlights

Manitoba just released its 2022 budget. Read our article to see how Manitoba's budget will impact you.

2022 Federal Budget Highlights

On April 7, 2022, the Federal Government released their 2022 budget. Our article contains highlights of the various financial measures in this budget, divided into these sections:

• Housing

• Alternative minimum tax

• Dental care

• Small businesses

• Tradespeople

• Canada Growth Fund

• Climate

• Bank and insurer taxes

2021 Income Tax Year Tips

It’ll be time to file your 2021 taxes soon, and you must take advantage of every tax credit and deduction that you can. Our article includes information on a variety of subjects you need to know about, including what to do if you’ve had to repay COVID-19 benefits, how to plan ahead if you’re self-employed or retiring soon, and what you need to know if you have a home office or employer-provided benefits.

Retirement Planning for Business Owners – Checklist

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come eventually, it’s important to have a retirement plan in place.

We've put together an infographic checklist that can help you get started on this.

Life Insurance after 60- is it necessary?

You may have had life insurance for as long as you can remember. You knew it was important to make sure that your family would be taken care of and be able to pay their bills if anything happened to you.

But now that you’re over 60, your children are grown, and your mortgage is paid off, you may feel you don’t need life insurance anymore. However, there are some circumstances under which it may still make sense for you to have life insurance:

• You still have substantial debt.

• You have dependent children or grandchildren.

• You want to be able to leave a financial legacy.

TFSA versus RRSP – What you need to know to make the most of them in 2022

TFSAs and RRSPs can be significant savings vehicles. To help you understand their differences, we have put together this article to compare:

- TFSA versus RRSP - Differences in deposits

- TFSA versus RRSP - Differences in withdrawals

Understanding the differences between these two types of tax-advantaged accounts can help you better plan for future purchases and your eventual retirement.

5 reasons for an RRSP-2022

There are some great reasons to open a Registered Retirement Savings Plan (RRSP) to save for your retirement. Here are the top 5 reasons to open an RRSP.

What is a Tax-Free Savings Account? 2022

Wondering if a TFSA is right for you? Read our informative article to learn:

• What a TFSA is.

• How a TFSA works.

• What you need to know about the basics of a TFSA.

• Advantages and limitations of a TFSA.

• TFSA contribution limits.

2022 Financial Calendar

Looking for an "at a glance" document covering all the important dates you need to know to stay on track with your financial planning in 2022?

Our 2022 financial calendar (which you can easily bookmark or print out) makes sure you're always in the loop! It lists important dates, including:

• Payments dates for the Canada Child Benefit, CPP, OAS, and the GST/HST credit.

• When TFSA contribution room starts again.

• Tax filing deadlines.

• Charitable contribution deadlines and the last day to contribute to registered investment accounts.

• When the Bank of Canada interest rate announcements are.

2021 Personal Year-End Tax Tips

The end of 2021 is quickly approaching – which means it’s time to get everything in order, so you’re ready when it comes time to file your taxes.

We’ve broken this article into the following sections to make it easy to find the tax tips you’re looking for:

• Individuals, including details on COVID-19 benefits and important tax credits.

• Investment considerations, including how to best contribute to TFSAs, RRSPs, and RDSPs.

• Families, including how to claim childcare expenses and make the most of RESPs.

• Retirees, including essential details about applying for CPP and OAS.

2021 Year-End Tax Tips for Business Owners

We’re approaching the end of the year, so it’s time to review your business finances. We’ve put together an article highlighting the most critical tax-planning tips you need to know as a business owner.

We’ve focused on:

• How to determine the right salary and dividend mix.

• The best ways to handle compensation.

• How to make sure you can take advantage of the small business deduction.

• What you need to know about depreciable assets and charitable donations.

• How to make the most of Covid-19 relief programs.

Why Should I Review My Life Insurance?

It’s important to review your life insurance regularly to ensure your policy is up-to-date and see if you require any coverage changes. Here are some reasons you may need to update your life insurance:

• You’ve gotten married or divorced or had a baby.

• You’ve changed jobs.

• You’ve taken on some debt.

• You’re supporting additional family members.

• You’ve bought a new home.

• A loved one has a change in their health.

When should I buy life insurance?

Life insurance is something you can use at any age. Whether you’re in your 20s or approaching retirement, you can benefit from having life insurance. Our article, “When should I buy life insurance”? can help you understand:

• What the two main types of life insurance are – term and permanent

• When term insurance is better for you and when permanent insurance is

• How life insurance can benefit you at different ages

• What costs life insurance can help your loved ones’ cover

“Final Pivot” – COVID-19 Emergency Benefits expire October 23rd, replaced by targeted supports

On Thursday, October 22nd, Deputy Prime Minister and Finance Minister Chrystia Freeland announced the "final pivot in delivering the support needed to deliver a robust recovery." This "Final Pivot" means several existing pandemic support programs for individuals and businesses will expire on October 23rd, 2021:

- Canada Recovery Benefit (CRB)

- Canada Emergency Rent Subsidy (CERS)

- Canada Emergency Wage Subsidy (CEWS)

Mortgage

Get your mortgage application approved within 24 hours online.

How to Make the Best of Inheritance Planning

Inheriting an unexpected, or even an anticipated, lump sum can fill you with mixed emotions – if your emotional attachment to the individual who has passed away was strong then you are likely to be grieving and the thought of how to handle your new-found wealth can be overwhelming and confusing but also exciting. One of the best pieces of advice in this situation is to give yourself some time before making any binding financial decisions. The temptation to quickly put the money to so-called ‘good use’ or to rush out and spend it can be strong but you must allow the news to sink in and also take some time to consider your options before you embark on the process of dealing with the inheritance. In the short term, put the money away in a high interest savings account and take time to research and think carefully about your financial goals and objectives and how this inheritance can help you to secure and maximize your financial future in the best way.

Estate Planning for Young Families

Having a family is a blessing and can also bring a lot of worry. A lot of this worry can stem from not being prepared for a disaster like if something were to happen to you or your spouse.

We've put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we're here to help and provide guidance.

Easy Exit: Business Succession in a Nutshell

Getting into the world of business is a meticulous task, but so is getting out of it Whether you’ve just hit the ground running on your business or if you’ve been at it for a long time, there is no better time to plan your exit strategy than now.

Defined Contribution vs. Benefit Pension Plan for Employees

As an employer, you may be thinking about offering your employees a pension plan. If so, you have two main options: a defined benefit pension plan and a defined contribution pension plan. A defined benefit pension plan offers your employees a set amount of money when they retire, whereas a defined contribution pension plan does not.

We walk you through the differences between the two types of pension plans.

Importance of a Buy-Sell Agreement

Working as a partnership between 2 or more individuals is never an easy task, and the situation only gets more complicated when one or more of them exits the business. Protecting not only the business, but your personal interests, as well as your family’s future are very important objectives for any business owner, and should not be overlooked.

Group Retirement Benefits

Working at an organization that offers a pension plan is one of the greatest financial advantages a Canadian can enjoy. Pension plans are designed to provide retirement income and help employees reach their retirement goals and for business owners- help retain key employees.

Federal Budget 2021 Highlights

On April 19, 2021, the Federal Government released their 2021 budget. Our article contains highlights of the various financial measures in this budget, divided into three different sections:

• Business Highlights, including an extension to COVID-19 Emergency Business Supports, new programs to support job creation, and a change in interest deductibility limits.

• Individual Highlights, including details on the tax treatment and repayment of personal COVID-19 benefits (such as CERB), eligibility changes to the Disability Tax Credit, an increase in OAS for those 75 and up, and support for job skills retraining.

• Additional Highlights, including a proposed federal minimum wage of $15, changes to the GST New Housing Rebate conditions, and new or increased taxes in areas such as luxury goods, tobacco, and Canadian housing owned by non-resident foreign owners.

What’s new for the 2021 tax-filing season?

Tax season is upon us once again. But since 2020 was a year like no other, the 2021 tax-filing season will also be different. Due to all the changes in both where and how Canadians worked, the Canadian government has introduced some new tax credits and deductions to keep pace with these changes. Our article covers all of the following:

• How to claim home office expenses

• The new Canada Training Credit

• Pandemic emergency funds

• New digital news subscription tax credit

Self Owned vs. Bank Owned Mortgage Insurance

Before buying insurance from your bank to cover your mortgage, please consider your options. What does the insurance cover?

Extended COVID-19 Federal Emergency Benefits

On Friday, February 19, 2021, Prime Minister Justin Trudeau announced an extension to:

- Canada Recovery Benefit

- Canada Recovery Caregiving Benefit

- Canada Recovery Sickness Benefit

- Employment Insurance

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

Great news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB)

TFSA vs RRSP – What you need to know to make the most of them in 2021

Both TFSAs and RRSPs can be significant savings vehicles for your clients. We've put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year

• How carry forward works for TFSAs and RRSPs

• Tax deductibility of contributions

• Tax treatment of growth

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

2021 Financial Calendar

We’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything you need to know in one place!

Government of Canada to allow up to $400 for home office expenses

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

Business Owners: 2020 Tax Planning Tips for the End of the Year

It's a great time to review your business finances now that we are nearing year-end. We have listed some of the critical areas to consider and provide you with some helpful guidelines to make sure that you cover all the essentials. We have divided our tax planning tips into four sections:

- Year-end tax checklist

- Remuneration

- Business tax

- Estate

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

Personal Tax Planning Tips – End of 2020 Tax Year

To help our clients, we’ve put together a comprehensive article filled with great tips on how to get ready for 2020 tax season. Here’s a summary of our personal tax tips article:

• Details about the different COVID-19 benefits programs and the tax ramifications of them

• Information about family tax issues including the Canada Child Benefits and tips on how to split income.

• Managing investments. Details about contributing to various savings plans such as a TFSA, RESP, or RDSP. Also tips on how and when to donate to charity and how to time the purchase or sale of investments.

• Retirement planning. How to make the most of your RRSP, things to know if you’ve turned 71, and tips on RRIF conversion.

Applications for the new Canada Emergency Rent Subsidy starts today!

The new Canada Emergency Rent Subsidy is open for applications today! Unlike the previous program, this subsidy will provide payments directly to qualifying renters and property owners, without requiring the participation of landlords.

CERS covers up to 65% of rent for businesses, charities and non-profits impacted by COVID-19.

An additional 25% Lockdown Support is available during a public health lockdown order.

2020 US election: Dissecting a tight race

The highly anticipated US election has now been (mostly) resolved. Although states have until early December to finalize vote counts and resolve disputes, Democrat candidate Joe Biden has been widely declared the victor.

Paying for Medical Expenses

Although we enjoy health care benefits in Canada, there are still some benefits that are not covered by the government. We outline strategies to pay for these benefits.

Applications for Canada Recovery Benefit now open!

The Canada Recovery Benefit (CRB) is now open for applications.

If you are eligible for the CRB, you can receive $1,000 ($900 after taxes withheld) for a 2-week period.

If your situation continues past 2 weeks, you will need to apply again. You may apply up to a total of 13 eligibility periods (26 weeks) between September 27, 2020 and September 25, 2021.

New Canada Emergency Rent Subsidy | Wage Subsidy extended | CEBA additional $20,000 loan

Great news for businesses! The new Canada Emergency Rent Subsidy will be available directly to business owners who need rent relief. The Wage Subsidy has been extended to June 2021. And the CEBA has been expanded to provide up to $20,000 interest-free loan.

Applications for Canada Recovery Sickness Benefit and Caregiving Benefit starts today!

Starting October 5, 2020, the Government of Canada will be accepting online applications for the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

ADVANTAGE ACCOUNT PROMOTION OCT 2020

Limited time offer: Earn 2.15%* for 4 months when you open an Advantage Account. Enjoy the benefits of a high interest savings account with the flexibility of a chequing account.

The Difference between Segregated Funds and Mutual Funds

Segregated Funds or Mutual Funds? What's the difference?

Throne Speech: Recovery Plan Highlights

On September 23rd, in a speech delivered by Governor General Julie Payette, Prime Minister Justin Trudeau outlined the Federal government's priorities.

CEBA extended to October 31st. Expanded to include more businesses.

On August 31st, Deputy Prime Minister and Minister of Finance Chrystia Freeland announced the extension of the Canada Emergency Business Account (CEBA) to October 31st, 2020. This will give small businesses 2 additional months to apply for the $40,000 loan.

In addition, the Federal Government said it was working with financial institutions to make the CEBA program available to those with qualifying payroll or non-deferrable expenses that have so far been unable to apply due to not operating from a business banking account.

Succession Planning for Business Owners

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

CERB transitions to NEW Recovery Benefits and EI

On August 20th, the Federal Government announced the extension of the Canada Emergency Response Benefit (CERB) by one month and the transition to the Canada Recovery Benefit, Canada Recovery Sickness Benefit, Canada Recovery Caregiving Benefit and a simplified EI.

Details of the EXPANDED Canada Emergency Wage Subsidy

On August 11th, the Government of Canada updated the calculator and Canada.ca with the changes to the Canada Emergency Wage Subsidy (CEWS).

If you're a business owner who has suffered losses as a result of COVID-19 and did NOT qualify previously for CEWS, you may now qualify.

Retirement Planning for Business Owners – Checklist

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come eventually, it’s important to have a retirement plan in place.

We've put together an infographic checklist that can help you get started on this.

Canada Emergency Wage Subsidy expanded to include more businesses!

On July 17th, Finance Minister Bill Morneau announced proposed changes to the Canada Emergency Wage Subsidy (CEWS) that will expand the number of businesses that qualify for the program.

Canada Emergency Wage Subsidy extended into December!

On July 13th, Prime Minister Justin Trudeau announced the extension of the Canada Emergency Wage Subsidy (CEWS) until December.

Insurance Planning for Business Owners

For business owners, making sure your business is financially protected can be overwhelming. Business owners face a unique set of challenges when it comes to managing risk. Insurance can play an important role.

CERB Extended | Business Owners who did not qualify previously – expanded CEBA starts June 19th

Great news for Canadians out of work and looking for work. The CERB will be extended another 8 weeks for a total of up to 24 weeks.

The expanded CEBA will begin June 19th.

Insurance Planning for Young Families

For young families, making sure your family is financially protected can be overwhelming, especially since there’s so much information floating online. This infographic addresses the importance of insurance- personal insurance.

Small Businesses! Applications for Canada Emergency Commercial Rent Assistance starts May 25th

The Application portal for the Canada Emergency Commercial Rent Assistance (CECRA) opens at 8:00am EST on May 25th

Expanded eligibility for CEBA $40,000 interest-free loan

The Prime Minister outlined the expanded eligibility for the Canada Emergency Business Account and highlighted companies such as hair salon owners, independent gym owners with contracted trainers and local physio businesses will now be eligible.

"If you are the sole owner-operator of a business, if your business relies on contractors, or if you have a family-owned business and you pay employees through dividends, you will now qualify." - PM Justin Trudeau

Apply starting Friday for Canada Emergency Student Benefit! Help on the way for seniors.

The Canada Emergency Student Benefit (CESB) provides financial support to post-secondary students, and recent post-secondary and high school graduates who are unable to find work due to COVID-19.

Extended! Canada Emergency Wage Subsidy extended beyond June

On May 8th, Prime Minister Justin Trudeau announced that they will extend the Canada Emergency Wage Subsidy (CEWS) beyond June.

Guide to Covid-19: Government Relief Programs in Canada

The intention for our "Guide to Covid-19: Government Relief Programs in Canada” is to help businesses and individuals to cut through the noise and make sure they’re getting all the help they can receive from the federal and provincial programs.

75% Commercial Rent Assistance Program

On April 24th, the Federal Government in partnership with the provinces and territories unveiled the Canada Emergency Commercial Rent Assistance which provides rent relief to businesses.

Canada Emergency Student Benefit: Students will be eligible for $1,250 a month from May through August

Great news for students worried about financially making ends meet. Prime Minister Justin Trudeau announced the Canada Emergency Student Benefit which provides $1,250/month from May through August or $1,750/month for those taking care of someone else or have a disability.

For students looking to volunteer to help fight COVID-19, the Canada Student Service Grant provides $1,000 to $5,000

Apply for Canada Emergency Wage Subsidy starting April 27th | Calculate your subsidy

On April 21st, Prime Minister Justin Trudeau announced that the Canada Revenue Agency will accept applications for the Canada Emergency Wage Subsidy (CEWS) starting Monday, April 27th. This new measure gives qualifying employers up to $847 per employee each week so they can keep people on the payroll.

New Canada Emergency Commercial Rent Assistance | Canada Emergency Business Account Expanded

On April 16th, Prime Minister Justin Trudeau announced support for to help small businesses with their rent for the months of April, May and June.

The program is being worked out with the provinces and more details will be available shortly.

Expanded eligibility for Canada Emergency Response Benefit (CERB) & Boosted wages for Essential Workers

Prime Minister Justin Trudeau announced:

"Today, we're announcing more help for more Canadians. This includes topping up the pay of essential workers. At the same time, we'll also be expanding the Canada Emergency Response Benefit to reach people who are earning some income as well as seasonal workers who are facing no jobs and for those who have run out of EI recently. Expanding the CERB to include people who earn up to $1,000 per month. Maybe you're a volunteer firefighter, or a contractor who can pickup some shifts, or you have a part-time job in a grocery store."

Applications for the Canada Emergency Business Account starts TODAY!

The new Canada Emergency Business Account (CEBA) is available starting TODAY and is available through major banking institutions.

The CEBA will provide qualifying businesses an interest-free loans of up to $40,000 until December 31, 2022.

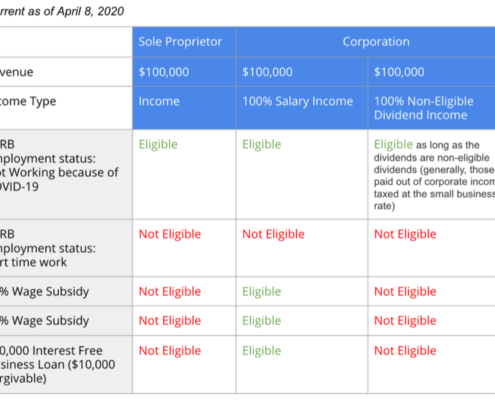

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

The sheer volume of applications for the Canada Emergency Response Benefit (CERB) will likely overwhelm the system. If you or someone you know need to apply for this benefit, we suggest you prepare TODAY before the applications begin:

Double check your myCRA account username and password

Setup Direct Deposit with CRA

Tax Loss Selling

Over the last few weeks, the financial market has taken a downturn amidst fears over Coronavirus.

Understandably, you are concerned with your portfolio, it’s important to stay level-headed to avoid making financial missteps. However, staying level-headed doesn’t necessarily mean you sit there and do nothing. In fact, one consideration you can look is taking an active tax management approach.

Tax loss selling is a strategy to crystallize or realize any capital losses in your non-registered accounts so it can be used to offset any capital gains.

Do I Qualify for the Canada Emergency Response Benefit & EI?

To help Canadians through this difficult time, the Federal Government created the Canada Emergency Response Benefit (CERB) and made changes to the Employment Insurance Program (EI). For those whose employment has affected by the Coronavirus, we have created a chart to help you figure out which program you qualify for and provide links to apply for each program.

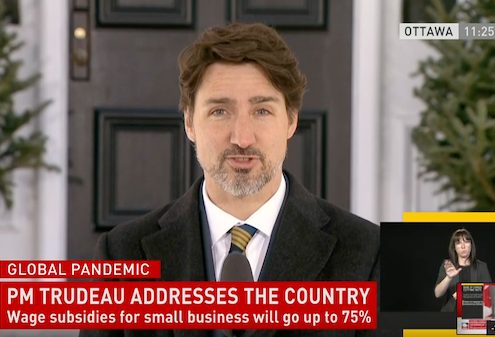

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

March 27, 2019 - Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

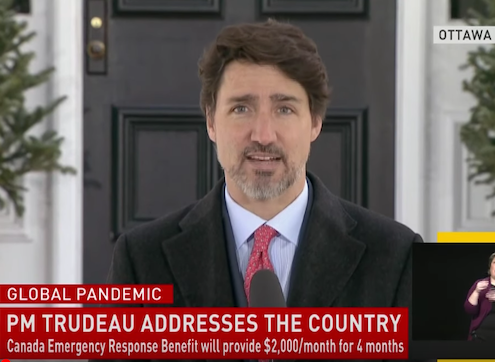

Canada Emergency Response Benefit to help workers and businesses

$2,000/month for 4 months - Canada Emergency Response Benefit to help workers and businesses

Manitoba Budget Highlights for 2020 and COVID-19 Supplement

On March 19th, 2020, Manitoba’s Minister of Finance Scott Fielding delivered the province’s 2020 budget along with a COVID-19 Emergency Supplement.

How to apply for EI benefits for COVID-19 quarantines and other support programs

Employment Insurance (EI) sickness benefits provide up to 15 weeks of income replacement and is available to eligible claimants who are unable to work because of illness, injury or quarantine, to allow them time to restore their health and return to work. Canadians quarantined can apply for Employment Insurance (EI) sickness benefits.

Support for Business Owners and Employees Covid 19

We know that clients have questions about the Federal government's economic response plan, we have included a summary of the information below specifically for business owners and employees.

Coronavirus & Market Uncertainty – $82 billion in aid for Families and Businesses

On March 18th, the Prime Minister, Justin Trudeau, announced a further $82 billion in support including $27 billion in direct support for Canadian workers and businesses. This is in addition to the $20 billion announced days earlier which includes $10 billion available through the Business Development Bank of Canada (BDC) to help small and medium-sized businesses.

Coronavirus & Market Uncertainty – Federal Government $20 billion economic aid package

On March 13th, the Prime Minister, Justin Trudeau, outlined Canada's response to COVID-19 including new investments to help protect Canadians and businesses. The total value of an aid package could be up to $20 billion across the country which includes $10 billion available through the Business Development Bank of Canada (BDC) to help small and medium-sized businesses. Here are some details of the programs they are funding:

Coronavirus & Market Uncertainty- What you should do.

Over the last week, the financial market has taken a downturn amidst fears over Coronavirus. The S&P 500 had its worst weekly drop since the financial crisis in 2008, after setting all-time highs the prior week.*

Understandably, investors are anxious about their money. If you are concerned with your portfolio, you’re not the only one, however during times of market volatility, it’s important to stay levelheaded to avoid making financial missteps.

Salary vs Dividend

As a business owner, you have the ability to pay yourself a salary or dividend or a combination of both. In this article and infographic, we will examine the difference between salary and dividends and review the advantages and disadvantages of each.

Comparing TFSAs and RRSPs – 2020

We examine the difference between RRSP and TFSA in the deposit and withdrawal stage.

5 Reasons for an RRSP – 2020

There are some great reasons to open a Registered Retirement Savings Plan (RRSP) to save for your retirement. Here are the top 5 reasons to open an RRSP:

RRSP Tax Savings Calculator for the 2019 Tax Year

The 2019 RRSP Tax Savings Calculator

2020 Financial Calendar

Financial Calendar for 2020- All the deadlines you need to know to maximize your benefits!

Business Owners: 2019 Tax Planning Tips for the End of the Year

If your corporate year end is December 31, it’s a great time to review your business finances. With the federal election over and no major business tax changes for this year, 2019 is a good year to make sure you are effectively tax planning. Please keep in mind that your business may be affected by the recent tax on split income (TOSI) and the passive investment income rules given they came into effect in 2018. These rules can be complicated, please don’t hesitate to consult us and your accountant to determine how this can affect your business finances.

2019 Tax Tips for Employees

Now that we are nearing year end, it’s a good time to review your finances. With the federal election over and no major tax personal tax changes for this year, 2019 is a good year to make sure you are effectively tax planning.

Saving for Education

Post-secondary education can be expensive, however having the opportunity to plan for it helps with making sure that you’re capable to meet the costs of education.

Financial Advice

An advisor can help you determine where you are today financially and where you want to go. An advisor can provide you guidance on how to reach your short, medium and long term financial goals.

Accessing Corporate Earnings

One of the financial planning issues that business owners face is how to access their corporate earnings in a tax efficient way. Please contact us to learn how we can get more money in your pocket than in the government's.

6 Steps to Retirement Success

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success. Talk to us about a complimentary comprehensive review of your retirement plan.

Financial Planning for Business Owners

Financial Planning for business owners is often two-sided: personal financial planning and planning for the business.

Business owners have access to a lot of financial tools that employees don't have access to; this is a great advantage, however it can be overwhelming too. A financial plan can relieve this.

A financial plan looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them. For you, personally and for your business.

Estate Planning for Retirees and Mature Families

What happens when the children grow up and they are no longer dependent on their parents? Estate planning for mature families and retirees can bring up a number of issues including family dynamics and harmony.

Group Insurance vs Individual Life Insurance

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand the that there are important differences when it comes to group life insurance vs. self owned life insurance.

Estate Planning for Business Owners

What happens when the children grow up and they are no longer dependent on their parents? What happens to your other "baby"- the business? Estate planning for business owners deals with the personal and business assets.

The Difference between Segregated Funds and Mutual Funds-Infographic

Segregated Funds and Mutual Funds often have many of the same benefits however there are key differences you should consider.

Investing as a Business Owner

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals. We outline the factors to consider when investing as a corporation.

10 Essential Decisions for Business Owners

Business owners can be busy… they’re busy running a successful business, wearing lots of hats and making a ton of decisions. We've put together a list of 10 essential decisions for every business owner to consider.

The Best Way to Buy Mortgage Insurance

Before buying insurance from your bank to cover your mortgage, please consider your options. What does the insurance cover?

2019 Federal Budget

The 2019 budget is titled “Investing in the Middle Class. Here are the highlights from the 2019 Federal Budget.

Manitoba Budget for 2019

The big news from the Manitoba Budget today was the reduction of the Provincial Sales Tax (PST) from 8% to 7%

Tax Lines to Look Out for 2018 Income Tax Year

An outline of the key lines to look out for in the 2018 Income Tax Year.

2019 Tax Calculator

Calculate your combined Provincial and Federal Tax in your Province

Comparing TFSA’s and RRSP’s – 2019

If you are seeking ways to save in the most tax-efficient manner available, TFSAs and RRSPs can both be effective options for you to achieve your savings goals more quickly. However, each plan does have distinct differences and advantages / disadvantages. Let’s take a look at their key features

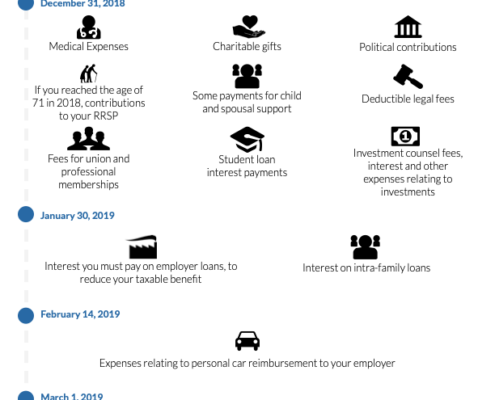

2019 Financial Calendar

Financial Calendar for 2019- All the deadlines you need to know to maximize your benefits!

Tax Planning Tips for End of 2018

Now that we are nearing year end, it’s a good time to review your finances. 2018 saw a number of major changes to tax legislation come in force and more will apply in 2019, therefore you should consider available opportunities and planning strategies prior to year-end.

The Importance of a Financial Plan

The importance of a financial plan. Working with us to create your financial plan helps you identify your long and short term life goals.Talk to us to see how we can help you.

Do you REALLY need life insurance?

You most likely do, but the more important question is, ‘What kind?’ Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your adult life. Most people would agree that having financial safety nets in place is a good way to make sure that your loved ones will be taken care of when you pass away. Insurance can also help support your financial obligations and even take care of your estate liabilities.

Paying for Education

Post-secondary education can be expensive, however having the opportunity to plan for it helps with making sure that you’re capable to meet the costs of education. In addition, when you have a plan, it’s easier to make financial decisions that align with your goals and provide peace of mind.

Why provide an employee benefits plan?

Business owners are increasingly recognizing the key importance of implementing employee benefit plans in their organization

Why You Should Consider Critical Illness Insurance

There are no perfect answers in the area of your personal finances, but if you are looking for an option that has the potential to offer you a real sense of peace of mind to secure the financial future of you and your family, critical illness insurance is certainly an interesting avenue to explore.

Getting the best from a financial advisor

Working with a professional to help you to make sense of your finances can be a wise move, but for this relationship to work effectively it is important that you understand what to expect from your financial advisor.

2018 Federal Budget Highlights for Families

Several key changes relating to personal financial arrangements are covered in the Canadian government’s 2018 federal budget, which could affect the finances of you and your family.

2018 Federal Budget Highlights for Business

The government’s 2018 federal budget focuses on a number of tax tightening measures for business owners. It introduces a new regime for holding passive investments inside a Canadian Controlled Private Corporation (CCPC). (Previously proposed in July 2017.)

Manitoba Budget 2018

The biggest changes include: The increase in the amount of income eligible for the small business deduction, The increase in Basic Personal Amount, Carbon tax

2018 Financial Calendar

Financial Calendar for 2018 - All the deadlines you need to know to maximize your benefits!